United States ATM Market Size, Share, and COVID-19 Impact Analysis, By Solution (Development solution and Managed service), By Cash Type (Cash dispenser, Cash deposit and Cash recycle), and United States ATM Market Insights, Industry Trend, Forecasts to 2035

Industry: Electronics, ICT & MediaUnited States ATM Market Insights Forecasts to 2035

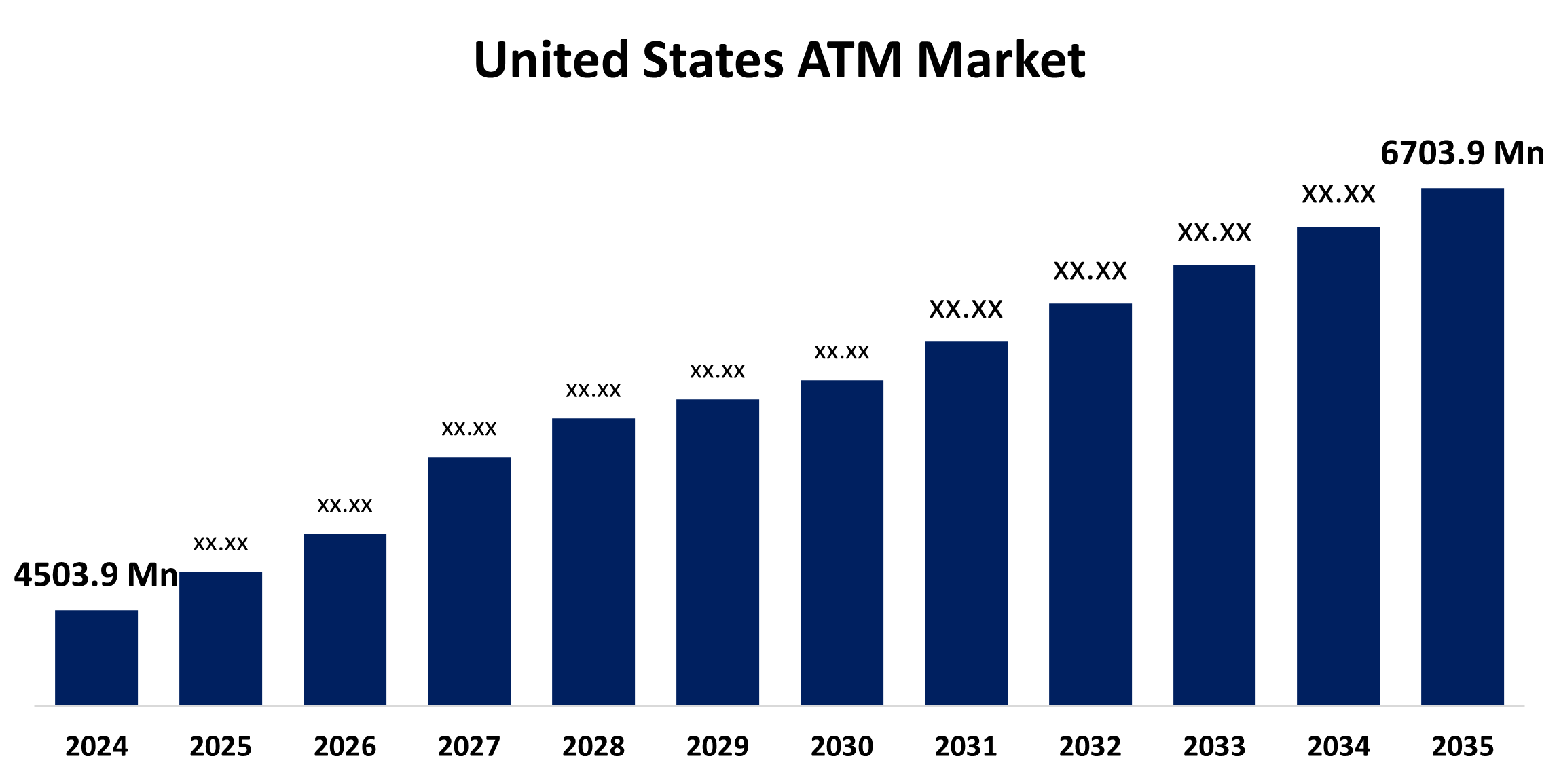

- The US ATM Market Size Was Estimated at USD 4,503.9 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 3.68% from 2025 to 2035

- The US ATM Market Size is Expected to Reach USD 6,703.9 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The United States ATM Market Size is anticipated to Reach USD 6,703.9 Million by 2035, Growing at a CAGR of 3.68% from 2025 to 2035. The expansion of the United States ATM market is propelled by a dependable, user-friendly cash withdrawal interface with features including 24-hour cash availability, fund transfer simplicity, and withdrawal and deposit convenience.

