United States Astaxanthin Market Size, Share, and COVID-19 Impact Analysis, By Product (Oil, Softgel, Liquid, Dried Algae Meal or Biomass, and Others), By Source (Natural and Synthetic), and United States Astaxanthin Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareUnited States Astaxanthin Market Size Insights Forecasts to 2035

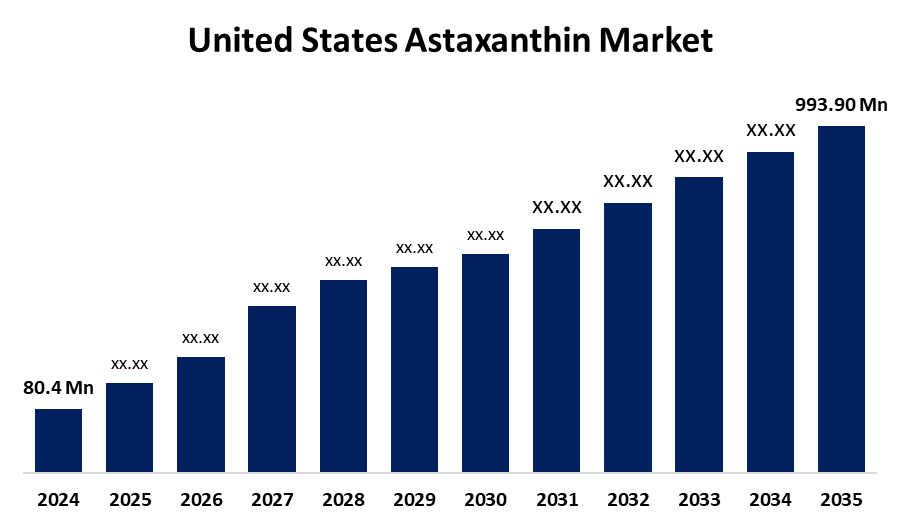

- The US Astaxanthin Market Size Was Estimated at USD 80.4 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 15.08% from 2025 to 2035

- The US Astaxanthin Market Size is Expected to Reach USD 993.90 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the United States Astaxanthin Market Size is anticipated to reach USD 993.90 million by 2035, growing at a CAGR of 15.08% from 2025 to 2035. The expansion of the United States astaxanthin market is propelled by its growing application in a number of sectors, such as food and beverage, medicines, nutraceuticals, cosmetics, aquaculture, and animal feed, among others.

Market Overview

Astaxanthin is a lipid-soluble, reddish-orange pigment that belongs to the carotenoid family as a keto-carotenoid, a kind of xanthophyll. The use of astaxanthin as a food additive for prawns and fish species such as salmon, trout, and ornamental fish both improves their colour and enhances their economic value. In addition, they also benefit aquatic animals regarding immune-related gene expressions, reproductive potential, disease resistance, stress tolerance, and performance. To meet the increasing demands in aquaculture, large players are focusing on new product developments and joint partnerships. The primary natural source of astaxanthin, Haematococcus pluvialis, a microalgae, is vital to the sustainable production of astaxanthin. Current culture approaches can use photobioreactors and regulated outdoor pond systems to enhance the scales of production and operational costs for the astaxanthin production process. Modern-day astaxanthin production practices minimize environmental damage while operating within the fundamental guidelines of meeting market demand for environmental and sustainable products. Innovations in advanced scientific methods and improved algae cultivation practices could further strengthen the market for natural astaxanthin through sustainability-based quality programs.

Report Coverage

This research report categorizes the market for the United States astaxanthin market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States astaxanthin market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States astaxanthin market.

United States Astaxanthin Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 80.4 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 15.08% |

| 2035 Value Projection: | USD 993.90 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 146 |

| Tables, Charts & Figures: | 128 |

| Segments covered: | By Product, By Source and COVID-19 Impact Analysis |

| Companies covered:: | Cyanotech Corp, Algatech Ltd, Fuji Chemical Industries Co., Ltd., DSM Nutritional Products, PIVEG, Inc., ENEOS Corporation, Valensa International, Atacama Bio Natural Products S.A., BASF, Lycored, and Other key vendors |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the United States astaxanthin market is boosted by consumers' tendency to prefer natural sources over synthetic chemicals and additives in food and topical products, to avoid the possible side effects of synthetic chemicals and additives. Nutraceuticals hold significant importance in dermatology because studies show that astaxanthin has been shown to decrease oxidative stress, improve the elasticity of the skin, and regulate the signs of ageing. Astaxanthin is prominently used as a UV protector and anti-aging agent in many premium products with abundant health benefits. The food and beverage industry explores the potential health benefits of astaxanthin, in addition to using it for natural coloring. In aquaculture production, astaxanthin is used as an additive to improve the colour of seafood for more marketable appeal.

Restraining Factors

The United States astaxanthin market faces obstacles like the potential for product adulteration and the obligation to comply with clean label regulations. Since animals get their astaxanthin from the diet, adverse health consequences can be caused to individuals and animals, as well as to the environment, by consuming contaminated astaxanthin.

Market Segmentation

The United States astaxanthin market share is classified into product and source.

- The dried algae meal or biomass segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States astaxanthin market is segmented by product into oil, softgel, liquid, dried algae meal or biomass, and others. Among these, the dried algae meal or biomass segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven by because of economic advantages, and very high yield of productivity when compared to traditional methods. Applying also the optimized parameters of light intensity, inoculum density, the innovative process promoted biomass yield whilst minimizing operational cost. With efficiency and scalability, this segment is instrumental to satisfy the rapidly growing demand in sectors such as cosmetics, animal feed, and supplements, and given that dried biomass promotes downstream extract quality, assuring high-standard products, cementing its market-leading position.

- The natural segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the source, the United States astaxanthin market is segmented into natural and Synthetic. Among these, the natural segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is propelled because of benefits like sustainability and superb efficacy. It is also being researched for the treatment of conditions such as cancer, parkinson's disease, alzheimer's disease, stroke, and high cholesterol levels. Additionally, natural astaxanthin has been demonstrated in several studies to have 10 times more free radical inhibitory action than other antioxidants and is effective for the treatment of ocular conditions such as cataracts, uveitis, and glaucoma, and also limits skin photoaging.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States astaxanthin market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Cyanotech Corp

- Algatech Ltd

- Fuji Chemical Industries Co., Ltd.

- DSM Nutritional Products

- PIVEG, Inc.

- ENEOS Corporation

- Valensa International

- Atacama Bio Natural Products S.A.

- BASF

- Lycored

- Others

Recent Development

- In March 2024, Nutrex-Hawaii, Inc., a subsidiary of Cyanotech Corporation, introduced a sugar-free gummy version of its top-selling BioAstin Hawaiian Astaxanthin dietary supplement, featuring an impressive 12mg of natural Hawaiian astaxanthin per daily serving. This innovative product is likely to strengthen Cyanotech's market position by catering to the growing demand for convenient, health-focused supplements.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States astaxanthin market based on the following segments:

United States Astaxanthin Market, By Product

- Oil, Softgel

- Liquid

- Dried Algae Meal or Biomass

- Others

United States Astaxanthin Market, By Source

- Natural

- Synthetic

Need help to buy this report?