United States Biogas to Hydrogen Market Size, Share, and COVID-19 Impact Analysis, By Biogas Input (Agricultural Feedstock, Industrial Wastewater, Municipal Wastewater, and Energy Crops), By Hydrogen Storage Method (Compressed Hydrogen Gas, Liquid Hydrogen, and Metal Hydrides), and United States Biogas to Hydrogen Market Insights, Industry Trend, Forecasts to 2035

Industry: Energy & PowerUnited States Biogas to Hydrogen Market Insights Forecasts to 2035

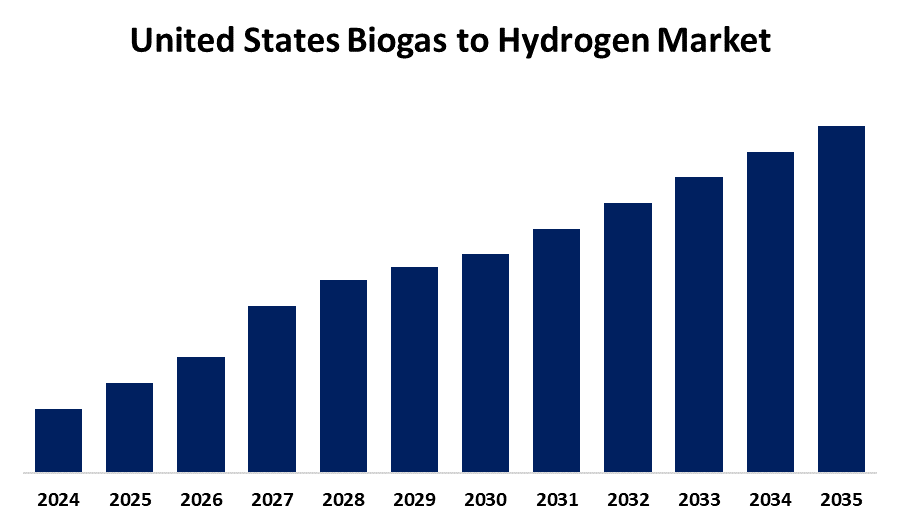

- The USA Biogas to Hydrogen Market Size is Expected to Grow at a CAGR of around 21.7% from 2025 to 2035.

- The United States Biogas to Hydrogen Market Size is Expected to Hold a Significant Share by 2035.

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the U.S. USA Biogas to Hydrogen Market Size is Expected to hold a significant share by 2035, Growing at a CAGR of 21.7% from 2025 to 2035. The U.S. biogas-to-hydrogen market is growing due to increasing demand for clean energy, government incentives, and climate goals aimed at reducing emissions. Advances in biogas upgrading and hydrogen production technologies, combined with abundant organic waste feedstock, drive expansion. Rising investments and infrastructure development further support market growth and adoption across various industries.

Market Overview

The U.S. biogas to hydrogen market refers to the production of hydrogen fuel from biogas, a renewable energy source derived from the anaerobic digestion of organic waste such as agricultural residue, landfill waste, and wastewater. This process converts methane-rich biogas into hydrogen, offering a cleaner alternative to conventional fossil fuel-based hydrogen. The market is driven by increasing demand for clean energy, the need to reduce greenhouse gas emissions, and growing interest in circular economy practices. A major strength of the market lies in its ability to utilize existing biogas infrastructure while simultaneously addressing waste management and energy production. Growth opportunities are substantial, with the U.S. Department of Energy identifying thousands of existing and potential biogas sites suitable for hydrogen production. Technological advancements, especially in carbon capture and hydrogen purification, are improving efficiency and scalability. Government initiatives such as the Infrastructure Investment and Jobs Act and the Inflation Reduction Act provide critical support through funding and tax incentives, making biogas-to-hydrogen projects more economically viable and accelerating their nationwide adoption.

Report Coverage

This research report categorizes the market for the United States biogas to hydrogen market based on various segments and regions, and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States' biogas to hydrogen market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States biogas to hydrogen market.

