United States Audiobooks Market Size, Share, and COVID-19 Impact Analysis, By Genre (Fiction and Non-Fiction), By Preferred Device (Laptops & Tablets, Personal Digital Assistants, Smartphones, and Others), and United States Audiobooks Market Insights, Industry Trend, Forecasts to 2035

Industry: Information & TechnologyUnited States Audiobooks Market Insights Forecasts to 2035

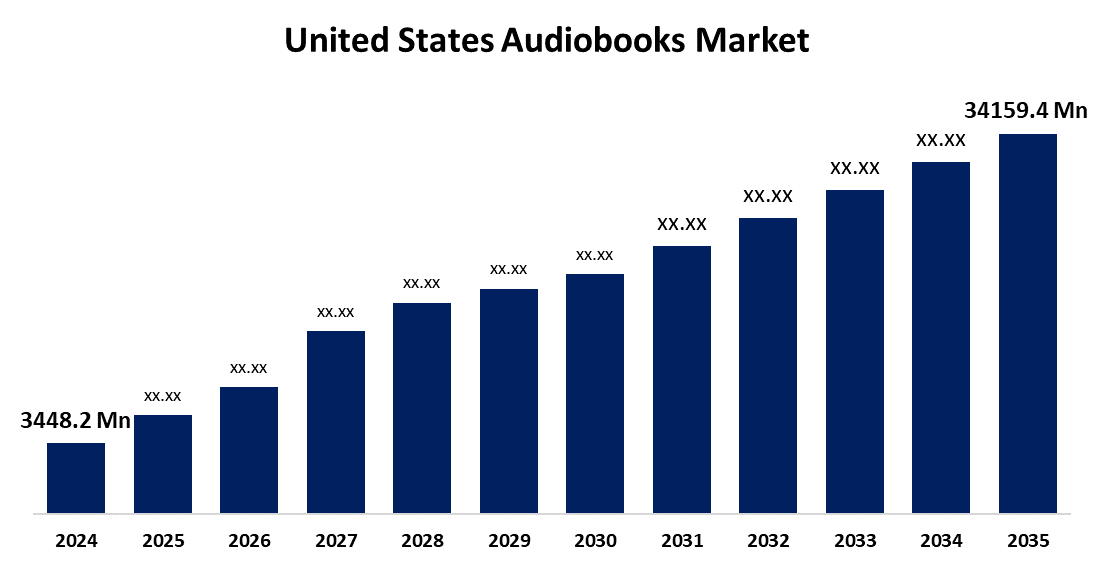

- The US Audiobooks Market Size Was Estimated at USD 3448.2 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 23.18% from 2025 to 2035

- The US Audiobooks Market Size is Expected to Reach USD 34159.4 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the United States Audiobooks Market Size is Anticipated to reach USD 34159.4 Million by 2035, Growing at a CAGR of 23.18% from 2025 to 2035. The expansion of the United States audiobooks market is propelled by the ability of audiobooks' adaptability and agility to make content readily available on electronic devices at any time and location.

Market Overview

An audiobook is a book or other written work read aloud by a narrator, who may be the author, a professional voice actor, or even a well-known individual. Audiobooks are gaining traction with consumers because of their ease of use. Audiobooks are available as digital files that can be played on any consumer electronics device that has the capability to stream audio, including computers, cellphones, tablets, etc. They also serve a variety of purposes, including leisure, entertainment, and educational purposes, and draw more customers. The audiobook industry has lots of room for growth with the introduction of smart appliances to homes in the form of voice assistants and smart speakers. Voice assistants and smart speakers provide consumers with another way to enjoy their books by simplifying playability with general voice commands and creating a hands-free experience. Additionally, if consumers value these features, they may also tap into a broader population that may not have previously considered audiobooks.

Report Coverage

This research report categorizes the market for the United States audiobooks market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States audiobooks market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States audiobooks market.

United States Audiobooks Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 3448.2 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 23.18% |

| 2035 Value Projection: | USD 34159.4 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 140 |

| Segments covered: | By Genre, By Preferred Device and COVID-19 Impact Analysis. |

| Companies covered:: | Barnes & Noble, Inc, Apple Inc., Amazon.com, Inc., Google LLC, Playster, Audible, Blackstone Audio, Brilliance Publishing, Podium Publishing and Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis |

Get more details on this report -

Driving Factors

The growth of the United States audiobooks market is boosted by the widespread use of smartphones and smart applications, which have helped make audiobooks vastly more accessible. Because of the smartphone and tablet age, the convenience of audiobooks instead of reading print has greatly increased, with audiobooks being one of many content options consumers have at their fingertips, anywhere and anytime. When multitasking is a common occurrence and life is busier than ever, mobility is crucial. Individuals listen to audiobooks on commutes, workouts, doing errands, or taking care of daily tasks. The combination of these devices and audiobook apps not only encourages more reading but it opens the door to a wider range of users, including students, working individuals, and others who may find audiobooks easier to manage than print books.

Restraining Factors

The United States audiobooks market faces obstacles like the increasing competition from sources of free digital materials will block the audiobook market. Open-source sites and other free content sources are offering similar content, which forces the premium audiobook model to compete in the marketplace.

Market Segmentation

The United States audiobooks market share is classified into genre and preferred device.

- The fiction segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States audiobooks market is segmented by genre into fiction and non-fiction. Among these, the fiction segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven because an audio publisher’s association study in 2022 reported science fiction is one of the most popular genres in the audiobook market. Nearly all consumers have access to audiobooks, though smartphones and other similar devices make them even easier to access.

- The smartphones segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the preferred device, the United States audiobooks market is segmented into laptops & tablets, personal digital assistants, smartphones, and others. Among these, the smartphones segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is propelled because of the ease of downloading audiobook sets and the ability to access the recorded version of the book at the same time as completing other tasks.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States audiobooks market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Barnes & Noble, Inc

- Apple Inc.

- Amazon.com, Inc.

- Google LLC

- Playster

- Audible

- Blackstone Audio

- Brilliance Publishing

- Podium Publishing

- Others

Recent Development

- In January 2023, Apple Inc. launched AI-powered audio narration for selected titles on Apple Books. Users can figure out if the audiobook is AI-powered by checking ‘Apple Books’ in the narrator section for those specific titles.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States audiobooks market based on the following segments:

United States Audiobooks Market, By Genre

- Fiction

- Non-Fiction

United States Audiobooks Market, By Preferred Device

- Laptops & Tablets

- Personal Digital Assistants

- Smartphones

- Others

Need help to buy this report?