United States Biocontrol Agents Market Size, Share, and COVID-19 Impact Analysis, By Crop Type (Cash Crops, Horticultural Crops, Row Crops), By Form (Macrobials and Microbials), and United States Biocontrol Agents Market Insights, Industry Trend, Forecasts to 2035.

Industry: AgricultureUnited States Biocontrol Agents Market Insights Forecasts to 2035

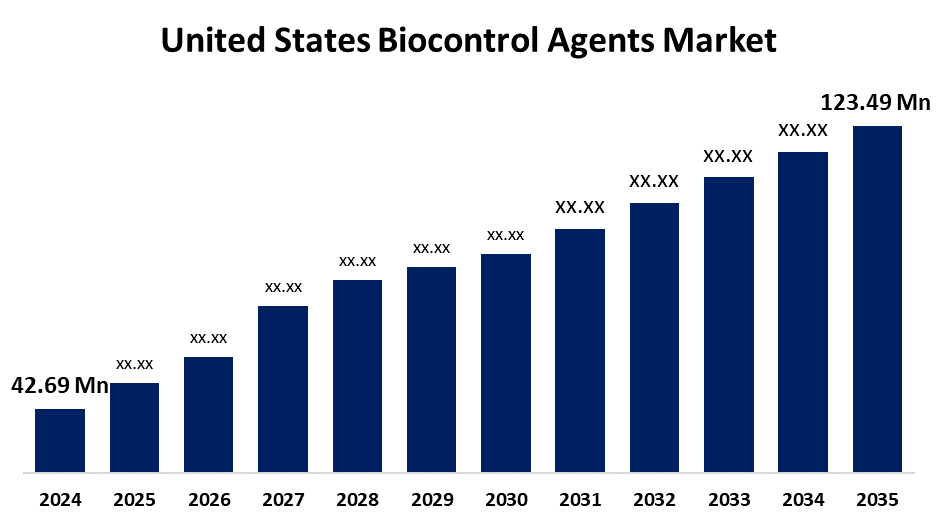

- The U.S. Biocontrol Agents Market Size was estimated at USD 42.69 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 10.14% from 2025 to 2035.

- The USA Biocontrol Agents Market Size is Expected to Reach USD 123.49 Million by 2035

Get more details on this report -

The US Biocontrol Agents Market Size is Anticipated to reach USD 123.49 Million By 2035, Growing at a CAGR of 10.14% from 2025 to 2035. The U.S. biocontrol agents market is growing rapidly, driven by demand for sustainable farming, eco-friendly pest control solutions, and regulatory shifts towards reducing chemical pesticide use, with innovations enhancing effectiveness and adoption.

Market Overview

United States biocontrol agents market is the market for natural organisms or substances that are of natural origin used to manage pests, diseases, and weeds in agriculture, forestry, and horticulture. The agents involved are beneficial insects, fungi, bacteria, nematodes, and plant-based chemicals that minimize the use of synthetic pesticides. Moreover, growth drivers for the U.S. biocontrol agents market are rising consumer demand for pesticide-free cultivation of cannabis, regulatory incentives towards sustainable agriculture practices, and the increasing growth of biological soil health programs. Such specialised areas, usually ignored in other large markets, are driving specialized applications and adoption of biocontrol solutions across a wide range of sectors. Furthermore, Key stakeholders can spur the market by investing in R&D for locally evolved biocontrol strains, collaborating with organic producers, expanding farmer education programs, and using AI-based platforms to track pest outbreaks and fine-tune timely, targeted biocontrol applications on diverse cropping systems. For instance, November 2020, after being purchased by Biobest Group NV 2020, Beneficial Insectary Inc. joined the global company, enhancing its distribution system and visibility.

Report Coverage

This research report categorizes the market for the U.S. biocontrol agents market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States biocontrol agents market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the USA biocontrol agents market.

United States Biocontrol Agents Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 42.69 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 10.14% |

| 2035 Value Projection: | USD 123.49 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 94 |

| Segments covered: | By Crop Type, By Form and COVID-19 Impact Analysis |

| Companies covered:: | Andermatt Group AG, Arizona Biological Control Inc., Beneficial Insectary Inc., Biobee Ltd, Bioline AgroSciences Ltd, Bioworks Inc., Koppert Biological Systems Inc., and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The U.S. market for biocontrol agents is fueled by the increasing prices of synthetic pesticides, growing pest resistance to chemicals, and more stringent Maximum Residue Limits (MRLs) required by export markets. Consumer pressure for transparency in food production and traceability also favors the adoption of biocontrol. Government and non-profit sustainability programs, as well as formulation and storage technology improvements, are also promoting wider use across conventional and organic farming systems. For instance, in January 2022, the company declared the merger of Andermatt Biocontrol AG with Andermatt Group AG. On a merged basis, all companies directly report to Andermatt Group AG, strengthening the efficiency of the management and streamlining the structure of the company.

Restraining Factors

Restraining factors are low farmer awareness, unpredictable field performance as a result of environmental fluctuations, high cost of production, and shorter shelf life than chemical products, which complicates large-scale adoption of biocontrol agents.

Market Segmentation

The United States biocontrol agents market share is classified into crop type and form.

- The horticultural crops segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States biocontrol agents market is segmented by crop type into cash crops, horticultural crops, and row crops. Among these, the horticultural crops segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. These high-value crops, including fruits, vegetables, and ornamentals, are more sensitive to chemical residues, driving demand for biocontrol solutions. Growers prioritize sustainable practices to meet consumer and export requirements, making biological pest control especially attractive in this segment.

- The microbials segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States biocontrol agents market is segmented by form into macrobials and microbials. Among these, the microbials segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to its broad-spectrum effectiveness, ease of mass production, and longer shelf life compared to microbials. Microbial agents, including bacteria and fungi, are widely used in integrated pest management programs across various crop types, especially in organic farming.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the US biocontrol agents market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Andermatt Group AG

- Arizona Biological Control Inc.

- Beneficial Insectary Inc.

- Biobee Ltd

- Bioline AgroSciences Ltd

- Bioworks Inc.

- Koppert Biological Systems Inc.

- Others

Recent Developments:

- In May 2022, UPL collaborated with Bayer for Spirotetramat Biocontrol Agents to create innovative pest control solutions. Under this long-term global data access and supply deal with Bayer, for meeting farmer needs in terms of resistance management and challenging sucking pests, UPL will create, register, and market new innovative solutions, such as Spirotetramat, leveraging its Biocontrol Agents expertise and global research and development network.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the USA biocontrol agents market based on the below-mentioned segments

United States Biocontrol Agents Market, By Crop Type

- Cash Crops

- Horticultural Crops

- Row Crops

United States Biocontrol Agents Market, By Form

- Macrobials

- Microbials

Need help to buy this report?