United States Bamboo Market Size, Share, and COVID-19 Impact Analysis, By Type (Tropical, Herbaceous, and Temperate), By Cultivation Method (Culms, Rhizomes, Seeds, and Others), and United States Bamboo Market Insights, Industry Trend, Forecasts to 2035

Industry: Advanced MaterialsUnited States Bamboo Market Insights Forecasts to 2035

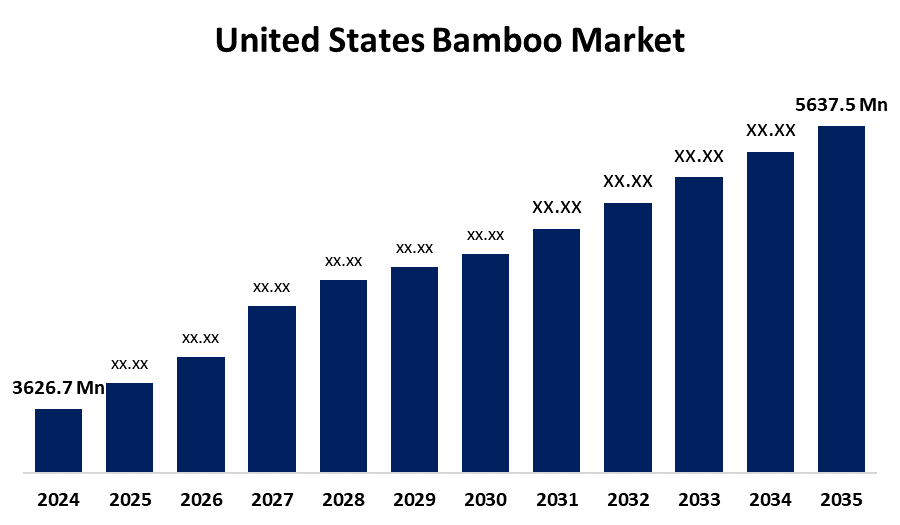

- The US Bamboo Market Size Was Estimated at USD 3626.7 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.09% from 2025 to 2035

- The US Bamboo Market Size is Expected to Reach USD 5637.5 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The United States Bamboo Market Size is anticipated to reach USD 5637.5 Million by 2035, growing at a CAGR of 4.09% from 2025 to 2035. The expansion of the United States bamboo market is propelled by the expanding expenditures on infrastructure construction and the growing consumer consciousness regarding eco-friendly, long-lasting, and sustainable products.

Market Overview

Bamboo refers to a broad group of woody grasses in the Bambusoideae subfamily of the Poaceae family, which includes more than 1,400 species in more than 115 genera. Bamboo's versatility, sustainability, and eco-friendliness have sparked rising consumption in the U.S. in recent years. Bamboo is a grass that grows fast, is durable, resilient, and beautiful, and can be used in several industries. Increased use of bamboo as building or construction materials is certainly a contributory factor in tightening demand for bamboo products. For flooring, fencing, decking, and structural components of both residential and commercial builds, bamboo has become a sustainable alternative to traditional hardwoods. Given bamboo's rapid growth and regenerative properties, it is an attractive material for those builders and consumers wanting sustainable, low-cost materials. Given their aesthetics and eco-friendly characteristics, bamboo products have quickly gained traction as furniture and home decor items.

The USDA Sustainable Agriculture Research and Education (SARE) Program offers grants for research and instructional projects that support sustainable agricultural practices, including bamboo production. In 2021, the SARE program awarded about $35 million in grants to academics and farmers in the United States.

Report Coverage

This research report categorizes the market for the United States bamboo market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States bamboo market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States bamboo market.

United States Bamboo Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 3626.7 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 4.09% |

| 2035 Value Projection: | USD 5637.5 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type and By Cultivation Method |

| Companies covered:: | Smith & Fong Company, Greenington, MOSO International B.V., Bamboo Village Company Limited, EcoPlanet Bamboo Group, Cali Bamboo LLC, Teragren, Inc., Bamboo Skateboards, Calfee Design, and Others |

| Pitfalls & Challenges: | Covid-19 Impact, Challenge, Future,Growth and Analysis |

Get more details on this report -

Driving Factors

The growth of the United States bamboo market is boosted because it is a sustainable alternative to plastic and lumber due to its quick growth, low input requirements, and significant carbon sequestration. Fast processing technology advancements, i.e., automated harvesting, designed composites improve their performance in textiles and construction. Adoption is further fuelled across sectors by consumer demand for eco-friendly, plastic-free products and supportive government legislation.

Restraining Factors

The United States bamboo market faces obstacles, as bamboo is abundant as a crop in tropical locations, it remains challenging to convert quickly growing stems into consistent, quality-stable goods for overseas markets.

Market Segmentation

The United States bamboo market share is classified into type and cultivation method.

- The tropical segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States bamboo market is segmented by type into tropical, herbaceous, and temperate. Among these, the tropical segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven by its sustainable and adaptive nature. Tropical bamboo is used in a variety of industries such as textiles, furniture, and construction, as they are strong and can grow quickly. Tropical bamboo is chosen because of its high strength-to-weight ratio, combined with its adaptability, its use is prevalent in tropical rainforest regions where it is hot and humid.

- The culms segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the cultivation method, the United States bamboo market is segmented into culms, rhizomes, seeds, and others. Among these, the culms segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is propelled as this method of harvesting mature bamboo stalks or culms while leaving the root system undisturbed has been growing in popularity for its efficiency and sustainability. The popularity of sustaining bamboo by this method is also supported by a reasonably priced harvesting method and high-quality bamboo from culm harvesting, which is important for a variety of applications, including construction, craft, and furniture manufacturing.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States bamboo market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Smith & Fong Company

- Greenington

- MOSO International B.V.

- Bamboo Village Company Limited

- EcoPlanet Bamboo Group

- Cali Bamboo LLC

- Teragren, Inc.

- Bamboo Skateboards

- Calfee Design

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States Bamboo market based on the following segments:

United States Bamboo Market, By Type

- Tropical

- Herbaceous

- Temperate

United States Bamboo Market, By Cultivation Method

- Culms

- Rhizomes

- Seeds

- Others

Need help to buy this report?