United States Automotive Protection Films Market Size, Share, and COVID-19 Impact Analysis, By Material (Polyethylene, Thermoplastic Polyurethane, Others), By Application (Interiors, Exteriors), and United States Automotive Protection Films Market Insights Forecasts 2023 – 2033

Industry: Automotive & TransportationUnited States Automotive Protection Films Market Insights Forecasts to 2032

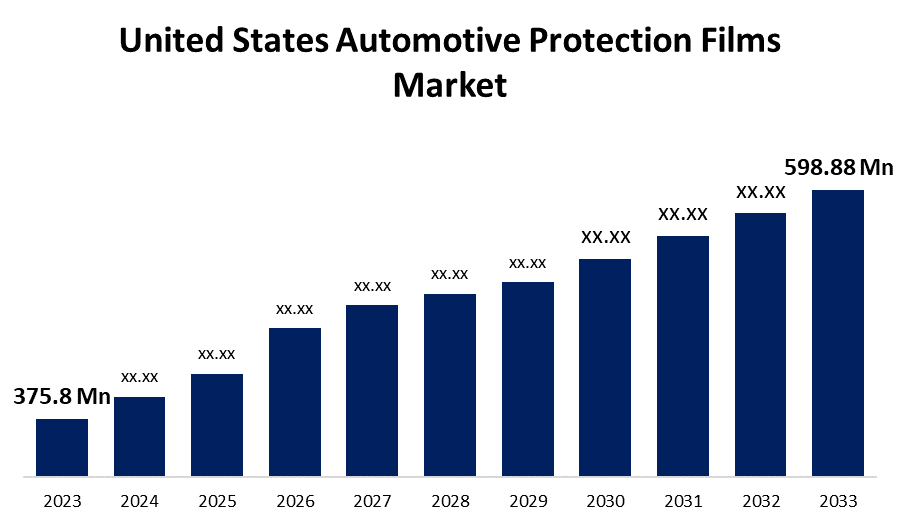

- The United States Automotive Protection Films Market Size was valued at USD 375.8 Million in 2022.

- The Market Size is Growing at a CAGR of 4.77% from 2023 to 2033.

- The United States Automotive Protection Films Market Size is Expected to Reach USD 598.88 Million by 2033.

Get more details on this report -

The United States Automotive Protection Films Market Size is Expected to Reach USD 598.88 Million by 2033, at a CAGR of 4.77% during the forecast period 2023 to 2033.

Market Overview

A paint protection film is a self-healing film applied to a car's painted surfaces to protect them from bug splatters, minor abrasions, and stone chips. Protection films are widely used by a variety of end users, including automotive, aerospace, oil and gas, electrical and electronics, and others. This expansion can be attributed to rising demand for automobiles, particularly luxury vehicles, as well as increased consumer awareness of the benefits of automotive protection film. The rising demand for PPF in the United States is due to increased demand from the automotive and electronic industries. Automakers have used high-quality paint protection films in response to fragmented and severe weather conditions in various seasons. Increased demand for high-quality, long-lasting products is expected to drive market growth in the United States. Furthermore, these automotive protection films are installed on the exterior and interior of automobiles and are primarily made of polyethylene terephthalate. The automotive protection films provide UV protection, reduce heat and glare, and enhance safety and security. Automotive protection film manufacturing companies are investing in the production of automotive films. The demand for automotive films is expected to outpace the increase in the number of cars manufactured. The use of automotive protection film is likely to expand to car side windows and sunroofs. Thus, the increase in the number of automobiles is projected to boost the United States automotive protection film market during the forecast period.

Report Coverage

This research report categorizes the market for the United States automotive protection films market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States automotive protection films market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States automotive protection films market.

United States Automotive Protection Films Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 375.8 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 4.77% |

| 2033 Value Projection: | USD 598.88 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | United States Automotive Protection Films Market |

| Companies covered:: | 3M, All Pro Window Films, ADS Window Films Ltd., Avery Dennison Corporation, Eastman Chemical Company, FILMTACK PTE LTD., Garware Suncontrol Film, Global Window Films, HEXIS SAS, Johnson Window Films Inc. and Other Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

One of the primary drivers of the United States automotive protection films market is growing consumer and vehicle owner awareness of the importance of maintaining the aesthetics and resale value of their vehicles, in addition to a trend toward vehicle customization and personalization. Advancements in protection film technology are a major driver of the United States automotive protection films market. Furthermore, manufacturers of protective films have been constantly innovating to create films with superior performance and durability. Environmental and economic concerns have emerged as key drivers in the United States automotive protection films market. Furthermore, the cost-effectiveness of protective films is a powerful motivator. Applying a protection film is generally less expensive than repainting or repairing paint damage caused by road debris or minor collisions. As the automotive industry recognizes the benefits of protection films in terms of preserving vehicle condition and value, their use expands, boosting automotive protection films market growth.

Restraining Factors

The initial installation cost of these films is high because they require expert supervision. Experts ensure that these films are properly installed without causing any damage or error to the painted surface of the designated object. Furthermore, the use of such films is restricted or avoided if the customer intends to keep the vehicle for a short period of duration. The automotive protection films market in the United States is facing intense competition and market saturation. One of the obstacles in the United States Automotive Protection Films Market is the need for installation expertise and quality assurance.

Market Segment

- In 2023, the thermoplastic polyurethane segment accounted for the largest revenue share over the forecast period.

Based on the material, the United States automotive protection films market is segmented into polyethylene, thermoplastic polyurethane, and others. Among these, the thermoplastic polyurethane segment has the largest revenue share over the forecast period. The thermoplastic polyurethane (TPU)-based paint protection films are ideal for achieving the desired non-yellowing clarity, self-healing properties, and stain resistance while also preserving the vehicle's new appearance. It has a lasting impact, strength, and elasticity. In addition to their low-temperature flexibility, thermoplastic polyurethane paint protection films are easy to remove without breaking or tearing. They can also conform to intricate shapes and surfaces. TPU's superior properties, such as biocompatibility and abrasion resistance, will drive segment growth. PVC, a synthetic plastic, is the most common component of first-generation paint protection films. The material's low cost will help drive the United States automotive protection films segment growth.

- In 2023, the exteriors segment accounted for a significant revenue share over the forecast period.

Based on the application, the United States automotive protection films market is segmented into interiors and exteriors. Among these, the exteriors segment accounted for a significant revenue share over the forecast period. These films are intended to withstand environmental elements such as sunlight, road debris, and rain, providing an additional layer of protection to the vehicle's exterior. They also improve the vehicle's appearance by applying color, gloss, or texture to the paint or bodywork. These films provide self-healing properties to repair minor scratches and imperfections, thereby extending the exterior's lifespan.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States automotive protection films market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- 3M

- All Pro Window Films

- ADS Window Films Ltd.

- Avery Dennison Corporation

- Eastman Chemical Company

- FILMTACK PTE LTD.

- Garware Suncontrol Film

- Global Window Films

- HEXIS SAS

- Johnson Window Films Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In December 2022, Toray Industries, Inc. created a polyethylene terephthalate (PET) film that has excellent applicability and adhesion for water-based and solvent-free coatings while also eliminating solvent-derived carbon dioxide emissions.

Market Segment

This study forecasts revenue at regional, and country levels from 2022 to 2033. Spherical Insights has segmented the United States automotive protection films market based on the below-mentioned segments:

United States Automotive Protection Films Market, By Material

- Polyethylene

- Thermoplastic Polyurethane

- Others

United States Automotive Protection Films Market, By Application

- Interiors

- Exteriors

Need help to buy this report?