United States Bearing Market Size, Share, and COVID-19 Impact Analysis, By Product (Ball Bearings, Roller Bearings, Plain Bearings, and Others), By Application (Automotive, Agriculture, Electrical, Mining & Construction, Railway & Aerospace, Automotive Aftermarket, and Others), and United States Bearing Market Insights, Industry Trend, Forecasts to 2035

Industry: Automotive & TransportationUnited States Bearing Market Size Insights Forecasts to 2035

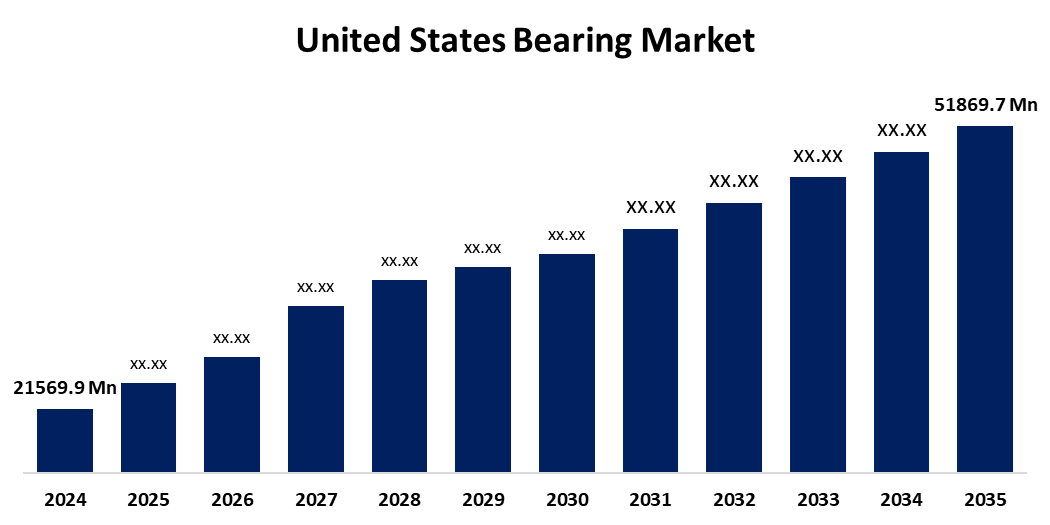

- The US Bearing Market Size Was Estimated at USD 21569.9 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 8.3% from 2025 to 2035

- The US Bearing Market Size is Expected to Reach USD 51869.7 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the United States Bearing Market Size is anticipated to reach USD 51869.7 million by 2035, growing at a CAGR of 8.3% from 2025 to 2035. The expansion of the United States' bearing market is propelled by its utilisation in all types of machinery and equipment, including defence and aerospace equipment, agricultural equipment, household appliances, and auto parts.

Market Overview

A bearing is a mechanical device that reduces friction and allows for regulated motion between two parts. It ensures smooth operation and reduces wear by supporting, moving, or rotating parts of machinery, like shafts or axles. The U.S. has a varied manufacturing base that includes sectors such as industrial machinery, automotive, aviation, and renewable energy. In the mechanical equipment industry, bearings are essential components. Its main purpose is to secure the rotating mechanical body when the equipment is handling a load in order to minimize the coefficient of friction of the mechanical load. Wind turbines, reducers, engine motors, propeller shafts, wind farms, robotics sports, and the construction and mining respectively are a few of the sectors where bearings are being utilized. Bearings can be used in so many areas of industry, from large machinery down to precise pieces of equipment. The automotive industry is also one of the largest users of bearings in the U.S. and helps drive the compound annual growth rate of the market. Many small and medium-sized businesses do not use bearings due to the unpredictability of the cost in production.

The U.S. government has taken a number of steps to assist the bearing industry, especially in sophisticated manufacturing, aerospace, and defence. One prominent example is the investment made by the Department of Defence (DoD) in The Timken Company, a well-known bearing manufacturer. Timken signed a $13.8 million contract with the DoD in 2023 to increase high-precision ball bearing production at its site in Keene, New Hampshire. These bearings are essential for modern systems related to space and defence.

Report Coverage

This research report categorizes the market for the United States bearing market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States bearing market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States bearing market.

United States Bearing Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 21569.9 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 8.3% |

| 2035 Value Projection: | USD 51869.7 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 198 |

| Tables, Charts & Figures: | 121 |

| Segments covered: | By Product, By Application and COVID-19 Impact Analysis |

| Companies covered:: | The Timken Co, Regal Rexnord Corp, RBC Bearings Inc, Schaeffler Group USA, GGB, Barden Corporation, Auburn Bearing & Manufacturing, SKF USA Inc, and Other key vendors |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the United States' bearing market is boosted because demand for food and drink has increased significantly as income and population grow. In order to meet that demand, food processors and packagers need food processing and packaging equipment and machinery that will increase efficiency, minimize costs, and reduce waste while adhering to FDA and sanitary requirements. To achieve these goals, appropriate bearings need to be selected. Ball bearings are used in many different types of industrial machinery, but they are vitally important to the equipment and systems used in the food and beverage industry. To be deemed safe in environments where they could ultimately come into contact with food that is meant for consumption, ball bearings are typically composed of food-grade stainless steel.

Restraining Factors

The United States bearing market faces obstacles, as in many cases, bearings are switched out before they really fail in order to maintain safety. In total, 0.05% of bearings will need to be changed out as they are broken or defective.

Market Segmentation

The United States' bearing market share is classified into product and application.

- The roller bearings segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States bearing market is segmented by product into ball bearings, roller bearings, plain bearings, and others. Among these, the roller bearings segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven by the products are more efficient at supporting extreme radial loads and limited axial loads than their competitors, and additionally can support axial and radial loads, but reduce the friction in rotation. It is anticipated that with the wide proliferation of roller bearings by manufacturers in various sectors, specifically, capital equipment, the automotive sector, home appliances, and aerospace, will have a positive effect on the demand for the products.

- The automotive segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the application, the United States bearing market is segmented into automotive, agriculture, electrical, mining & construction, railway & aerospace, automotive aftermarket, and others. Among these, the automotive segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is propelled by the increasing production of automobiles. There is also an increased demand for cars with technological solutions, which increases the production of cars that will use instrumented products. The automobile industry's need for bearings has been impacted by the rise in demand for technologically sophisticated vehicles and the expansion of such vehicles' capacities.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States bearing market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- The Timken Co

- Regal Rexnord Corp

- RBC Bearings Inc

- Schaeffler Group USA

- GGB

- Barden Corporation

- Auburn Bearing & Manufacturing

- SKF USA Inc

- Others

Recent Development

- In November 2023, The Timken Company successfully concluded the acquisition of Engineered Solutions Group, also recognized as Innovative Mechanical Solutions or iMECH. Specializing in the production of radial bearings, specialty coatings, thrust bearings, and other components primarily tailored for the energy industry, iMECH operates with a workforce of around 70 professionals. The business foresees generating revenue of approximately USD 30 million for the calendar year 2023. This strategic acquisition is instrumental in enhancing the company’s standing as a provider of comprehensive solutions within the industrial motion and engineered bearings sector.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States bearing market based on the following segments:

United States Bearing Market, By Product

- Ball Bearings

- Roller Bearings

- Plain Bearings

- Others

United States Bearing Market, By Application

- Automotive

- Agriculture

- Electrical

- Mining & Construction

- Railway & Aerospace

- Automotive Aftermarket

- Others

Need help to buy this report?