United States Automotive Cybersecurity Market Size, Share, and COVID-19 Impact Analysis, By Security Type (Application Security, Wireless Network Security, Endpoint Security), By Application (ADAS, Body Control & Comfort, Infotainment, Telematics, Powertrain Systems, Others), and United States Automotive Cybersecurity Market Insights Forecasts to 2033

Industry: Automotive & TransportationUnited States Automotive Cybersecurity Market Insights Forecasts to 2033

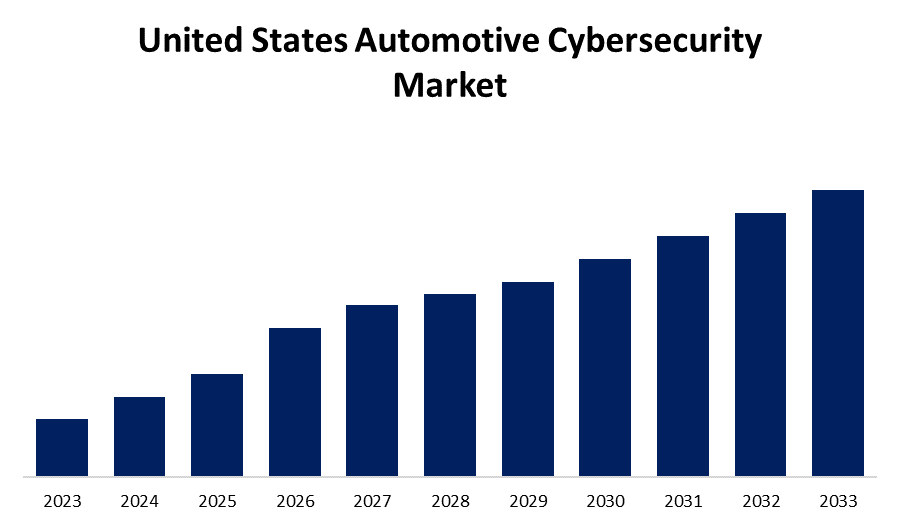

- The Market Size is Growing at a CAGR of 17.8% from 2023 to 2033.

- The United States Automotive Cybersecurity Market Size is Expected to Hold a Significant Share by 2033.

Get more details on this report -

The United States Automotive Cybersecurity Market Size is Expected to Hold a Significant Share by 2033, at a CAGR of 17.8% during the forecast period 2023 to 2033.

Market Overview

Automotive cybersecurity is a vital part of modern car technology that focuses on securing automobiles from illegal information access, modification, or theft. It covers a range of kinds, such as cloud security, endpoint security, network security, and application security. Numerous parts of an automobile, including the infotainment system, powertrain, safety systems, and telematics system, are linked with cybersecurity. Threat detection, data encryption, intrusion protection, and real-time monitoring are just a few of its primary features. Furthermore, the United States growing ubiquity of connected cars equipped with internet access and wireless networks, necessitating sophisticated cybersecurity measures, is driving market expansion. In addition, the industry is expanding due to the growing number of electric vehicles (EVs), which present new cybersecurity challenges due to their increased reliance on software controls. Moreover, the United States market is growing as a result of the incorporation of cutting-edge technologies like machine learning (ML) and artificial intelligence (AI) in automotive systems, which has created a demand for complex cybersecurity solutions. In addition, the U.S. market is expanding due to the growing use of cloud-based services for telematics and car diagnostics, which require secure cloud connectivity.

Report Coverage

This research report categorizes the market for United States automotive cybersecurity market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States automotive cybersecurity market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the United States automotive cybersecurity market.

United States Automotive Cybersecurity Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 17.8% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Security Type, By Application and COVID-19 Impact Analysis. |

| Companies covered:: | Intel Corporation, Cisco Systems Inc., Harman International Industries Inc., AT & T, Microsoft Corporation And Other Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The industry is expanding more quickly due to the growing use of wireless technologies like fifth-generation (5G) connectivity, which brings new risks and calls for strong security measures. Additionally, the industry is expanding due to the increasing alliances and partnerships that cybersecurity companies and automakers are forming. In addition, the United States market growth is being reinforced by the proliferation of the Internet of Things (IoT) inside the automobile industry. The market is expanding due in part to the quick development of autonomous car technology, which primarily depends on connectivity and data, highlighting the need for improved security measures.

Restraining Factors

The automotive sector has become a priority area for many non-automotive technology companies since the value chain is fragmented and revenue distribution has become a difficulty for stakeholders. The lack of cybersecurity solution standardization makes the creation of countermeasures difficult. As a result, when handling threats and vulnerabilities associated with a car, automotive cybersecurity solution providers encounter integration risks.

Market Segment

- In 2023, the wireless network security segment accounted for the largest revenue share over the forecast period.

Based on the security type, the United States automotive cybersecurity market is segmented into application security, wireless network security, and endpoint security. Among these, the wireless network security segment has the largest revenue share over the forecast period. Wireless network security is the process of creating and testing security measures within programs in order to avoid security risks such as unauthorized access and modification. A wireless network is primarily shielded from attempts at harmful and unauthorized access by wireless network security.

- In 2023, the ADAS segment accounted for the largest revenue share over the forecast period.

On the basis of application, the United States automotive cybersecurity market is segmented into ADAS, body control & comfort, infotainment, telematics, powertrain systems, and others. Among these, the ADAS segment has the largest revenue share over the forecast period. ADAS stands for advanced driver assistance systems, or ADAS, are a class of passive and active safety devices that eliminate mistakes made by humans in a variety of vehicle operations. Advanced driving assistance systems, or ADAS systems, use cutting-edge technology to support drivers and enhance their performance.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States automotive cybersecurity market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Intel Corporation

- Cisco Systems Inc.

- Harman International Industries Inc.

- AT & T

- Microsoft Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at regional, and country levels from 2022 to 2033. Spherical Insights has segmented the United States automotive cybersecurity market based on the below-mentioned segments:

United States Automotive Cybersecurity Market, By Security Type

- Application Security

- Wireless Network Security

- Endpoint Security

United States Automotive Cybersecurity Market, By Application

- ADAS

- Body Control & Comfort

- Infotainment,

- Telematics

- Powertrain Systems

- Others

Need help to buy this report?