United States Biobanks Market Size, Share, and COVID-19 Impact Analysis, By Product and Service (Services and Products), By Biospecimen (Organs, Stem Cells, and Human Tissues), By Type (Virtual Biobanks and Physical Biobanks), By Application (Clinical Diagnostics, Therapeutics, Drug Discovery, Clinical Research, and Others), and US Biobanks Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareUSA Biobanks Market Insights Forecasts to 2035

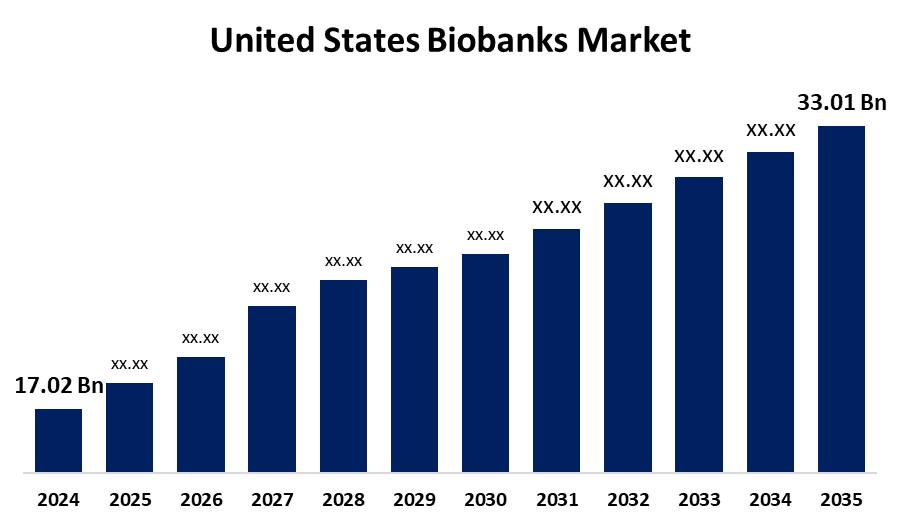

- The US Biobanks Market Size was Estimated at USD 17.02 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.21% from 2025 to 2035

- The USA Biobanks Market Size is Expected to Reach USD 33.01 Billion by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The US Biobanks Market Size is anticipated to reach USD 33.01 Billion by 2035, Growing at a CAGR of 6.21% from 2025 to 2035. The innovations in the drugs and growing focus on the research and development sectors, and rising need for advanced therapies such as personalized medications and cancer studies, drive the market growth.

Market Overview

The US Biobanks Market Size collects, stores, and distributes biological samples for research and therapeutic purposes, including drug development, biomarker identification, personalized medicine, and disease research. An organized collection of human biological samples and data for research purposes is called a biobank. They have long been present in public health research, distinguished by lifestyle data and medical records. Models for biobank governance regulate data access and usage, which may have an impact on how the data is used in research or therapeutic settings. Stem cell banks, gametes, and embryo storage banks for IVF, and cord blood banks are a few examples. Biobanks are referred to as biorepositories. The goal of biobanks is to offer a collection of biospecimens that may be used to diagnose, treat, and comprehend the pathophysiology of diseases. Following current procedures and scientific findings, they gather, preserve, and process human biological material. The collection and processing of biospecimens are determined by biobank staff following study plans and specimen sources. Disease-oriented biobanks, population-based repositories, and virtual repositories are among the several varieties of biobanks. Disease-oriented biobanks concentrate on clinical trials, case-control studies, and basic research, whereas population-based repositories offer biospecimens for stem cell and transplant research. Biospecimens and material from various medical institutes are archived in searchable central databases, which serve as "clearinghouses" for stored specimens. Eliminating the requirement for a central location, they can increase access to far-off areas. Therefore, the rising prevalence of chronic diseases such as myocardial infarction, angina, neurological disorders, cancer, and respiratory diseases among the United States population, leading to a rising need for treatment such as vaccines and medications, drives the market growth.

Report Coverage

This research report categorizes the market for the US biobanks market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the US biobanks market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the US biobanks market.

