United States Biofertilizers Market Size, Share, and COVID-19 Impact Analysis, By Product (Nitrogen Fixation, Phosphate Solubilizing, and Others), By Application (Seed Treatment and Soil Treatment), and United States Biofertilizers Market Insights, Industry Trend, Forecasts to 2035.

Industry: AgricultureUnited States Biofertilizers Market Insights Forecasts to 2035

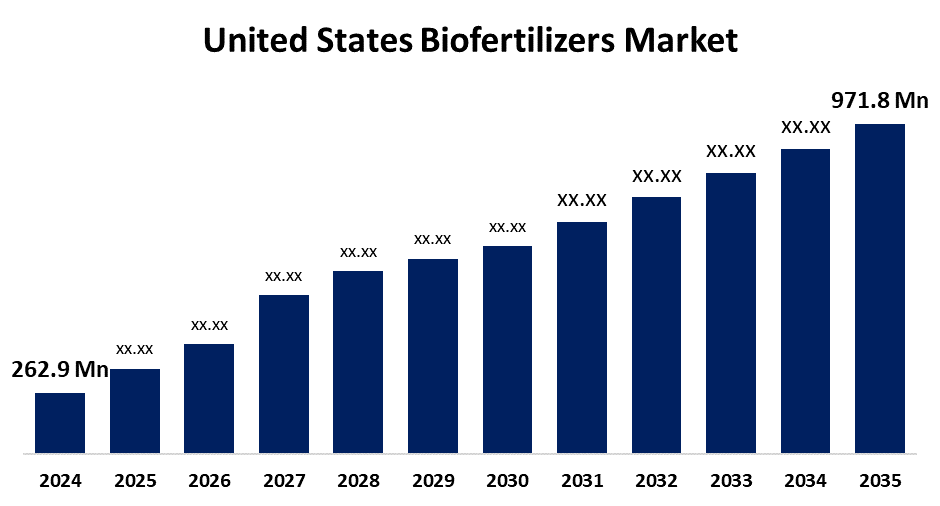

- The US Biofertilizers Market Size Was Estimated at USD 262.9 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 12.62% from 2025 to 2035

- The US Biofertilizers Market Size is Expected to Reach USD 971.8 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The United States Biofertilizers Market Size is anticipated to reach USD 971.8 Million by 2035, growing at a CAGR of 12.62% from 2025 to 2035. The expansion of the United States biofertilizers market is propelled by growing awareness of synthetic fertilisers' negative effects on the environment has prompted businesses to invest more in biofertilizer research and development.

Market Overview

Living microorganisms found in biofertilizers are substances that, when applied to soil, plant surfaces, or seeds, colonise the rhizosphere, or interior of the plant, increasing the host plant's supply or availability of primary nutrients and so fostering development. In 2022, the consolidated market structure, where the top five competitors had over 32.5% of the market share, indicates that the US biofertilizer industry operates in a concentrated competitive setting. Based on market share data, rhizobium-based products are the leader in the biofertilizer market with a 33.7% share, and the biofertilizer market is characterized by phosphate-solubilizing and nitrogen-fixing microorganisms. The mycorrhiza sector has 26.4% of the total market share and azospirillum has 24.4% share of the market. This market system promoted vigorous competition while maintaining strict requirements for product quality and stimulated innovation around microbes and variation in compositions. Technological advancements related to biofertilizer technologies have made products perform much better and enabled improved strategies for use. For instance, Rhizobium-containing products have shown that they can fix 200–300 kg of nitrogen for plants to consume in a year, thus reducing the demand for synthetic fertilisers. The introduction of LALFIX START spherical granule by Lallemand in July 2022, which included a combination of Bacillus velezensis and two varieties of Rhizobium strains to enhance solubilised phosphorus availability and root mass development, is another example of how industry producers have created cutting-edge formulation technology.

Report Coverage

This research report categorizes the market for the United States biofertilizers market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States biofertilizers market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States biofertilizers market.

United States Biofertilizers Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 262.9 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 12.62% |

| 2035 Value Projection: | USD 971.8 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 208 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product, By Application |

| Companies covered:: | Kula Bio Inc.Boehringer Ingelheim, BioWorks Inc., American Vanguard Corporation, Sustane Natural Fertilizer Inc., Novozymes A/S, Rizobacter S.A., Symborg Corporate, Lallemand Inc., and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the United States biofertilizers market is boosted by high-value crops, specifically horticultural crops, can be produced through the use of biofertilizers. The use of biofertilizers as an alternative non-chemical input is crucial since the overuse of chemical fertilisers and, to a lesser extent, intensive farming practices have decreased the fertility of agricultural soils. Accordingly, biofertilizers also contribute to enhanced microbial content and soil fertility as these products restore microbial populations in agricultural soils. Thus, combining these products with others helps to maintain soil health and increase yields.

Restraining Factors

The market for biofertilizers in the US confronts challenges, including the preservation and storage of the microorganisms utilized in the final products is one of the most crucial manufacturing concerns for producers of biofertilizer. The effective storage of these microorganisms is crucial because their viability will determine the effectiveness of the biological fertilizers.

Market Segmentation

The United States biofertilizers market share is classified into product and application.

- The nitrogen fixation segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States biofertilizers market is segmented by product into nitrogen fixation, phosphate solubilizing, and others. Among these, the nitrogen fixation segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven as plants cannot utilize air nitrogen to create the fixed nitrogen necessary for growth, so nitrogen-fixing bacteria, such as rhizobium, azotobacter, and azospirillum, are routinely used as biofertilizers. Because Azotobacter can survive in alkaline soil and grow in aerobic conditions, it can be used with a variety of crops, including potatoes, cotton, wheat, maize, and mustard. Rhizobium is most beneficial for growing leguminous crops because it forms an endosymbiotic association with legume plant roots.

- The seed treatment segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the application, the United States biofertilizers market is segmented into seed treatment and soil treatment. Among these, the seed treatment segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is propelled by treated seeds, which are soaked in a phosphate and nitrogen fertiliser solution, dried in the sun, and planted in the field. The biofertilizer coating promotes rapid and vigorous plant growth. With the increased demand for organic food, there is an expected growth in the use of biofertilizers in seed treatment.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States biofertilizers market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Kula Bio Inc.Boehringer Ingelheim

- BioWorks Inc.

- American Vanguard Corporation

- Sustane Natural Fertilizer Inc.

- Novozymes A/S

- Rizobacter S.A.

- Symborg Corporate

- Lallemand Inc.

- Others

Recent Development

- In September 2022, Pivot Bio, a U.S.-based company, launched PROVEN 40 On-Seed (OS) and RETURN On-Seed for corn, sorghum, and spring wheat that delivers nitrogen-producing microbes on the seed and integrates nitrogen during the planting season.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States biofertilizers market based on the following segments:

United States Biofertilizers Market, By Product

- Nitrogen Fixation

- Phosphate Solubilizing

- Others

United States Biofertilizers Market, By Application

- Seed Treatment

- Soil Treatment

Need help to buy this report?