United States Biopharmaceutical Third-party Logistics Market Size, Share, and COVID-19 Impact Analysis, By Supply Chain (Cold Chain, Non-cold Chain), By Service Type (Transportation, Warehousing & Storage, Others Services), and United States Biopharmaceutical Third-party Logistics Market Insights Forecasts 2022 – 2032

Industry: HealthcareThe United States Biopharmaceutical Third-party Logistics Market Size Insights Forecasts to 2032

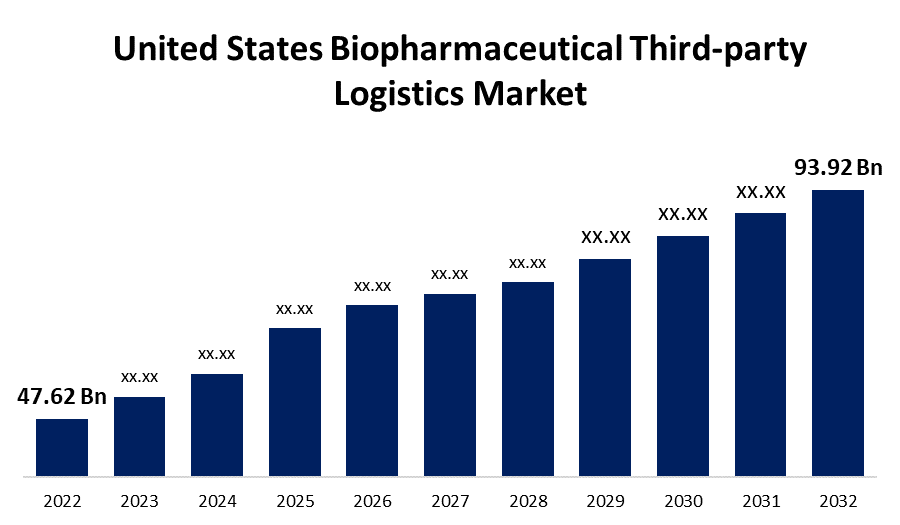

- The United States Biopharmaceutical Third-party Logistics Market Size was valued at USD 47.62 Billion in 2022.

- The Market Size is Growing at a CAGR of 7.03% from 2022 to 2032.

- The United States Biopharmaceutical Third-party Logistics Market Size is Expected to Reach USD 93.92 Billion by 2032.

Get more details on this report -

The United States Biopharmaceutical Third-party Logistics Market Size is Expected to Reach USD 93.92 Billion by 2032, at a CAGR of 7.03%during the forecast period 2022 to 2032.

Market Overview

Biopharmaceutical third-party logistics (3PL) refers to logistics services provided by third-party organizations to pharmaceutical companies. Receiving small molecule pharmaceuticals into the warehouse, for instance, in addition to fulfilling orders and managing commodity inventory using a warehouse management system. Thus, 3PL assists pharmaceutical and medical institutions in maintaining logistics for the delivery of medical therapies by reducing unnecessary overhead costs, ensuring continuous product supply, optimizing transportation, and improving overall organizational efficiency. The pharmaceutical industry's rapid expansion is one of the primary reasons for the market's optimistic outlook. Additionally, the growing trend of medical organizations outsourcing logistics to improve their distribution network is driving market growth. Among other technological advances, warehouse robots, mobile cloud computing, real-time monitoring, and data mining technologies all contribute to economic growth. Logistics-related tasks can be automated with the help of these technologies, reducing the complexity of operations, human errors, and product damage in transit. In addition, temperature-sensitive pharmaceutical products are managed and real-time shipment notifications are received via cold chain monitoring solutions based on Near Field Communication (NFC) and the Internet of Things (IoT).

Report Coverage

This research report categorizes the market for the United States biopharmaceutical third-party logistics market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States biopharmaceutical third-party logistics market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States biopharmaceutical third-party logistics market.

United States Biopharmaceutical Third-party Logistics Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 47.62 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 7.03% |

| 2032 Value Projection: | Reach USD 93.92 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Supply Chain, By Service Type. |

| Companies covered:: | FedEx, DHL International GmbH, SF Express, United Parcel Service of America, Inc., AmerisourceBergen Corporation, DB Schenker, KUEHNE + NAGEL, Kerry Logistics Network Ltd., Agility, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The introduction of novel biopharmaceutical products, such as cell and gene therapies, has increased demand for cold chain storage, transportation, and distribution solutions. The growing demand for efficient logistics solutions that can safely transport temperature-sensitive medications is expected to drive the growth of the biopharmaceutical third-party logistics (3PL) market. The introduction of a wide range of biologics and biosimilars, all of which require temperature-controlled logistics service to be distributed, is expected to be the driving force behind the growth of the biopharmaceutical third-party logistics market. The increased adoption of automation in manufacturing facilities to reduce operational costs is driving demand for third-party logistics services.

Restraining Factors

Vaccines, biologics, and other medications that are temperature sensitive and require temperature-controlled storage and transportation. Maintaining the required temperature range throughout the supply chain may be difficult, especially in areas with poor infrastructure or harsh weather. The need for specialized cold chain logistics complicates and increases the cost of third-party logistics providers' operations.

Market Segment

- In 2022, the non-cold chain segment accounted for the largest revenue share over the forecast period.

Based on the supply chain, the United States biopharmaceutical third-party logistics market is segmented into cold chain and non-cold chain. Among these, the non-cold chain segment has the largest revenue share over the forecast period. This is largely due to the majority of pharmaceutical drugs do not require temperature control and are shipped as general cargo. Furthermore, because temperature control solutions are expensive to implement and maintain, businesses are hesitant to adopt these practices, despite the growing demand for blood-related products and vaccines that require temperature-controlled environments for transportation. Furthermore, the widespread use of cold chain products in both developed and developing regions, as well as ongoing drug innovation, are fueling growth.

- In 2022, the warehousing & storage segment accounted for a significant revenue share over the forecast period.

Based on the service type, the United States biopharmaceutical third-party logistics market is segmented into transportation, warehousing & storage, and other services. Among these, the warehousing & storage segment accounted for a significant revenue share over the forecast period. This is due to the high demand for third-party warehouse and storage services in the United States. The country's demand for third-party warehouse and storage services is expected to rise further as drug development activities expand and regulations tighten.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States biopharmaceutical third-party logistics market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- FedEx

- DHL International GmbH

- SF Express

- United Parcel Service of America, Inc.

- AmerisourceBergen Corporation

- DB Schenker

- KUEHNE + NAGEL

- Kerry Logistics Network Ltd.

- Agility

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In January 2023, Amgen introduced the Amjevita biosimilar for the treatment of active polyarticular juvenile idiopathic arthritis.

- In December 2022, The USFDA approved Briumvi's ublituximab-xiiy for the treatment of multiple sclerosis. Similar drug approvals and drug launches in the country are expected to create opportunities for third-party logistics services in the forecast period.

Market Segment

This study forecasts revenue at regional, and country levels from 2021 to 2032. Spherical Insights has segmented the United States Biopharmaceutical Third-party Logistics Market based on the below-mentioned segments:

United States Biopharmaceutical Third-party Logistics Market, By Supply Chain

- Cold Chain

- Non-cold Chain

United States Biopharmaceutical Third-party Logistics Market, By Service Type

- Transportation

- Warehousing & Storage

- Others Services

Need help to buy this report?