United States Benzenoid Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Benzaldehyde, Benzoic Acid, Toluene, Xylene, Styrene, and Others), By Source (Natural and Synthetic), and United States Benzenoid Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsUnited States Benzenoid Market Insights Forecasts to 2035

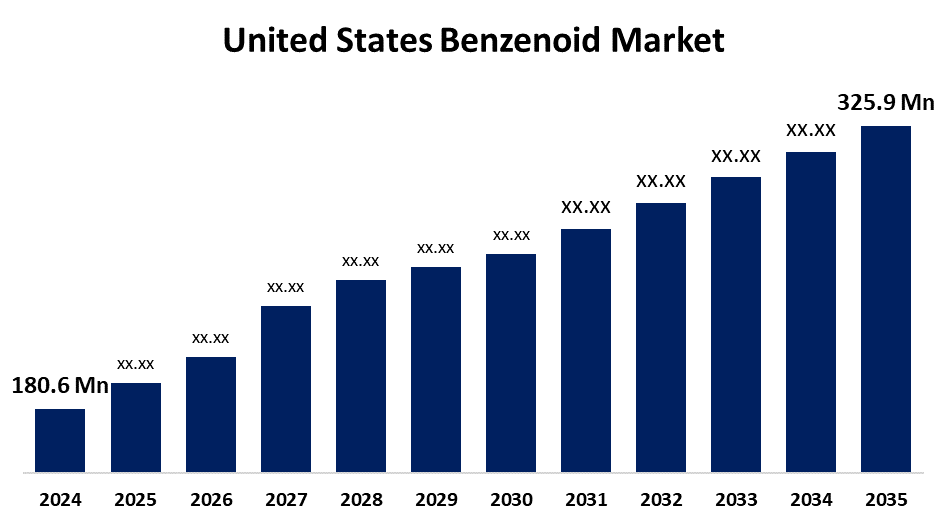

- The US Benzenoid Market Size Was Estimated at USD 180.6 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.51% from 2025 to 2035

- The US Benzenoid Market Size is Expected to Reach USD 325.9 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the United States Benzenoid Market is anticipated to reach USD 325.9 million by 2035, growing at a CAGR of 5.51% from 2025 to 2035. The expansion of the United States benzenoid market is propelled by the growing need for flavours and perfumes in a variety of industries.

Market Overview

The benzenoid refers to the class of aromatic compounds with at least one benzene ring in organic chemistry. Demand for benzenoids has risen due to the development of the luxury fragrance segment and the increasing demand for premium personal care products. Demand for scented and flavoured products is expected to be driven to new levels due to rising urbanisation and disposable income. Moreover, the move towards sustainable and biobased benzenoid chemicals is orderly speeding up the consumption market. Based on higher consumer preference for sustainable products and increased regulatory restrictions on synthetic materials, manufacturers are developing bio-derived benzenoids from reusable natural sources like essential oils and plant extracts. This shift ensures it complies with stringent environmental regulations while meeting consumer preferences. Benzenoid compounds, due to their versatility and usage, provide a host of opportunities. The pharmaceutical industry involves the manufacture of products, no matter what, from analgesics to antibiotics, in addition to the material industry involves polymers such as synthetic fibers, polymers, and resins, contributing to the upward growth of the market.

Report Coverage

This research report categorizes the market for the United States benzenoid market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States benzenoid market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States benzenoid market.

United States Benzenoid Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 180.6 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 5.51% |

| 2035 Value Projection: | USD 325.9 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 124 |

| Segments covered: | By Product Type, By Source and COVID-19 Impact Analysis |

| Companies covered:: | Sigma Aldrich, BASF, international Flavors and fragrances Inc, Sensient Technology Crop, Dupont USA, SMS, Reagents INc. |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the United States benzenoid market is boosted because it is used in the pharmaceutical industry as a flavouring agent in oral pharmaceuticals and medical syrups, and as an intermediate in the production of many drugs. The pharmaceutical drugs that treat sore throats include phenol benzenoid chemicals. Aniline benzenoids are used in trace amounts in many paracetamol products. Many pharmaceutical drugs that treat medical illnesses and fungal skin infections are composed of the benzenoid molecule benzoic acid. These factors are contributing to the growth of the benzenoid market. The food and beverage industry uses benzenoid chemicals as flavouring agents to provide products with specific tastes and smells. Benzenoid compounds containing benzoic acid are used as food preservatives in the food and beverage industry.

Restraining Factors

The United States benzenoid market faces obstacles like the exposure to benzene from various sources, like petroleum products, including motor fuels and solvents. Short-term or long-term health effects, haematological effects, and cancer impacts can arise from exposure to benzene. Because benzene is so volatile, most exposures occur through inhalation.

Market Segmentation

The United States benzenoid market share is classified into product type and source.

- The benzaldehyde segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States benzenoid market is segmented by product type into benzaldehyde, benzoic acid, toluene, xylene, styrene, and others. Among these, the benzaldehyde segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven because it is a precursor to other benzenoid compounds and is an important synthetic building block for certain active pharmaceutical ingredients. The demand for benzaldehyde as an API's essential building block continues to expand as the pharmaceutical industry continues to develop, due to chronic disease and demand for new therapeutic designs.

- The natural segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the source, the United States benzenoid market is segmented into natural and synthetic. Among these, the natural segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is propelled because it continues to grow with consumer preferences for natural and organic aspects, and manufacturing limitations based on synthetic chemicals are also driving the limitations as consumers become more aware of risks to their health and the environment associated with synthetic chemicals, as found in the horticultural and herbicides industry, and as new natural and bio-based benzenoid compounds or functional groups are emerging that are still synthetic but have bio-similar or natural traits. .

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States benzenoid market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List Of Companies

- Sigma Aldrich

- BASF

- international Flavors and fragrances Inc

- Sensient Technology Crop

- Dupont USA

- SMS

- Reagents INc

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States benzenoid market based on the following segments:

United States Benzenoid Market, By Product Type

- Benzaldehyde

- Benzoic Acid

- Toluene

- Xylene

- Styrene

- Others

United States Benzenoid Market, By Source

- Natural

- Synthetic

Need help to buy this report?