United States Biobanks Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 17.02 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 6.21% |

| 2035 Value Projection: | USD 33.01 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 218 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product and Service, By Biospecimen, By Type, By Application |

| Companies covered:: | Precision Cellular Storage Ltd., BioCision, LLC, Azenta US Inc., Tecan Trading AG, Icbiomedical, Merck KgaA, ThermoFisher Scientific Inc., QIAGEN, LabVantage Solutions Inc., Stemcell Technologies, ViaCord, and Other Key Companies. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Research on regenerative medicine, medication development, cord blood stem cell conservation, and genomics are some of the drivers propelling the biobanks industry. One of the main factors propelling the market is the increasing quantity of biobanks and human biosamples. Researchers can access a greater variety of samples through collaborative biobanking research programs, which produce more trustworthy results. Governance frameworks guarantee data ownership, privacy, and consent, as well as data exchange and adherence to ethical standards. Chronic illnesses, government programs, drug development, advancements in regenerative medicine, healthcare expenditures, and the treatment of tissue and cell problems are the main factors propelling the market. The market is expanding as a result of the popularity of biobank facilities. It is anticipated that technological developments and methods would create new prospects for the USA biobanks industry. Two important trends are virtual and green banking, which fuel the demand for biobanks.

Restraining Factors

The limited presence of skilled and trained personnel, high cost of the biobank facilities, stringent regulatory framework, ethical, legal, and storage concerns may limit the growth of the market.

Market Segmentation

The USA biobanks market share is classified into product & service, biospecimen, type, and application.

- The service segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The US biobanks market is segmented by product & service into services and products. Among these, the service segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is attributed to the growing healthcare providers, research organizations, and pharmaceutical businesses, increasing the need for sample processing, storage, and data management solutions. Organizations can concentrate on their core research while maintaining operational effectiveness and regulatory compliance by using outsourced biobanking services, such as sample logistics and genetic analysis.

- The human tissues segment accounted for the largest market share of 34.82% in 2024 and is expected to grow at a significant CAGR during the forecast period.

The US biobanks market is segmented by biospecimen into organs, stem cells, and human tissues. Among these, the human tissues segment accounted for the largest market share of 34.82% in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment growth is attributed to the increasing need for tissue samples are essential for drug development, biomarker identification, and disease modeling, particularly in oncology and regenerative medicine. There is a greater need for preserved, annotated samples, and improvements in imaging and preservation technology make them more useful for both commercial and scholarly research.

- The physical biobanks segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The US biobanks market is segmented by type into virtual biobanks and physical biobanks. Among these, the physical biobanks segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The sectoral growth is attributed to the large volumes of biospecimens that are frequently stored and managed in biobanks under stringent quality and temperature standards, facilitating drug development, translational research, and clinical trials, well-established infrastructure, adherence to regulations, and a variety of specimen kinds.

- The therapeutics segment accounted for the largest share in 2024 and is predicted to grow at a significant CAGR during the forecast period.

The US biobanks market is segmented by application into clinical diagnostics, therapeutics, drug discovery, clinical research, and others. Among these, the therapeutics segment accounted for the largest share in 2024 and is predicted to grow at a significant CAGR during the forecast period. The segment dominance is ascribed to application in personalized therapy, regenerative medicine, cell and gene therapies, targeted medicines, and increased translational research spending.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the US biobanks market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Precision Cellular Storage Ltd.

- BioCision, LLC

- Azenta US Inc.

- Tecan Trading AG

- Icbiomedical

- Merck KgaA

- ThermoFisher Scientific, Inc.

- QIAGEN

- LabVantage Solutions Inc.

- Stemcell Technologies

- ViaCord

- Others

Recent Developments:

- In June 2022, Mars Petcare launched the MARS PETCARE BIOBANK, a comprehensive real-world study aiming to improve understanding of pet health and disease. The biobank will recruit 20,000 pets across the US over 10 years, generating longitudinal physiological data to understand health status changes and differences between healthy and diseased pets. Enrolling pets in the study will enable new scientific discoveries to improve pet health for generations to come.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the US biobanks market based on the below-mentioned segments

US Biobanks Market, By Product & Service

- Services

- Products

US Biobanks Market, By Biospecimen

- Organs

- Stem Cells

- Human Tissues

US Biobanks Market, By Type

- Virtual Biobanks

- Physical Biobanks

US Biobanks Market, By Application

- Clinical Diagnostics

- Therapeutics

- Drug Discovery

- Clinical Research

- Others

Need help to buy this report?