United States Benzene Market Size, Share, and COVID-19 Impact Analysis, By End-User (Alkylbenzene, Cyclohexane, Cumene, and Ethylbenzene) and US Benzene Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsUSA Benzene Market Insights Forecasts to 2035

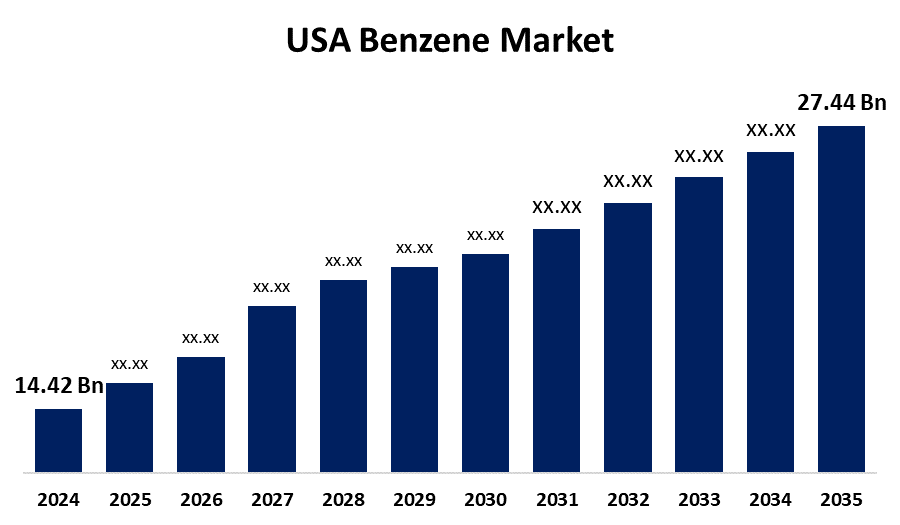

- The US Benzene Market Size was Estimated at USD 14.42 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.02% from 2025 to 2035

- The USA Benzene Market Size is Expected to reach USD 27.44 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the US Benzene Market Size is anticipated to reach USD 27.44 Billion by 2035, Growing at a CAGR of 6.02% from 2025 to 2035.

Market Overview

The production, distribution, and use of benzene, a vital petrochemical used as a building block for numerous chemicals and polymers in plastics, synthetic fibers, rubber, resins, and pharmaceuticals, are all included in the US benzene market. A colorless liquid with a sweet smell, benzene is a highly flammable substance that is produced by both natural and man-made processes. It is one of the top 20 chemicals in terms of production volume and is widely used in the US. Plastics, resins, nylon and synthetic fibers, rubbers, lubricants, dyes, detergents, medications, and pesticides are just a few of the industries that use it. Cigarette smoke, gasoline, and crude oil also contain benzene. The growing demand for benzene, especially in tire manufacturing and vehicle body parts due to the growing use of styrene, is propelling the market's expansion.

Report Coverage

This research report categorizes the market for US benzene market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the US benzene market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the US benzene market.

United States Benzene Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 14.42 Billion |

| Forecast Period: | 2025 - 2035 |

| Forecast Period CAGR 2025 - 2035 : | 6.02% |

| 2035 Value Projection: | USD 27.44 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 170 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By End-User and COVID-19 Impact Analysis |

| Companies covered:: | Reliance Industries, China Petroleum and Chemical Corp Class, Marathon Petroleum Corp, Chevron Corp, LG Chem, LyondellBasell Industries NV Class A, and Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

The demand for benzene, a crucial raw material used in the manufacture of tires and body parts, has increased as a result of the automotive industry's adoption of electric vehicles. Tires, shoe bottoms, pipes, gaskets, wire insulation, and conveyor belts all use styrene butadiene rubber (SBR), which is a crucial component of SBR. Demand has also steadily increased for synthetic materials, such as fibers, polymers, plastics, and resins. The demand for reasonably priced and long-lasting consumer goods is being driven by the US population growth and urbanization trends. The need for benzene is anticipated to increase in tandem with the number of industries that employ these materials. The petrochemical sector is also expanding due to rising energy demands and global economic expansion. The growth of transportation fuels and refinery expansions points to a booming petrochemical sector with more production capacity to meet the rising demand in downstream applications.

Restraining Factors

The strict environmental regulations, fluctuating crude oil prices, health concerns, and supply chain disruptions. Benzene is classified as hazardous, leading to strict regulations and limited production, which may hinder the growth of the market.

Market Segmentation

The USA benzene market share is classified by end-user.

- The ethylbenzene segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The US benzene market is segmented by end-user into alkylbenzene, cyclohexane, cumene, and ethylbenzene. Among these, the ethylbenzene segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is widely available, low molecular weight, gasoline odour, and combustible liquid.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the US benzene market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Reliance Industries

- China Petroleum and Chemical Corp Class

- Marathon Petroleum Corp

- Chevron Corp

- LG Chem

- LyondellBasell Industries NV Class A

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the US benzene market based on the below-mentioned segments:

US Benzene Market, By End-User

- Alkylbenzene

- Cyclohexane

- Cumene

- Ethylbenzene

Need help to buy this report?