United States Baler Market Size, Share, and COVID-19 Impact Analysis, By Type (Horizontal Balers, Vertical Balers, Specialty Balers, and Others), By Operations (Manual, Semi-Automatic, and Fully Automatic), and United States Baler Market Insights, Industry Trend, Forecasts to 2035

Industry: Automotive & TransportationUnited States Baler Market Insights Forecasts to 2035

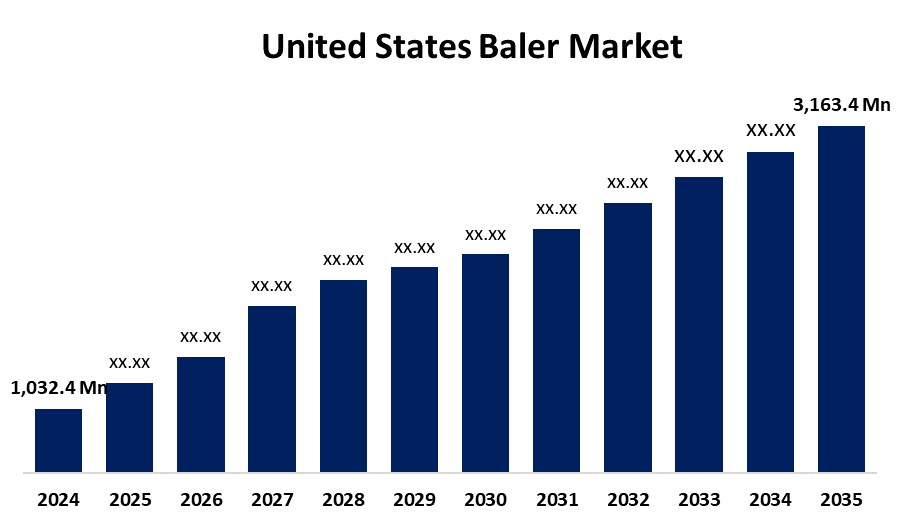

- The US Baler Market Size Was Estimated at USD 1,032.4 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 10.72% from 2025 to 2035

- The US Baler Market Size is Expected to Reach USD 3,163.4 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the United States Baler Market is anticipated to reach USD 3,163.4 million by 2035, growing at a CAGR of 10.72% from 2025 to 2035. The expansion of the United States baler market is propelled as it is used to compress cut, raked crops, and bale hay.

Market Overview

A baler is a piece of mechanical machinery that cuts and compresses raked products, like cotton, silage, flax straw, and hay, into tiny square, spherical, or rectangular bales. It is easy to handle, move, and store these bales. The chain-based and belt-based versions of the equipment are widely accessible. Belt balers employ a sequence of belts and rollers to spin the material, whereas chain balers use connecting bars, chains, and rollers at the bottom of the chamber. They are typically made of sheet steel and comprise many parts, including tires, wheels, belts, hydraulic cylinders, and pumps. They can be used to create bales from waste materials like plastic, paper, fibreboard, cans, and foil, and they also help to preserve the nutritional value of the bundled crops. The market is being pushed forward by technological advancements in the agriculture industry aimed at boosting farm production and addressing the changing demand for food. To keep materials like paper, cardboard, and plastic as recyclable as possible and in better condition for storage and transportation, balers are crucial. The increases in the market are also attributable to changing farming approaches and the increasing demand for bioenergy production. The increases in the required efficiencies of crop management systems in the U.S. produce industry and the awareness of sustainability trends are adding more optimism to this outlook. Funded programs from USDA and in the states are readily affording producers capital to purchase advanced baling equipment, which is automated and semi-automated balers, necessary to increase efficiencies, production, and to work through labor shortages.

Report Coverage

This research report categorizes the market for the United States baler market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States baler market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States baler market.

United States Baler Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1,032.4 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 10.72% |

| 2035 Value Projection: | USD 3,163.4 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 121 |

| Segments covered: | By Type, By Operations and COVID-19 Impact Analysis |

| Companies covered:: | John Deere, AGCO Corporation, Vermeer Corporation, International Baler Corporation (IBC), Harris Waste Management Group, Harmony Enterprises, PTR Baler and Compactor Company, Others. |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the United States baler market is boosted because recycling becomes more economical and efficient when balers compress loose wastes into compact, dense bales. By reducing the chance of contamination during collection and transit, baling also enhances the quality of the material. By keeping waste out of landfills and promoting a more environmentally friendly method of waste management, balers also assist companies in adhering to legislation. The need for balers, which can handle enormous volumes of recyclable materials, including paper, plastic, and metal cans, is further fuelled by the expansion of Material Recovery Facilities (MRFs). For MRFs to handle large numbers and produce consistent bales, horizontal and auto-tie balers are crucial. Textile balers can compress fabric scraps for recycling or repurposing, while plastic film balers can handle post-industrial plastic trash.

Restraining Factors

The United States baler market faces obstacles like the high cost of intricate machinery, the requirement for skilled workers, and the intricacy of more recent technology. The challenges may make it more difficult for small-scale farmers and operators to employ balers at markets.

Market Segmentation

The United States baler market share is classified into type and operations.

- The horizontal balers segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States baler market is segmented by type into horizontal balers, vertical balers, specialty balers, and others. Among these, the horizontal balers segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven by effectively handling high material volumes. Industries or facilities that produce large amounts of recyclable materials, like cardboard, plastics, and paper, are the main source of demand for horizontal balers. Businesses looking to optimise their waste management procedures and boost operational efficiency are drawn to the capacity to process big volumes rapidly and produce dense bales for convenient storage and transportation.

- The semi-automatic segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the operations, the United States baler market is segmented into manual, semi-automatic, and fully automatic. Among these, the semi-automatic segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is propelled as compared to manual balers, semi-automatic balers provide a balance between automation and human operation, resulting in increased output and efficiency. Businesses are looking to boost throughput and simplify trash handling procedures while preserving some degree of operator control and flexibility.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States baler market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- John Deere

- AGCO Corporation

- Vermeer Corporation

- International Baler Corporation (IBC)

- Harris Waste Management Group

- Harmony Enterprises

- PTR Baler and Compactor Company

- Others

Recent Development

- In January 2024, New Holland launched Autonomous Baling Technology. A novel technology, IntelliSense Bale Automation, reportedly transforms the way customers and operators approach large square baling by delivering an automated solution for farmers. The new system is compatible with Class 3 ISOBUS tractors specifically, the T7 LWB, T7 HD, and T8 from New Holland, and model year 2022 and model year 2023 New Holland BigBaler Large Square Balers.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States baler market based on the following segments:

United States Baler Market, By Type

- Horizontal Balers

- Vertical Balers

- Specialty Balers

- Others

United States Baler Market, By Operations

- Manual

- Semi-Automatic

- Fully Automatic

Need help to buy this report?