United States Autonomous AI and Autonomous Agents Market Size, Share, and COVID-19 Impact Analysis, By Application (Healthcare, Automotive, Manufacturing, Retail, and Finance), By Technology (Machine Learning, Natural Language Processing, Computer Vision, and Reinforcement Learning), By Deployment Model (On-Premises, Cloud-Based, and Hybrid), By Industry (Aerospace, Telecommunications, Education, and Agriculture), and United States Autonomous AI and Autonomous Agents Market Insights, Industry Trend, Forecasts to 2035

Industry: Automotive & TransportationUnited States Autonomous AI and Autonomous Agents Market Insights Forecasts to 2035

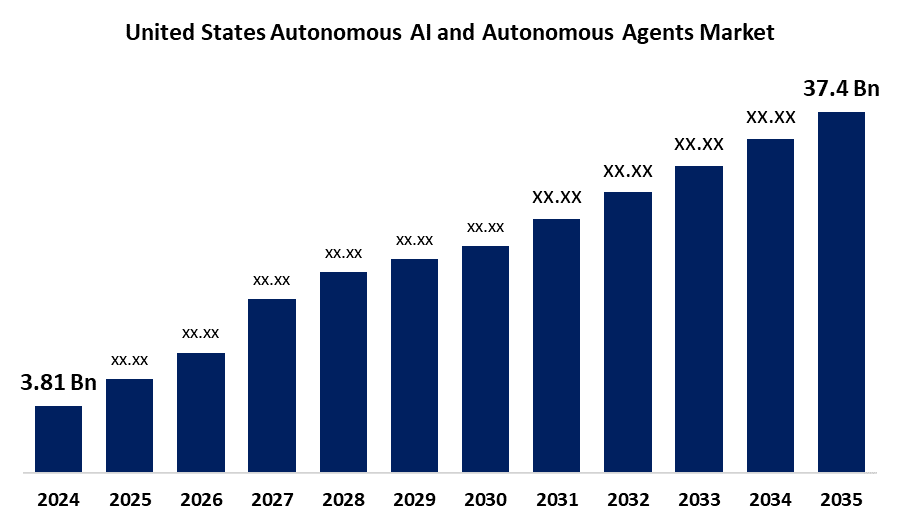

- The United States Autonomous AI and Autonomous Agents Market Size was Estimated at USD 3.81 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 23.08% from 2025 to 2035

- The United States Autonomous AI and Autonomous Agents Market Size is Expected to Reach USD 37.4 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The United States autonomous AI and autonomous agents market Size is anticipated to reach USD 37.4 Billion by 2035, growing at a CAGR of 23.08% from 2025 to 2035. The U.S. autonomous AI and agents market is expanding rapidly due to advancements in AI and machine learning, widespread adoption across industries, and increased demand for automation. Technological progress enables real-time data analysis and decision-making, enhancing efficiency in sectors like manufacturing, healthcare, and logistics. Additionally, significant investments from tech giants and government initiatives bolster innovation and infrastructure development, fueling market growth.

Market Overview

The United States autonomous AI and autonomous agents market refers to the industry focused on developing and deploying intelligent systems and software agents capable of performing tasks independently without human intervention. These systems use advanced artificial intelligence, machine learning, and real-time data processing to make autonomous decisions, enabling automation across various sectors like transportation, healthcare, manufacturing, and logistics. This surge is driven by advancements in AI applications, increased availability of parallel computational resources, and progress in autonomous driving and healthcare technologies. Key strengths include the integration of advanced AI and machine learning algorithms, edge computing, enhanced sensor technologies, and 5G connectivity, which collectively enhance the capabilities of autonomous systems. Opportunities abound in sectors such as autonomous vehicles, healthcare automation, and smart manufacturing, where autonomous AI and agents can optimize operations and improve efficiency. The U.S. government has implemented initiatives like the AI Bill of Rights, focusing on safe and effective systems, algorithmic discrimination protection, and data privacy. Additionally, the National Security Commission on Artificial Intelligence has emphasized the need for AI integration in national security to maintain competitiveness.

Report Coverage

This research report categorizes the market for the United States autonomous AI and autonomous agents market based on various segments and regions, and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States' autonomous AI and autonomous agents market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States autonomous AI and autonomous agents market.

