United States Bioherbicides Market Size, Share, and COVID-19 Impact Analysis, By Source (Microbial, Biochemical, and Others), By Formulation (Liquid Suspension, Dry Granules, and Encapsulated or Micro-encapsulated), and United States Bioherbicides Market Insights, Industry Trend, Forecasts to 2035

Industry: AgricultureUnited States Bioherbicides Market Insights Forecasts to 2035

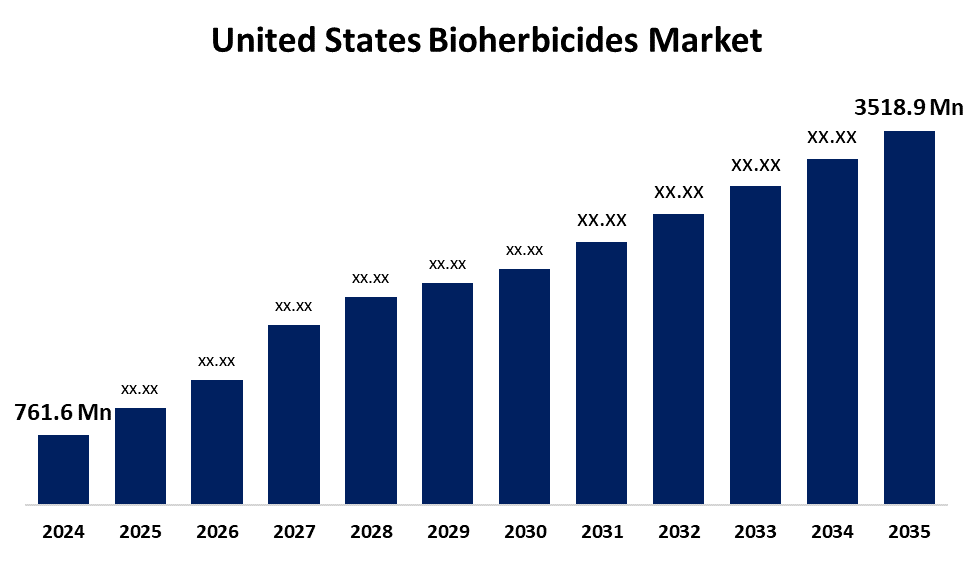

- The US Bioherbicides Market Size Was Estimated at USD 761.6 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 14.93% from 2025 to 2035

- The US Bioherbicides Market Size is Expected to Reach USD 3518.9 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the United States Bioherbicides Market Size is Anticipated to reach USD 3518.9 Million by 2035, Growing at a CAGR of 14.93% from 2025 to 2035. The expansion of the United States bioherbicides market is propelled because individuals become aware of the negative consequences of synthetic herbicides, farmers are looking for better alternatives that will benefit beneficial insects, the environment, and human health.

Market Overview

Bioherbicides are herbicidal formulations manufactured from live organisms, such as bacteria, fungi, or viruses, or their natural metabolites, such as phytotoxins and allelochemicals, to decrease or control weed populations in agricultural and ecological situations. The growing necessity for environmentally acceptable pest management techniques, as well as awareness of sustainable agricultural practices, has created an observable trend within the US to pursue bioherbicides. The Environmental Protection Agency (EPA) is in favor of biopesticides, which include bioherbicides, because of their role in integrated pest management systems. The quest for effective and natural weed control solutions will continue as consumers are now looking to source products that are sustainably and organically sourced. Two possible pathways to investigate in the US bioherbicides market are to create innovative formulations that improve efficacy and widen the active ingredient base. Additionally, government programs to promote ecologically friendly farming practices affect the US bioherbicides market industry considerably.

The U.S. government actively supports the bioherbicide industry by combining its efforts in sustainability, research, and regulation. Through its Biopesticides and Pollution Prevention Division, the Environmental Protection Agency (EPA) has greatly expedited the approval process for biopesticides, including bioherbicides, cutting down on registration times and lowering obstacles to market access.

Report Coverage

This research report categorizes the market for the United States bioherbicides market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States bioherbicides market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States bioherbicides market.

United States Bioherbicides Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 761.6 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 14.93% |

| 2035 Value Projection: | USD 3518.9 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 140 |

| Segments covered: | By Source, By Formulation and COVID-19 Impact Analysis. |

| Companies covered:: | Mycologics, EcoPesticides, Verdesian Life Sciences, Marrone Bio Innovations, Inc., Certis USA LLC, Bayer CropScience, BASF SE, Corteva Agriscience and Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the United States bioherbicides market is boosted because farmers are becoming increasingly aware of the detrimental effects of synthetic herbicides on soil health, water quality, and biodiversity. As a result, there is greater demand for sustainable, environmentally-friendly farming practices, which fuels the market for bioherbicides. Additionally, greater awareness of health and wellness by consumers has made organic food and products popular, which increases the use of bioherbicides. Changes in law by governments and movements to encourage environmentally-friendly agricultural practices have also influenced this change.

Restraining Factors

The United States bioherbicides market faces obstacles as compared to synthetic herbicides; bioherbicides can be slower and less reliable for weed control. Environmental factors like temperature and humidity can influence their efficacy, which varies compared to synthetic herbicides and can lead to variable results.

Market Segmentation

The United States bioherbicides market share is classified into source and formulation.

- The microbial segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States bioherbicides market is segmented by source into microbial, biochemical, and others. Among these, the microbial segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven by the due to their high level of environmental safety, biodegradability, target specificity, and efficacy. These microorganisms, e.g., bacteria, fungi, viruses, and protozoa, are perfect for organic farming and integrated weed management systems because they selectively suppress weed species without putting at risk beneficial organisms.

- The liquid suspension segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the formulation, the United States bioherbicides market is segmented into liquid suspension, dry granules, and encapsulated or micro-encapsulated. Among these, the liquid suspension segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is propelled due to their superior potency, ease of mixing, and ease of application. These formulations increase performance and reliability through seamless integration into current spraying equipment, which improves uniform coverage and increases contact time with target weed.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States bioherbicides market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Mycologics

- EcoPesticides

- Verdesian Life Sciences

- Marrone Bio Innovations, Inc.

- Certis USA LLC

- Bayer CropScience

- BASF SE

- Corteva Agriscience

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States bioherbicides market based on the following segments:

United States Bioherbicides Market, By Source

- Microbial

- Biochemical

- Others

United States Bioherbicides Market, By Formulation

- Liquid Suspension

- Dry Granules

- Encapsulated or Micro-encapsulated

Need help to buy this report?