United States Biogas to Hydrogen Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 21.7% |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 189 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Biogas Input, By Hydrogen Storage Method, and COVID-19 Impact Analysis |

| Companies covered:: | Air Products and Chemicals, Inc., Kaizen Clean Energy, LLC, Hago Energetics, Inc., Linde North America, Nikola Corporation, Ashlawn Energy, Plug Power, Inc., FuelCell Energy, BayoTech, Inc., Bloom Energy, Cummins Inc., Sierra Energy, Tenaska Inc., Monolith, Oncor, and Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

Growing concerns over climate change and the urgent need to reduce greenhouse gas emissions have pushed demand for low-carbon and renewable hydrogen alternatives. The shift toward sustainable energy sources is further supported by national decarbonization targets and commitments to net-zero emissions. Additionally, the abundance of organic waste from agriculture, landfills, and wastewater treatment plants provides a reliable feedstock for biogas production. Economic drivers include rising natural gas prices and the increasing cost-competitiveness of renewable hydrogen technologies. Technological advancements in biogas upgrading, steam methane reforming, and carbon capture also enhance production efficiency. Strong policy support and financial incentives further fuel market momentum, encouraging private and public investment in this sector.

Restraining Factors

The high initial capital costs, limited infrastructure for hydrogen distribution, and technological challenges in scaling production efficiently. Moreover, regulatory uncertainties and permitting delays can hinder project development. Inconsistent feedstock availability and competition with other renewable energy sources also pose challenges to widespread market adoption and growth.

Market Segmentation

The United States' biogas to hydrogen market share is classified into biogas input and hydrogen storage method.

- The agricultural feedstock segment held the highest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States biogas to hydrogen market is segmented by biogas input into agricultural feedstock, industrial wastewater, municipal wastewater, and energy crops. Among these, the agricultural feedstock segment held the highest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to the vast availability of organic waste from farms, including manure and crop residues. Its high biogas yield, combined with the integration of on-site energy systems and biofertilizer production, makes it a cost-effective and sustainable option, significantly contributing to market leadership in this segment.

- The compressed hydrogen gas segment held a substantial share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States biogas to hydrogen market is segmented by hydrogen storage method into compressed hydrogen gas, liquid hydrogen, and metal hydrides. Among these, the compressed hydrogen gas segment held a substantial share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is attributed to its mature technology, cost-effectiveness, and widespread infrastructure. It allows for efficient, high-pressure storage suitable for transportation and industrial use. Compared to liquid hydrogen and metal hydrides, it offers a practical balance of safety, performance, and economic viability, driving its market leadership.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States biogas to hydrogen market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Air Products and Chemicals, Inc.

- Kaizen Clean Energy, LLC

- Hago Energetics, Inc.

- Linde North America

- Nikola Corporation

- Ashlawn Energy

- Plug Power, Inc.

- FuelCell Energy

- BayoTech, Inc.

- Bloom Energy

- Cummins Inc.

- Sierra Energy

- Tenaska Inc.

- Monolith

- Oncor

- Others

Recent Developments:

- In January 2023, Plug Power launched its largest liquid green hydrogen production facility in Woodbine, Georgia, utilizing advanced PEM electrolyzers. This significant development boosts the U.S. clean hydrogen supply infrastructure and supports the green hydrogen economy’s growth. While based on water electrolysis, the plant sets the stage for potential future integration with biogas-derived hydrogen technologies.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the U.S., regional, and country levels from 2020 to 2035. Spherical Insights has segmented the USA biogas to hydrogen market based on the below-mentioned segments:

United States Biogas to Hydrogen Market, By Biogas Input

- Agricultural Feedstock

- Industrial Wastewater

- Municipal Wastewater

- Energy Crops

United States Biogas to Hydrogen Market, By Hydrogen Storage Method

- Compressed Hydrogen Gas

- Liquid Hydrogen

- Metal Hydrides

Need help to buy this report?