United States Bakeware Market Size, Share, and COVID-19 Impact Analysis, By Product (Molds, Cups, Rolling Pin, Tins & Trays, Pans & Dishes, and Others), By Material (Aluminum, Stainless Steel, Stoneware, Carbon steel, Glass, and Others), and United States Bakeware Market Insights, Industry Trend, Forecasts to 2035

Industry: Consumer GoodsUnited States Bakeware Market Insights Forecasts to 2035

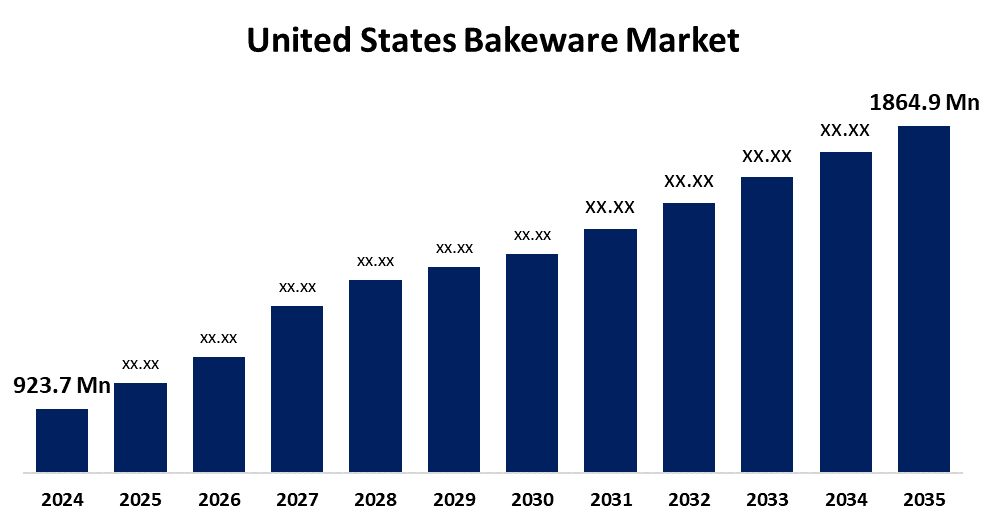

- The US Bakeware Market Size Was Estimated at USD 923.7 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.6% from 2025 to 2035

- The US Bakeware Market Size is Expected to Reach USD 1864.9 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The United States Bakeware Market Size is anticipated to reach USD 1864.9 Million by 2035, growing at a CAGR of 6.6% from 2025 to 2035. The expansion of the United States bakeware market is propelled by the surge in baking at home since the pandemic, the increased baking activity over the holidays, and the impact of social media.

Market Overview

The term bakery refers to a range of cooking utensils or apparatus made especially for baking meals in an oven. There has also been a surge in the utilization of cutting-edge and modern technologies in bakeware products and equipment. U.S. manufacturers use innovative products to enhance the baking experience. Some examples of smart bakeware are nonstick technology and temperature sensors. Companies are putting together collections that satisfy the growing demand and variety of products for in-home baking activities. Baked goods are being prepared at home, performance, durability, and ease of use were kept in mind with evolving consumer demand. There is a selection of bakeware, silicone tools, and baking products that include baking sheets, pans, spatulas, whisks, and even oven mittens, as these types of products need to satisfy the in-home cooks and bakers' requirements. According to the International Houseware Association reports that the retail sales of bakeware, cookware, and kitchenware all had increases in 2020. There is now a steady market for both new and established businesses to launch creative bakeware products in the United States due to the growing demand for these goods in both physical and online retailers.

Report Coverage

This research report categorizes the market for the United States bakeware market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States bakeware market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States bakeware market.

United States Bakeware Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 923.7 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 6.6% |

| 2035 Value Projection: | USD 1864.9 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Product and By Material |

| Companies covered:: | USA Pan, Newell Brands Inc, Emile Henry USA, Wilton Brands LLC, Nordic Ware, Meyer Corporation U.S., Caraway, Le Creuset, and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the United States bakeware market is boosted because the baking professionals and food industry, legislative, and other media deal with exclusive bakeware production acceptance trends for professionals. More and more individuals are attempting to bake, whether they have experience with baking or not, and as home baking becomes more popular, this appeal is probably fuelled by the desire to try new recipes and the desire for homemade, fresh ingredients. Furthermore, higher disposable incomes are allowing consumers to spend more on quality bakeware. Because they can now afford tools and equipment, consumers are really opting to spend in items that enhance their baking experience.

Restraining Factors

The United States bakeware market faces obstacles like high purchase price points of high-end products, such as fine metals pieces and ceramic bakeware can create buying blocks. As consumers on a tight budget, high-end items are not adaptable to societally defined product costs; instead, they are seen as just another type of media.

Market Segmentation

The United States bakeware market share is classified into product and material.

- The pans & dishes segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States bakeware market is segmented by product into molds, cups, rolling pin, tins & trays, pans & dishes, and others. Among these, the pans & dishes segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven by its versatility, pans and dishes are very popular right now for cooking and baking purposes. For home cooks and bakers who like making casseroles, lasagna, pies, baked desserts, pans, and dishes, they have unlimited uses for both savoury and sweet. Each item is suitable for cooking, baking, brunching, and roasting and features a durable, warp-resistant body. Made with an ultra-nonstick ceramic coating, the product is completely toxin-free, evading dangerous products such as PFAS, lead, and cadmium.

- The aluminum segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the material, the United States bakeware market is segmented into aluminum, stainless steel, stoneware, carbon steel, glass, and others. Among these, the aluminum segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is propelled because it works well for baking pizzas, focaccias, and other yeast-leavened preparations, given its excellent thermal conductivity and heat distribution. Aluminium's versatility means the pans may be placed on any shelf to create the proper crust texture in either static or vented ovens.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States bakeware market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- USA Pan

- Newell Brands Inc

- Emile Henry USA

- Wilton Brands LLC

- Nordic Ware

- Meyer Corporation U.S.

- Caraway

- Le Creuset

- Others

Recent Development

- In May 2024, Meyer Corporation, under its Farberware brand, launched three new collections inspired by Mickey Mouse as part of the Disney Home range: Monochrome cookware, Bake with Mickey bakeware, and Bon Voyage Mickey and Minnie Mouse-themed cookware. These durable, nonstick baking pans are available in red and classic black variants. They are manufactured using heavy-gauge steel to prevent warping and bending. The bakeware is designed for ease of use and quick cleaning. It features imprints of Mickey Mouse's silhouette on the interior nonstick surface. These products offer both functionality and whimsical charm.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States bakeware market based on the following segments:

United States Bakeware Market, By Product

- Molds

- Cups

- Rolling Pin

- Tins & Trays

- Pans & Dishes

- Others

United States Bakeware Market, By Material

- Aluminum

- Stainless Steel

- Stoneware

- Carbon steel,

- Glass

- Others

Need help to buy this report?