United States Biomaterials Market Size, Share, and COVID-19 Impact Analysis, By Product (Natural, Metallic, Polymer, and Ceramics), By Application (Cardiovascular, Orthopedics, Plastic Surgery, Dental, Ophthalmology, Wound Healing, Tissue Engineering, Plastic Surgery, Neurology, and Others), and United States Biomaterials Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareUnited States Biomaterials Market Insights Forecasts to 2035

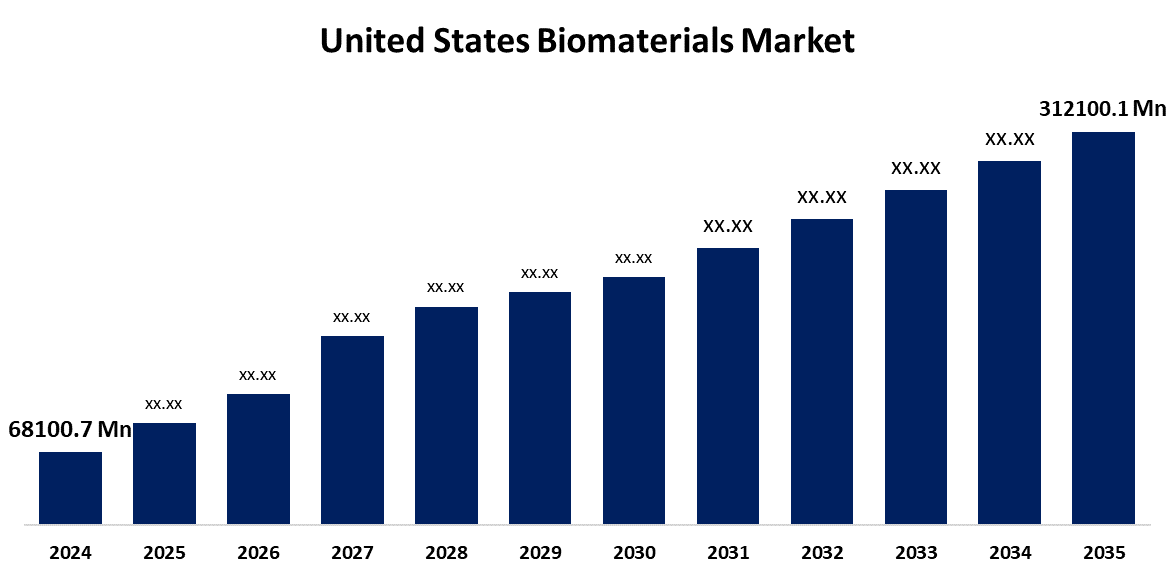

- The US Biomaterials Market Size Was Estimated at USD 68100.7 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 14.84% from 2025 to 2035

- The US Biomaterials Market Size is Expected to Reach USD 312100.1 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the United States Biomaterials Market Size is Anticipated to Reach USD 312100.1 Million by 2035, Growing at a CAGR of 14.84% from 2025 to 2035. The expansion of the United States biomaterials market is propelled due to the rising prevalence of musculoskeletal and chronic skeletal disorders.

Market Overview

Biomaterials are natural or artificial materials that are intended to work with biological systems for therapeutic purposes. They can be used to support, replace, or repair bodily tissues and organs, or they can be used as a component of a medical device. The impetus for innovation in the US biomaterials industry is rooted in the need for advanced healthcare options. The US medical sector has embraced biomaterials in creating durable and biocompatible implants, spurred by an ageing population, the prevalence and rise of chronic diseases such as arthritis and cardiovascular disease. Changes in consumer preferences include less invasive procedures that also accelerate recovery and improve patient outcomes. The US market for biomaterials is also expanding due to advances and commercialization of next-generation biomaterials with increased bioactivity and biodegradability. The biomaterials market is increasingly influenced by partnerships between industry and academia. Rapid advancements in medical technology have also translated to greater investment in education programs that provide students with emerging, research-informed skills to meet the labour market. Academic departments are also becoming instrumental in the innovation pipeline by providing students with learning environments that are similar to industry practice. This lab emphasized connections between theoretical knowledge and the applied nature of biomedical experiments by providing students with real experience in scaffold production, mammalian cell culture, and biodegradation assessments.

Report Coverage

This research report categorizes the market for the United States biomaterials market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States biomaterials market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States biomaterials market.

United States Biomaterials Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 68100.7 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 14.84% |

| 2035 Value Projection: | USD 312100.1 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 160 |

| Tables, Charts & Figures: | 130 |

| Segments covered: | By Product, By Application and COVID-19 Impact Analysis. |

| Companies covered:: | CoorsTek, Carpenter Technology Corp, Zimmer Biomet Holdings Inc, Dentsply Sirona Inc, Stryker Corp, Johnson & Johnson, Baxter International, Medtronic, Evonik Industries AG, Carpenter Technology Corporation and Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the United States biomaterials market is boosted by the rising elderly demographic. An example is the increasing demand for medical products that tackle old-age health problems. The expenditure for medical-type actions, including implants, prosthetics, and joint reconstruction, is increasing along with the expensive need that leads to the growth of the U.S. biomaterials market. Biomaterials are needed to improve the quality of life of older adults. Cardiovascular devices, creating dental devices, and orthopedic implants all make use of biomaterials. The ageing population is also causing chronic diseases such as diabetes, arthritis, heart disease, etc., that greatly increase the urgency to develop and create cutting-edge and bio-compatible biomaterials for medical use.

Restraining Factors

The United States biomaterials market faces obstacles like the high costs of production and complex manufacturing processes associated with biomaterials products. The development of higher-end biomaterials usually requires significant costs associated with testing requirements, research to develop the processes of creating the biomaterials, and following regulations applied to get approval for the products.

Market Segmentation

The United States biomaterials market share is classified into product and application.

- The metallic segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States biomaterials market is segmented by product into natural, metallic, polymer, and ceramics. Among these, the metallic segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven by their unique combination of attributes such as corrosion resistance, biocompatibility, and mechanical properties. The most common biomaterial metal is commonly used in structural load-bearing implants. Metallic biomaterials' extensive success in medical use and an extensive ongoing research agenda to improve their attributes confirm market dominance and assist in explaining their heavy reliance on implants and medical devices.

- The orthopedics segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the application, the United States biomaterials market is segmented into cardiovascular, orthopedics, plastic surgery, dental, ophthalmology, wound healing, tissue engineering, plastic surgery, neurology, and others. Among these, the orthopedics segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is propelled by their high load-bearing capacity. Revenue is expected to be further propelled by the ongoing effort by market suppliers to develop state-of-the-art orthopedic implants.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States biomaterials market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- CoorsTek

- Carpenter Technology Corp

- Zimmer Biomet Holdings Inc

- Dentsply Sirona Inc

- Stryker Corp

- Johnson & Johnson

- Baxter International

- Medtronic

- Evonik Industries AG

- Carpenter Technology Corporation

- Others

Recent Development

- In May 2025, Nexture Bio launched a suite of services in the United States to support biomaterials fabrication and cell culture development, expanding its reach in the cell-based systems sector. The services, based in California and Ohio, focused on ACF microcarriers and scaffolds tailored for research institutions and bioprocess scaling.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States biomaterials market based on the following segments:

United States Biomaterials Market, By Product

- Natural

- Metallic

- Polymer

- Ceramics

United States Biomaterials Market, By Application

- Cardiovascular

- Orthopedics

- Plastic Surgery

- Dental

- Ophthalmology

- Wound Healing

- Tissue Engineering

- Plastic Surgery

- Neurology

- Others

Need help to buy this report?