United States Biochip Market Size, Share, and COVID-19 Impact Analysis, By Type (DNA Chips, Protein Chips, Lab-on-chip, Tissue Arrays, and Cell Arrays), By End Use (Biotechnology and Pharmaceutical Companies, Academic & Research Institutes, Hospitals and Diagnostic Centers, and Others), and United States Biochip Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareUnited States Biochip Market Insights Forecasts to 2035

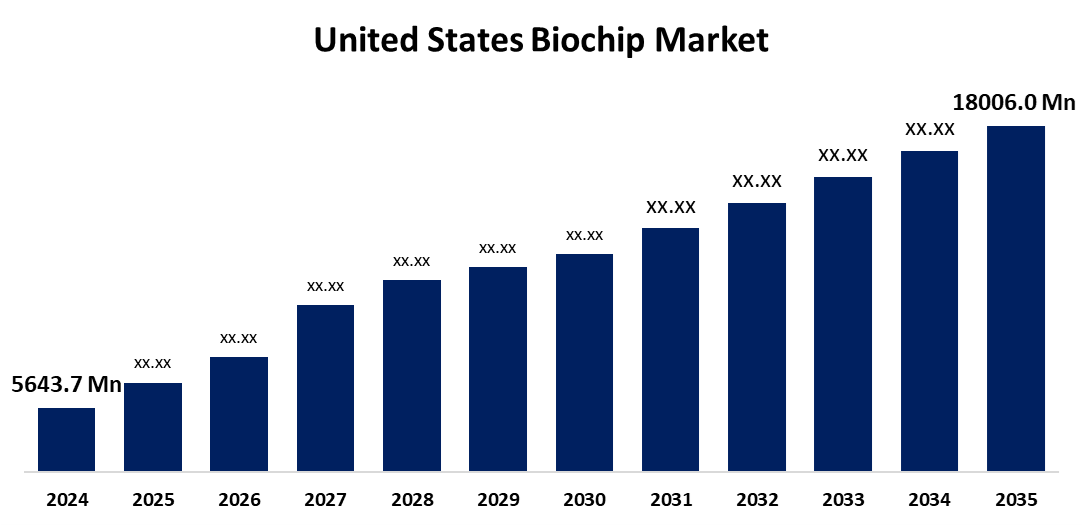

- The US Biochip Market Size Was Estimated at USD 5,643.7 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 11.12% from 2025 to 2035

- The US Biochip Market Size is Expected to Reach USD 18,006.0 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The United States Biochip Market Size is anticipated to Reach USD 18,006.0 Million by 2035, Growing at a CAGR of 11.12% from 2025 to 2035. The expansion of the United States biochip market is propelled by the expansion of next-generation sequencing (NGS) applications, the rise in drug research, and the expanding use of personalised medications.

Market Overview

A biochip is a small device that can be as small as a few millimeters or as large as a few centimeters in size. The biochip allows for quick analysis of biological components such as DNA, proteins, or cells through hundreds of microscopic biochemical assays performed simultaneously on a single substrate. The US biochips industry is experiencing considerable growth, boosted by advancements in personalised medicine and medical diagnostics, which are also becoming more significant in the healthcare environment. Biochip technology is an important component in the advancement of drug discovery and development processes, through high-throughput screening and genomic applications, which allow for greater specificity in diagnosing and treating disease. The largest drivers for this market are the demand for rapid diagnosis, the increase in chronic disease prevalence, and the increase in funding for biotechnology researchers. The effort to employ more advanced technologies in clinical and laboratory settings is also a major factor in driving greater specificity and efficiency.

The US government is actively involved in this market through policies aimed at furthering biotechnology research and development. Agencies are facilitating partnerships between private-sector enterprises and public institutions to spur innovation. All things considered, the trends all highlight a vibrant and evolving future for the US biochips market, buoyed by technological advances and a continued emphasis on improving healthcare outcomes.

Report Coverage

This research report categorizes the market for the United States biochip market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States biochip market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States biochip market.

United States Biochip Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 5,643.7 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 11.12% |

| 2035 Value Projection: | USD 18,006.0 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Type, By End Use |

| Companies covered:: | PerkinElmer, Standard BioTools Inc, Bio-Rad Laboratories Inc, Agilent Technologies Inc, Illumina Inc, Thermo Fisher Scientific Inc, GE HealthCare Technologies Inc, Abbott Laboratories, and Other Key Companies. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the United States biochip market is boosted by the increasing need for personalised treatment. Biochips are becoming crucial for enabling precision oncology, pharmacogenomics, and other personalised medicines as a result of the development of technology that enables customised medical treatments based on individual genetic profiles. The National Institutes of Health states that studies show that individuals treated with personalised medicine procedures had a 30% higher chance of treatment success, suggesting that personalised medicine can raise the chances of beneficial health outcomes.

Restraining Factors

The United States biochip market faces obstacles, including potential health risks from metals or other toxic materials included in biochips that may cause allergic reactions or other severe health issues. Furthermore, privacy and security concerns arise from biochips' ability to store personal data. High development and manufacturing costs, driven by complex designs, expensive raw materials, and limited scalability, further obstruct industry growth.

Market Segmentation

The United States biochip market share is classified into type and end use.

- The DNA chips segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States biochip market is segmented by type into DNA chips, protein chips, lab-on-chip, tissue arrays, and cell arrays. Among these, the DNA chips segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven by the sheer number of products that exist in a particular framework, such as gene expression, SNP genotyping, genomics, drug discovery, diagnosis of existing cancer, cancer treatment, agricultural biotechnology, and more. Other applications may be toxicogenomics, proteomics, microbial genotyping, screening, and tracking subjects in clinical trials and subsequent patient and environmental biology.

- The biotechnology and pharmaceutical companies segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the end use, the United States biochip market is segmented into biotechnology and pharmaceutical companies, academic & research institutes, hospitals diagnostic centers, and others. Among these, the biotechnology and pharmaceutical companies segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is propelled by pharmaceutical companies' use of biochips for a variety of reasons, which drives advancements in drug discovery, development, and manufacture. Pharmaceutical companies use biochips for high-throughput screening of compound libraries to quickly screen for and identify lead candidates, which, if they pass diligence and evaluation, can be developed as potential drug candidates.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States biochip market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- PerkinElmer

- Standard BioTools Inc

- Bio-Rad Laboratories Inc

- Agilent Technologies Inc

- Illumina Inc

- Thermo Fisher Scientific Inc

- GE HealthCare Technologies Inc

- Abbott Laboratories

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States biochip market based on the following segments:

United States Biochip Market, By Type

- DNA Chips

- Protein Chips

- Lab-on-chip

- Tissue Arrays

- Cell Arrays

United States Biochip Market, By End Use

- Biotechnology and Pharmaceutical Companies

- Academic & Research Institutes

- Hospitals and Diagnostic Centers

- Others

Need help to buy this report?