United States Bakelite Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Oil-soluble, Alcoholic Soluble, Modified, and Others), By Application (Automotive, Aerospace, Electricals & Electronics, Power Generation, and Others), and United States Bakelite Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsUnited States Bakelite Market Size Insights Forecasts to 2035

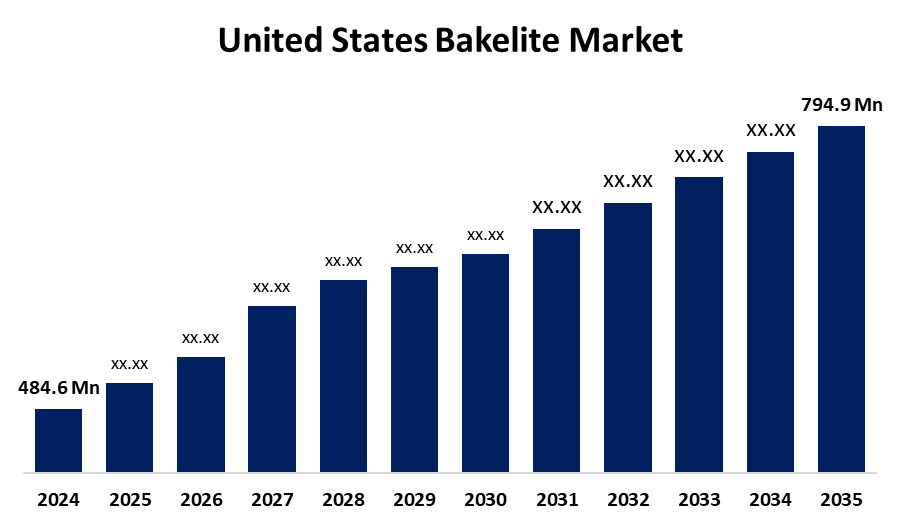

- The US Bakelite Market Size Was Estimated at USD 484.6 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.6% from 2025 to 2035

- The US Bakelite Market Size is Expected to Reach USD 794.9 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the United States Bakelite Market Size is anticipated to reach USD 794.9 million by 2035, growing at a CAGR of 4.6% from 2025 to 2035. The expansion of the United States Bakelite market is propelled because it has exceptional thermal stability and flame-retardant properties. Its application is being driven by the increased demand for fire-resistant product types in the automotive and construction industries.

Market Overview

Bakelite, a thermosetting phenol-formaldehyde resin made by condensing phenol and formaldehyde under pressure and heat, is the first completely synthetic plastic. Bakelite is a preferred alternative to standard plastics and metals in many industries, including electronics, automotive, and aerospace, due to its high mechanical strength and thermal stability. Bakelite's ability to provide replacements for heavier materials in circuit boards, brake pads, and electrical housings makes it even more noteworthy as industries move toward more long-lasting and lighter-weight materials. Manufacturers are creating specialized Bakelite formulations to optimize performance while meeting any applicable regulations since phenolic resins have long been used in sustainable product development. Given the demand for sustainable materials, the Bakelite market offers substantial prospects for growth. Innovations in the production process have improved performance, reduced cost, and enhanced quality, allowing Bakelite to compete with other materials.

The U.S. Environmental Protection Agency enforces the National Emission Standards for Hazardous Air Pollutants (NESHAP) under 40 CFR Subpart OOO, which targets the production of amino and phenolic resins, including Bakelite-type products. These rules, which were last updated in October 2014 and again in 2018, aim to reduce emissions of harmful air pollutants such as formaldehyde, methanol, phenol, xylene, and toluene from covered facilities.

Report Coverage

This research report categorizes the market for the United States Bakelite market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States Bakelite market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States Bakelite market.

United States Bakelite Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 484.6 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 4.6% |

| 2035 Value Projection: | USD 794.9 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 158 |

| Tables, Charts & Figures: | 126 |

| Segments covered: | By Product Type, By Application and COVID-19 Impact Analysis |

| Companies covered:: | Plastics Engineering Co., Akrochem Corporation, Georgia-Pacific Chemicals LLC, Bakelite Synthetics, SI Group Inc., Hexion Inc., SAE Manufacturing Specialties Corp, The Chemical Co., and Other key vendors |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors

The growth of the United States Bakelite market is boosted by the expansion of the electrical and electronics industry. Bakelite is well suited for electrical components, like switchgear, circuit breakers, and electric panels, due to its enhanced insulating capabilities and enhanced heat resistance. The rise in the use of Bakelite is mainly due to growing demand for consumer electronics, industrial automation, and smarter network infrastructure. Additionally, the trend towards renewable energy sources is increasing demand for Bakelite, especially in transformers, contacts, and power distribution units, as more energy-efficient systems become available. The increased automotive sector is another factor that continues to drive demand in the Bakelite market.

Restraining Factors

The United States Bakelite market faces obstacles like the environmental and health issues associated with Bakelite production. There are numerous regulatory measures in force to manage, minimize, and restrict the use and production of formaldehyde, which can be a carcinogen to humans.

Market Segmentation

The United States Bakelite market share is classified into product type and application.

- The oil-soluble segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States Bakelite market is segmented by product type into oil-soluble, alcoholic soluble, modified, and others. Among these, the oil-soluble segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven by the growing use of its products in industrial lubrication and high-performance coatings. Oil-soluble phenolic resins are gaining traction in applications such as corrosion-resistant coatings and components for heavy-duty machinery as industries seek materials that will provide mechanical durability and thermal resistance in extreme operating environments.

- The automotive segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the application, the United States Bakelite market is segmented into automotive, aerospace, electricals & electronics, power generation, and others. Among these, the automotive segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is propelled because it is looking toward lightweight, but still highly durable materials for components in brake pads, clutch plates, and ignition systems, and the desire for Bakelite. New emission and fuel economy standards have also put pressure on motor vehicle manufacturers to explore long-lasting, thermally stable materials to replace heavier metals while maintaining performance and safety.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States Bakelite market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Plastics Engineering Co.

- Akrochem Corporation

- Georgia-Pacific Chemicals LLC

- Bakelite Synthetics

- SI Group Inc.

- Hexion Inc.

- SAE Manufacturing Specialties Corp

- The Chemical Co.

- Others

Recent Development

- In August 2023, Bakelite Synthetics finalized its acquisition of LRBG Chemicals, a company specializing in resins and related products for various sectors like construction and transportation. This move allows Bakelite Synthetics to broaden its product range, customer base, and overall growth strategy. Additionally, the acquisition gives Bakelite Synthetics a foothold in the US, improving service to customers in the U.S.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States Bakelite market based on the following segments:

United States Bakelite Market, By Product Type

- Oil-soluble

- Alcoholic Soluble

- Modified

- Others

United States Bakelite Market, By Application

- Automotive

- Aerospace

- Electricals & Electronics

- Power Generation

- Others

Need help to buy this report?