United States Beer Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Standard Lager, Premium Lager, Specialty Beer, Others), By Flavor (Flavored, Unflavored), By Packaging (Glass, PET Bottle, Metal Can, Others), By Distribution Channel (Supermarkets and Hypermarkets, On-Trades, Specialty Stores, Convenience Stores), and US Beer Market Insights Forecasts to 2032.

Industry: Food & BeveragesUnited States Beer Market Insights Forecasts to 2032.

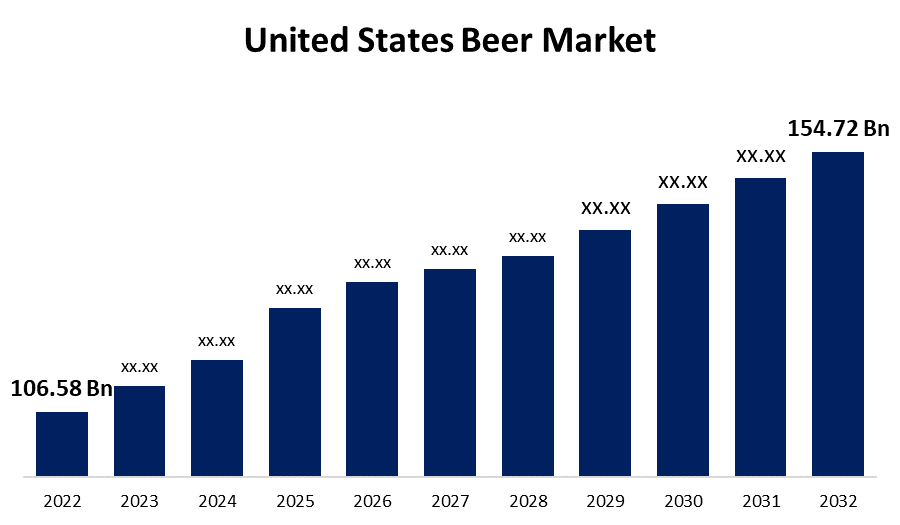

- The United States Beer Market Size was valued at USD 106.58 Billion in 2022.

- The Market is growing at a CAGR of 3.8% from 2022 to 2032.

- The United States Beer Market Size is expected to reach 154.72 Billion by 2032.

- United States is expected to grow the fastest during the forecast period.

Get more details on this report -

The United States Beer Market Size is expected to reach USD 154.72 Billion by 2032, at a CAGR of 3.8% during the forecast period 2022 to 2032.

Market Overview

Beer is a popular alcoholic beverage that humans have consumed for thousands of years. It is made by the brewing process, which involves fermenting cereal grains, often barley, with water and yeast. As a result of consuming the carbohydrates in the grains, the yeast generates alcohol and carbon dioxide. This fermentation process imparts beer's distinct flavor, aroma, and effervescence. Water, malted grains (typically barley), hops, and yeast are the essential constituents of beer. Water is the most important component, accounting for the majority of the beer's volume. Malted grains provide the fermentable sugars required for yeast fermentation, while hops add bitterness, flavor, and fragrance to balance the sweetness of the malt. Beer is available in a wide range of styles, from light and pleasant lagers to deep and complex ales, stouts, and IPAs. The beer-drinking culture of the United States is truly established in its social fabric. Beer is frequently connected with socializing, sporting events, and celebrations, making it a popular consumer option. Furthermore, economic factors such as disposable income, unemployment, and consumer confidence have a considerable impact on the beer market. The demographic composition of the United States plays a key role in defining the beer market. Demand for low-alcohol and non-alcoholic beer alternatives has also increased as a result of health-conscious behaviors. Other than that, the US beer market is highly competitive, with both large-scale breweries and a booming craft beer industry. Breweries are always innovating by offering new tastes, styles, and packaging formats to attract customers and differentiate themselves in the market.

Report Coverage

This research report categorizes the market for United States Beer Market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States Beer Market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the United States Beer Market.

United States Beer Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 106.58 Bn |

| Forecast Period: | 2022 – 2032 |

| Forecast Period CAGR 2022 – 2032 : | 3.8% |

| 022 – 2032 Value Projection: | USD 154.72 Bn |

| Historical Data for: | 2020-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 150 |

| Segments covered: | By Product Type, By Flavor, By Packaging, By Distribution Channel. |

| Companies covered:: | Bells Brewery Inc., Carlsberg Breweries AS, Constellation Brands Inc., D.G. Yuengling and Son Inc., Deschutes Brewery, Duvel Moortgat NV, FIFCO USA, Molson Coors Beverage Co., New Belgium Brewing Co. Inc., Pabst Brewing, SALT LAKE BREWING CO, Sierra Nevada Brewing Co., and Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market is being influenced by the changing demographics of the United States. The rise of the millennial generation is an important demographic trend. Millennials' desire for craft beer has driven the expansion of the craft beer category. They value unique flavors, high-quality ingredients, and the beer's history. This demographic is also more experimental and receptive to exploring new styles and brands, which contributes to the beer market's diversification. Furthermore, the growing diversity of the population has created a desire for a wide range of beer varieties that cater to various cultural preferences. Beer consumer tastes have been developing, driven by the need for more variety and mouthwatering selections. Craft beer has been at the forefront of this trend, providing customers with a diverse selection of types and flavors in addition to typical mass-produced beers. Craft breweries prioritize quality ingredients, local sourcing, and small-batch production, which results in beers with distinct and complex flavors. Consumer tastes have also been influenced by health-conscious tendencies, resulting in an increase in demand for low-alcohol and non-alcoholic beer alternatives.