United States Autonomous AI and Autonomous Agents Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 3.81 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 23.08% |

| 2035 Value Projection: | USD 37.4 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 269 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Application, By Technology, By Deployment Model and By Industry |

| Companies covered:: | Microsoft Corporation, Palantir Technologies, Amazon Robotics, Zoox/Amazon subsidiary, ServiceNow, Waymo, Tesla, Oracle, Salesforce, NVIDIA, IBM, Intel Corporation, Boston Dynamics, UiPath, Cruise, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The rapid advancements in AI technologies, including machine learning, natural language processing, and computer vision, enhance autonomous decision-making and efficiency. Growing demand for automation in industries such as healthcare, manufacturing, logistics, and transportation fuels market expansion by improving productivity and reducing operational costs. Increasing availability of high-performance computing resources and widespread adoption of 5G networks also accelerate real-time data processing and connectivity. Furthermore, rising investments from both private and public sectors, along with government initiatives supporting AI innovation and ethical guidelines, provide strong momentum for market growth. Additionally, the urgent need for safer and more reliable autonomous systems, especially in autonomous vehicles and robotics, further drives market development and adoption.

Restraining Factors

The high development costs, complex regulatory challenges, and concerns over data privacy and security. Additionally, ethical issues, lack of standardized frameworks, and potential job displacement slow adoption. These factors create uncertainty, limiting widespread implementation despite strong technological advances and growing demand across industries.

Market Segmentation

The United States autonomous AI and autonomous agents market share is classified into application, technology, deployment model, and industry.

- The healthcare segment held a substantial share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States autonomous AI and autonomous agents market is segmented by application into healthcare, automotive, manufacturing, retail, and finance. Among these, the healthcare segment held a substantial share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to increasing demand for intelligent diagnostic tools, personalized treatment, and robotic process automation in medical settings. AI-driven agents enhance clinical decision-making, streamline administrative tasks, and improve patient outcomes, making healthcare the leading sector for autonomous technology adoption and innovation.

- The machine learning segment held the highest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States autonomous AI and autonomous agents market is segmented by technology into machine learning, natural language processing, computer vision, and reinforcement learning. Among these, the machine learning segment held the highest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth is attributed to its broad applicability across industries and ability to analyze vast datasets for predictive insights. It powers intelligent decision-making, adapts autonomously to new data, and serves as the foundation for most AI applications, making it the most widely adopted and influential technology in the market.

- The cloud-based segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States autonomous AI and autonomous agents market is segmented by deployment model into on-premises, cloud-based, and hybrid. Among these, the cloud-based segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to its scalability, cost-effectiveness, and ease of deployment. It enables real-time data processing, seamless updates, and remote accessibility, making it ideal for dynamic AI applications. Cloud infrastructure also supports faster innovation and integration, driving widespread adoption across healthcare, finance, retail, and more.

- The aerospace segment dominated the market in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States autonomous AI and autonomous agents market is segmented by industry into aerospace, telecommunications, education, and agriculture. Among these, the aerospace segment dominated the market in 2024 and is expected to grow at a significant CAGR during the forecast period. This is because it's a critical need for precision, safety, and automation in complex operations. AI enhances flight systems, predictive maintenance, and autonomous navigation. High investment in defense and space exploration further accelerates AI adoption, positioning aerospace as the leading industry for advanced autonomous technologies.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States autonomous AI and autonomous agents market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Microsoft Corporation

- Palantir Technologies

- Amazon Robotics

- Zoox/Amazon subsidiary

- ServiceNow

- Waymo

- Tesla

- Oracle

- Salesforce

- NVIDIA

- IBM

- Intel Corporation

- Boston Dynamics

- UiPath

- Cruise

- Others

Recent Developments:

- In May 2025, Waymo revealed plans to bring its fleet of robo-taxis to Houston. It allows Waymo to test its AI-driven cars using the city's unique roadways and learn from its drivers. According to Waymo, about 10 cars will make the journey through the various Houston neighborhoods of Midtown, Norhill, and Greenway and on Interstates 45, 10, and 69.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the U.S., regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States autonomous AI and autonomous agents market based on the below-mentioned segments:

USA Autonomous AI and Autonomous Agents Market, By Application

- Healthcare

- Automotive

- Manufacturing

- Retail

- Finance

USA Autonomous AI and Autonomous Agents Market, By Technology

- Machine Learning

- Natural Language Processing

- Computer Vision

- Reinforcement Learning

USA Autonomous AI and Autonomous Agents Market, By Deployment Model

- On-Premises

- Cloud-Based

- Hybrid

USA Autonomous AI and Autonomous Agents Market, By Industry

- Aerospace

- Telecommunications

- Education

- Agriculture

Need help to buy this report?