United States Biologics Market Size, Share, and COVID-19 Impact Analysis, By Product (MABs, Recombinant Proteins, Antisense & RNAi, Vaccines, and Others), By Source (Microbial, Mammalian, and Others), and United States Biologics Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareUnited States Biologics Market Insights Forecasts to 2035

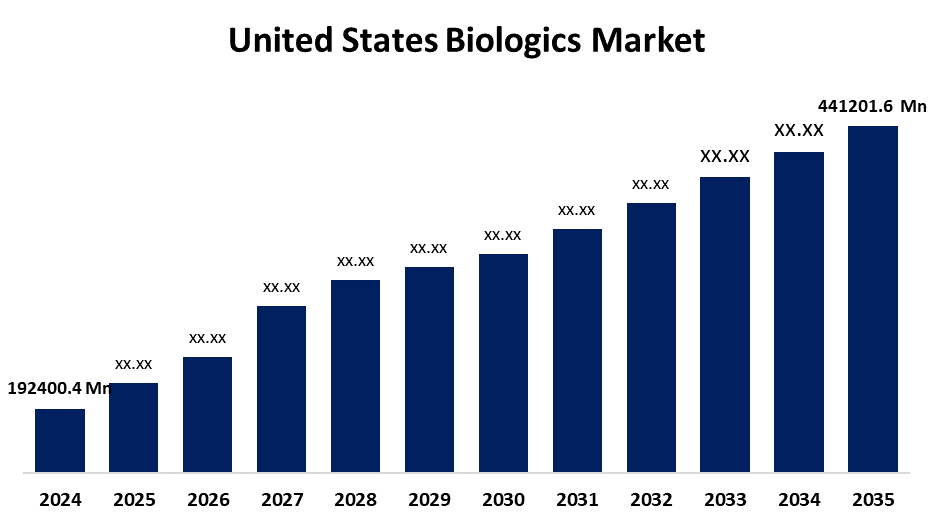

- The US Biologics Market Size Was Estimated at USD 192400.4 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 7.84% from 2025 to 2035

- The US Biologics Market Size is Expected to Reach USD 441201.6 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the United States Biologics Market is anticipated to reach USD 441201.6 million by 2035, growing at a CAGR of 7.84% from 2025 to 2035. The expansion of the United States biologics market is propelled by an increase in the prevalence of autoimmune, genetic, and cancer disorders, as well as the acceptance of various disease-modifying treatments for these diseases.

Market Overview

Biologics, also known as biological products or biopharmaceuticals, are sophisticated medical treatments made from living things such as human, animal, or microbial cells. These include cells, tissues, proteins, vaccines, monoclonal antibodies, and gene therapies. Biotechnology advancements that provide treatments like gene therapies, monoclonal antibodies, and biosimilars are powering the biologics sector in the US. Biotech and pharmaceutical companies increasing spending in research and development (R&D) are helping move next-generation medicines forward. The United States biologics market is quickly embracing innovative bioprocessing technologies that increase production efficiency and scalability. Biotech companies are improving efficiencies in their manufacturing processes by adopting new technologies like high-throughput screening systems, continuous manufacturing, and single-use bioreactors. With the growing demand for gene therapies and biologics like monoclonal antibodies, biopharmaceutical companies are investing heavily in making adjustments to their facilities. There is significant R&D investment to improve production methods, so bioprocessing innovations will continue to positively impact market growth.

Report Coverage

This research report categorizes the market for the United States biologics market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States biologics market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States biologics market.

United States Biologics Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 192400.4 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 7.84% |

| 2035 Value Projection: | USD 441201.6 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 121 |

| Segments covered: | By Product, By Source and COVID-19 Impact Analysis |

| Companies covered:: | Eli Lilly and Co, Bristol-Myers Squibb Co, AbbVie Inc, Amgen Inc, Johnson & Johnson, Merck & Co., F. Hoffmann-La Roche Ltd., Sanofi, Bayer AG, AstraZeneca, Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the United States biologics market is boosted by the health care industry, and there is a significant importance placed on innovation in the development of new drugs and therapeutics. As rheumatic arthritis is one of the chronic diseases that is rising the fastest, the industry has invested substantial resources into the development of viable drugs to alleviate the condition. While traditional therapies such as DMARDs and opioids are the first lines of treatment for arthritic pain, their performance has not been great. This ties into the need for viable arthritis medications to be developed. Biologics come from living organisms and can inhibit or target certain elements of the human immune system that contribute to inflammation. The accepted use of biologics for arthritis treatment is growing and beginning to be more recognized by clinicians.

Restraining Factors

The United States biologics market faces obstacles like the capital investment in developing biologics, as well as the length and complexity of the development cycle. Years can pass between the initial investment and the drug being accepted to market. The length of the development cycle represents additional costs through requirements for ongoing clinical trials, research, related activities, and the production process.

Market Segmentation

The United States biologics market share is classified into product and source.

- The MABs segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States biologics market is segmented by product into MABs, recombinant proteins, antisense & RNAi, vaccines, and others. Among these, the MABs segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven by the growing number of these medications in multiple therapeutic areas. MABs can target the sick cells, with no harm to the healthy cells. Currently, monoclonal antibodies are the most widely approved class of biologic therapies.

- The microbial segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the source, the United States biologics market is segmented into microbial, mammalian, and others. Among these, the microbial segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is propelled by the fact that the majority of the biologics currently approved for use are characterized by creation and manufacture processes that utilize microbial expression methods. Microbial expression methods are utilized to manufacture products, such as granulocyte-macrophage colony-stimulating factor, recombinant insulin, platelet-derived growth factor, and recombinant interferons.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States biologics market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Eli Lilly and Co

- Bristol-Myers Squibb Co

- AbbVie Inc

- Amgen Inc

- Johnson & Johnson

- Merck & Co.

- F. Hoffmann-La Roche Ltd.

- Sanofi

- Bayer AG

- AstraZeneca

- Others

Recent Development

- In March 2024, Bone Biologics, a company that specializes in spine fusion implants, announced an IPO for $2 million. According to a news release dated March 4, the public offering consists of 781,251 shares of the company's common stock, which is priced at $2.56 per share. According to the firm, the funds obtained would go toward funding clinical research, working capital, general corporate goals, and its portfolio of patents.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States biologics market based on the following segments:

United States Biologics Market, By Product

- MABs

- Recombinant Proteins

- Antisense & RNAi

- Vaccines

- Others

United States Biologics Market, By Source

- Microbial

- Mammalian

- Others

Need help to buy this report?