Market Overview

ATM is a computerized machine that provides customers of the bank the facility of accessing their account for dispensing cash and carrying out other financial transactions without actually visiting the bank. The industry's growth has largely been credited to the recent adoption of innovative technologies, including contactless payments and biometric authentication, and the consumer trend towards a greater customer experience. Cash recycling, remote video help, and cardless transactions are among the new services that financial services are adding to their ATM networks. Modern ATM deployments are also being driven by the switch to digital banking and the demand for convenient cash access in urban and rural communities. With the increase in cyber threats and ATM fraud, the ATM market is shifting its focus to enhance security features. Financial Institutions have started to use more advanced security features (i.e., end-to-end encryption, biometric identification, and real-time monitoring systems) in their ATMs. All of these advances are to help protect consumer-sensitive data and reduce risk for the user to build trust. Although it is an addition, the added upgraded security features (fingerprint, biometric, and double authentication) allow for that continued level of protection, which is available for the sophisticated ATMs, and have the potential to help reduce the amount of fraud, while still encouraging the future use of ATMs.

Report Coverage

This research report categorizes the market for the United States ATM market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States ATM market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States ATM market.

United States ATM Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 4,503.9 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 3.68% |

| 2035 Value Projection: | USD 6,703.9 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 215 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Solution, By Cash Type |

| Companies covered:: | NCR Corporation, Diebold Nixdorf Inc Ordinary Shares- New, NCR Atleos, Euronet, Triton Systems, Tidel Engineering, Brinks Company, Genmega, and Other Key Companies. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the United States' ATM market is boosted by a variety of factors, including the increased demand for convenient access to cash, improvements in ATM technologies, changes in policy and regulation that promote financial inclusion, and the expansion of banking networks. The growth of this market is further driven by increased domestic and international travel and tourism, the growth of retail and e-commerce, improvements in security, and advancements in cash recycling ATMs.

Restraining Factors

The United States ATM market faces obstacles, as there are fewer cash withdrawals due to the increasing popularity of digital banking, cashless payments, and contactless purchases, pushing consumer preferences away from ATM usage. Additionally, there may be reluctance from financial institutions to expand the ATM networks due to the associated costs of upgrading and maintaining the machines.

Market Segmentation

The United States ATM market share is classified into solution and cash type.

- The development solution segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States ATM market is segmented by solution into development solution and managed service. Among these, the development solution segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven by the process of deployment entails installing, configuring, testing, operationalizing, and bringing an ATM online. There are different types of ATMs, i.e., mobile, off-site, and on-site. On-site ATMs can be inside and/or close to the branch. On-site ATMs resulting in shorter queues of customers depositing cash, withdrawing cash, and transferring cash on bank property remove some stress from bank staff.

- The cash dispenser segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the cash type, the United States ATM market is segmented into cash dispenser, cash deposit and cash recycle. Among these, the cash dispenser segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is propelled by customers withdrawing cash for regular needs when they want. In-store cash recycling devices that reduce obsolete currency to new currency denominations are important for convenience stores, grocery stores, and transport due to the rise in cash usage.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States ATM market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- NCR Corporation

- Diebold Nixdorf Inc Ordinary Shares- New

- NCR Atleos

- Euronet

- Triton Systems

- Tidel Engineering

- Brinks Company

- Genmega

- Others

Recent Development

- In February 2023, NCR Corporation, a provider of corporate technology renewed and expanded its long-term partnership with Walgreens, a leading global drugstore operator. NCR continues to supply ATM services in nearly all Walgreens shops in the U.S., Puerto Rico, and the District of Columbia under the new deal.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States ATM market based on the following segments:

United States ATM Market, By Solution

- Development solution

- Managed service

United States ATM Market, By Cash Type

- Cash dispenser

- Cash deposit

- Cash recycle

Need help to buy this report?