Restraining Factors

The wide range of beer alternatives is a significant impediment to industry growth. Soft drinks, energy drinks, rum, vodka, and whiskey are the most popular beer substitutes. Traditional alcoholic beverages with high alcohol concentrations are generally available and fulfill their intended purpose. Other options, such as soft drinks and energy drinks, are widely available and are regarded to be healthier than alcoholic beverages such as beer. Non-alcoholic beverages, such as energy drinks and soft drinks, are aggressively advertised, increasing their attractiveness. However, alcoholic products such as beer cannot be advertised due to legal restrictions. So, suppliers have to depend on surrogate advertising, which is not considered a viable marketing method for reaching a new target group. This further restricts the selling of low-alcohol beer. As a result, the availability of substitutes in the market will have a negative influence on the market under consideration throughout the projection period.

Market Segment

- In 2022, the standard lager segment accounted for the largest revenue share over the forecast period.

Based on the product type, the United States Beer Market is segmented into standard lager, premium lager, specialty beer, and others. Among these, the standard lager segment has the largest revenue share over the forecast period. Standard lagers have a broad consumer base and are frequently regarded as a safe option by many consumers. They provide a consistent and recognizable flavor profile that appeals to a broad range of beer drinkers, from casual customers to those looking for a refreshing and easy-to-drink option. Another concern is the dominance and marketing power of major breweries that produce standard lagers. These brewing companies frequently have large distribution networks, well-established brand recognition, and huge advertising budgets. Their ability to reach a large audience through widespread availability and targeted marketing campaigns contributes to the market dominance of standard lagers. Furthermore, standard lagers frequently have a price-competitive advantage. They are typically less expensive than other beer styles, making them more accessible to a wider consumer base.

- In 2022, the unflavored segment is expected to hold the largest share of the United States set Beer market during the forecast period.

Based on the flavor, the United States Beer Market is classified into flavored, unflavored. Among these, the unflavored segment is expected to hold the largest share of the United States Beer Market during the forecast period. Unflavored beers, such as lagers and ales, have a long history and cultural significance. They reflect historic beer types that consumers have enjoyed for years, which contributes to their sustained popularity and market domination. Unflavored beers also provide an extensive and versatile drinking experience. They have a clean and balanced flavor profile with no dominating flavors, enabling customers to enjoy the natural characteristics of the malt, hops, and yeast. This neutrality appeals to a wide spectrum of beer enthusiasts who desire a simple and refreshing beverage free of extra flavors.

- In 2022, the glass segment accounted for the largest revenue share over the forecast period.

On the basis of packaging, the United States Beer Market is segmented into glass, PET bottle, metal can, and others. Among these, the glass segment has the largest revenue share over the forecast period. Glass has a long association with beer and is frequently regarded as the traditional and premium packaging material. It conveys a sense of quality and authenticity, which appeals to a wide range of consumers. Glass also has various features that contribute to its popularity. It is transparent, allowing consumers to see the beer's color and clarity, which is particularly significant for specific beer genres. Glass is also impermeable, acting as an effective barrier against oxygen and moisture, maintaining the flavor of the beer and extending its shelf life. Also, glass is recyclable, which aligns with consumer expectations for environmentally friendly packaging solutions. The sense of flavor is another reason driving the dominance of glass packaging. Many beer fans believe that beer tastes better when poured into a glass or taken from a glass bottle.

- In 2022, the supermarkets & hypermarkets segment are expected to hold the largest share of the United States set Beer market during the forecast period.

Based on the distribution channel, the United States Beer Market is classified into supermarkets & hypermarkets, on-trades, specialty stores, convenience stores, and others. Among these, the supermarkets & hypermarkets segment is expected to hold the largest share of the United States Beer Market during the forecast period. Supermarkets and hypermarkets have a wide and frequent reach, with several outlets located across different areas. Their enormous physical size enables them to service a large number of customers, offering beer shoppers convenience and accessibility. Moreover, major breweries and beer distributors have created links and partnerships with supermarkets and hypermarkets. This enables them to get favorable partnerships, competitive pricing, and a consistent supply of popular beer brands. Their ability to buy helps them to offer a varied choice of beer options that cater to various consumer preferences. Other than that, supermarkets and hypermarkets frequently include alcoholic beverage sections or aisles, including an extensive range of beers.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States Beer Market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Bells Brewery Inc.

- Carlsberg Breweries AS

- Constellation Brands Inc.

- D.G. Yuengling and Son Inc.

- Deschutes Brewery

- Duvel Moortgat NV

- FIFCO USA

- Molson Coors Beverage Co.

- New Belgium Brewing Co. Inc.

- Pabst Brewing

- SALT LAKE BREWING CO

- Sierra Nevada Brewing Co.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- On August 2023, Innis & Gunn, the brewery based in Edinburgh, introduced 12 Moons Lager. This fresh brew was bottled in August 2022 during a full moon and matured for a full year in 75 bottles. With a 5.8% alcohol content, this bottle-conditioned and unpasteurized lager marks the fourth addition to Innis & Gunn's limited-edition lineup for 2023.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2021 to 2032. Spherical Insights has segmented the United States Beer Market based on the below-mentioned segments:

United States Beer Market, By Product Type

- Standard Lager

- Premium Lager

- Specialty Beer

- Others

United States Beer Market, By Flavor Type

- Flavored,

- Unflavored

United States Beer Market, By Packaging

- Glass

- PET Bottle

- Metal Can

- Others

United States Beer Market, By Distribution Channel

- Supermarkets & Hypermarkets

- On-Trades

- Specialty Stores

- Convenience Stores

- Others

Need help to buy this report?