United States Biomarkers Market Size, Share, and COVID-19 Impact Analysis, By Product (Consumable, Services, and Software), By Type (Efficacy, Validation, Safety, Predictive, Surrogate, Pharmacodynamic, and Prognostics), and United States Biomarkers Market Insights, Industry Trend, Forecasts to 2035.

Industry: HealthcareUnited States Biomarkers Market Insights Forecasts To 2035

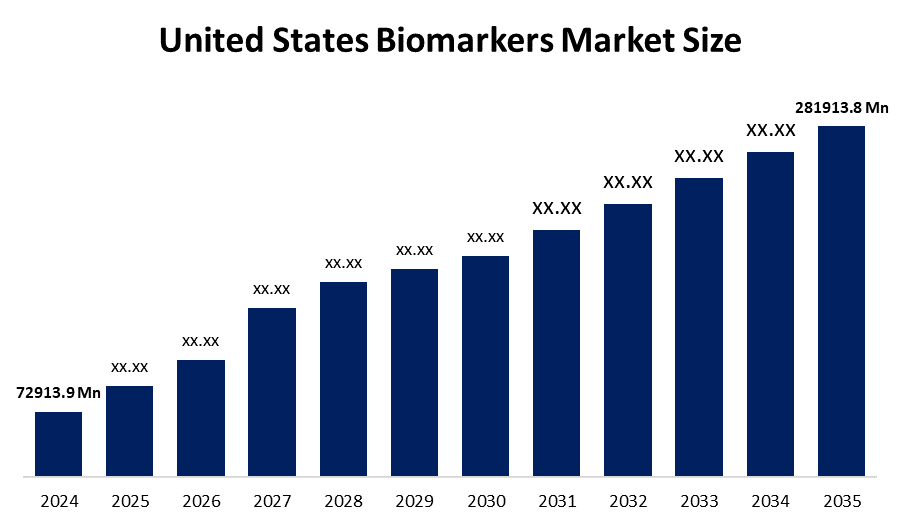

- The US Biomarkers Market Size Was Estimated at USD 72913.9 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 13.08% from 2025 to 2035

- The US Biomarkers Market Size is Expected to Reach USD 281913.8 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The United States Biomarkers Market Size is Anticipated to Reach USD 281913.8 Million by 2035, Growing at a CAGR of 13.08% from 2025 to 2035. The expansion of the United States biomarkers market is propelled by the increasing incidence of cancer, the importance of companion diagnostics, research expenditures, and noteworthy advancements brought about by continuous research.

Market Overview

A biomarker refers to an objectively quantifiable trait that shows whether a biological process is normal or pathological, such as the occurrence, course, or response to therapy of a disease. The rising rates of cancer, cardiovascular disease, and neurodegenerative disease in the US are increasing the need for biomarker-based diagnostic and screening tools. Cancer is one of the most common causes of mortality in the US, with the number of new cancer cases each year continuing to be substantial, as well. Biomarkers are utilized for a range of purposes across oncology, including early detection, tumor classification, and monitoring response to treatment. Initiatives by governments and with government support have been increasing the use of biomarkers in the US healthcare ecosystem, which includes not only the regulatory framework, but also clinical practice. National government programs and enablers, such as the precision medicine initiative, have stimulated the integration of biomarkers into national healthcare activity, and the many complementary and supportive programs to create personalized treatments based on individual genetic and molecular profiles. The US Food and Drug Administration's Program, Fit-for-Purpose Initiative, is establishing a regulatory framework to allow for the use of emerging drug development tools in defined contexts as part of clinical drug development. In addition, along with regulatory support, US federal funding from agencies, such as the National Institutes of Health, is driving biomarker-based research and development activity and infrastructure.

The U.S. government has taken a number of significant actions to support biomarker research, commercialisation, and regulatory clarification. The National Institutes of Health (NIH) released new funding opportunities for biomarker validation in March 2025. These opportunities included one for neurological or neuromuscular disorders and another for Alzheimer's disease and related dementias. The goal of these awards is to improve the reproducibility and clinical value of biomarker assays in important disease areas.

Report Coverage

This research report categorizes the market for the United States biomarkers market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States biomarkers market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States biomarkers market.

United States Biomarkers Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 72913.9 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 13.08% |

| 2035 Value Projection: | USD 281913.8 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 250 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product, By Type |

| Companies covered:: | PerkinElmer, Portland General Electric Co, Bio-Rad Laboratories Inc, Agilent Technologies Inc, Thermo Fisher Scientific Inc, Abbott Laboratories, Johnson & Johnson, Exact Sciences Corporation, Hologic, Inc., and Others |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the United States biomarkers market is boosted by the prevalence of chronic diseases in the US continues to rise in complexity, and healthcare systems are starting to embrace more personalized and preventative types of care. Biomarkers serve as valuable clinical tools that allow clinicians to lesion-segment patients with molecular angiosome signatures and better focus therapy. The clinical applications for protein, genomic, and imaging US Biomarkers are becoming more prevalent, whilst healthcare providers search for ways to mitigate diagnostic ambiguity and improve the efficiencies of treatment. The ongoing rise of disease cases, along with increased awareness from clinicians and patients, is advancing biomarkers in the delivery of precise, timely, and individualized medical care across various chronic health conditions. Biomarkers play a prominent role in personalized medicine, with multiple applications, including diagnosis, prognosis, and targeted therapy, for various disease conditions.

Restraining Factors

The United States biomarkers market faces obstacles regarding start-ups and smaller businesses, and the high costs associated with developing and validating biomarkers. Furthermore, the intricacies of most diseases that it is difficult to obtain a useful life cycle of biomarkers that represents a universal application, which adds an extra layer of complexity while subject to standardisation and reproducibility concerns.

Market Segmentation

The United States biomarkers market share is classified into product and type.

- The consumable segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States biomarkers market is segmented by product into consumable, services, and software. Among these, the consumable segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven by the increasing importance of personalized and precision medicine which has generated demand for biomarkers to identify particular disease markers and tailor treatment options accordingly. This creates demand for consumables in biomarker discovery and validation. Furthermore, the increase in prevalence of chronic conditions such as cardiovascular diseases, cancer, and neurodegenerative diseases has also contributed to the overall increase in the consumption of consumables.

- The safety segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the type, the United States biomarkers market is segmented into efficacy, validation, safety, predictive, surrogate, pharmacodynamic, and prognostics. Among these, the safety segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is propelled because it can be used to personalize therapies for patients due to a higher likelihood of adverse reactions, and it can predict or track exposure effects or adverse drug events. The use of safety biomarkers is expected to continue increasing and contribute positively to market growth. Additionally, an increase in at-risk population groups, related to cancers, cardiovascular disease, and kidney disease, is expected to influence the market positively.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States biomarkers market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- PerkinElmer

- Portland General Electric Co

- Bio-Rad Laboratories Inc

- Agilent Technologies Inc

- Thermo Fisher Scientific Inc

- Abbott Laboratories

- Johnson & Johnson

- Exact Sciences Corporation

- Hologic, Inc.

- Others

Recent Development

- In June 2025, Columbia University launched the Center for Innovation in Imaging Biomarkers and Integrated Diagnostics (CIMBID). The multidisciplinary center combines AI, biomedical imaging, and data science to develop novel imaging biomarkers and accelerate translation into clinical practice.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States biomarkers market based on the following segments:

United States Biomarkers Market, By Product

- Consumable

- Services

- Software

United States Biomarkers Market, By Type

- Efficacy

- Validation

- Safety

- Predictive

- Surrogate

- Pharmacodynamic

- Prognostics

Need help to buy this report?