United States Artificial Lift Market Size, Share, and COVID-19 Impact Analysis, By Lift Type (Reciprocating Rod Lift, Electric Submersible Pumps (ESP), Gas lift, Progressing Cavity Pumps, Jet Pump, Others), By Application (Onshore, Offshore), By Mechanism (Pump Assisted, Gas Assisted), By Well Type (Horizontal, Vertical), and United States Artificial Lift Market Insights Forecasts to 2033

Industry: Energy & PowerUnited States Artificial Lift Market Insights Forecasts to 2033

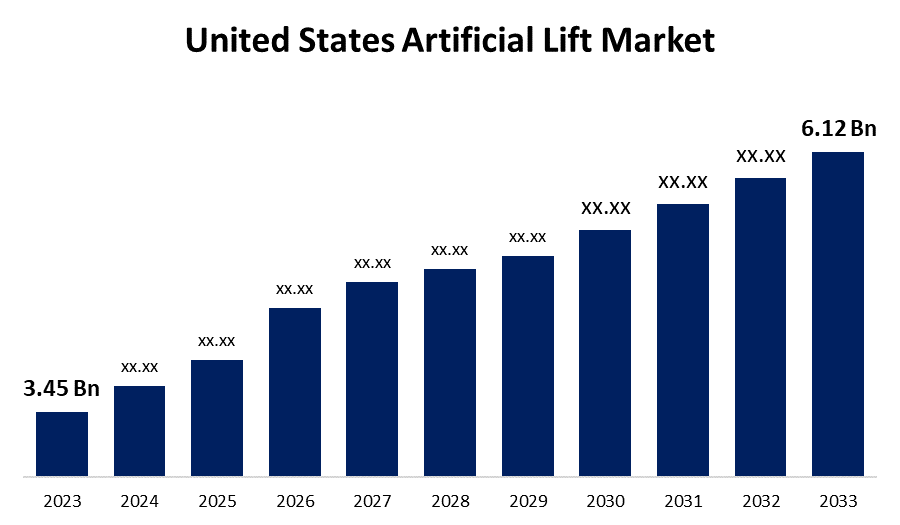

- The United States Artificial Lift Market Size was valued at USD 3.45 Billion in 2023.

- The Market Size is Growing at a CAGR of 5.9% from 2023 to 2033.

- The United States Artificial Lift Market Size is Expected to Reach USD 6.12 Billion by 2033.

Get more details on this report -

The United States Artificial Lift Market Size is Expected to Reach USD 6.12 Billion by 2033, at a CAGR of 5.9% during the forecast period 2023 to 2033.

Market Overview

The United States artificial lift market is a critical component of the country's oil and gas industry, playing a critical role in optimizing hydrocarbon extraction from wells. This market includes a wide range of cutting-edge technologies and solutions designed to boost production rates and maximize recovery from both conventional and unconventional reservoirs across the country. Several factors are driving market growth, including an increased emphasis on revitalizing output from mature fields where natural pressure declines necessitate advanced artificial lift mechanisms. Lift system technological advancements, leveraging predictive analytics, IoT integration, and adaptive control, are continuing to revolutionize the industry, optimizing production efficiencies and lowering operational costs. Furthermore, rising demand for unconventional resources, such as shale plays, has accelerated the adoption of specialized lift systems tailored to specific well conditions, propelling the United States artificial lift market's ongoing expansion and evolution.

Report Coverage

This research report categorizes the market for United States artificial lift market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States artificial lift market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the United States artificial lift market.

United States Artificial Lift Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 3.45 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 5.9% |

| 2033 Value Projection: | USD 6.12 Billion |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Lift Type, By Application, By Mechanism and COVID-19 Impact Analysis. |

| Companies covered:: | Schlumberger Limited, Baker Hughes Company, Halliburton Company, Weatherford International plc, National Oilwell Varco, Inc., Dover Corporation, NOVOMET Group, Borets International Limited, General Electric Company (GE), Occidental Petroleum Corporation, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The need to revitalize production from mature fields is one of the primary drivers propelling the United States Artificial Lift Market. Many oil and gas fields across the country have seen a drop in natural reservoir pressure, which has resulted in lower production rates over time. The industry heavily relies on artificial lift systems to offset this decline and maximize hydrocarbon recovery. These systems, which include technologies such as electric submersible pumps (ESPs), rod pumps, and progressive cavity pumps (PCPs), aid in increasing production rates by artificially lifting fluids to the surface. Operators can optimize production from mature wells by implementing advanced lift systems in conjunction with technological innovations in downhole equipment and control mechanisms. The relentless pursuit of technological advancements is a key driver guiding the evolution of the United States artificial lift market. The industry is constantly investing in R&D to improve lift system capabilities, improve operational efficiency, and address the various challenges encountered in oil and gas extraction. Lift system design, materials science, and data-driven analytics innovations have transformed artificial lift mechanisms, enabling more effective and adaptable solutions. Lift systems' intelligence and responsiveness have been enhanced by advanced control algorithms, IoT integration, and machine learning applications, optimizing production under varying well conditions.

Restraining Factors

The demand for artificial lift is inextricably linked to the exploration, development, and production activities of oil and gas companies, as well as their capital expenditures. Oil and gas price fluctuations have a direct impact on these activities, which are influenced by supply and demand shifts, governmental regulations, weather, and other factors. Companies may reduce or postpone major expenditures due to long-term price expectations, especially given the length of many large projects. Low crude oil prices, or the expectation of low crude oil prices, could stymie the growth of the United States artificial lift market.

Market Segment

- In 2023, the electric submersible pumps (ESPs) segment accounted for the largest revenue share over the forecast period.

Based on the lift type, the United States artificial lift market is segmented into reciprocating rod lift, electric submersible pumps (ESPs), gas lift, progressing cavity pumps, jet pump, and others. Among these, the electric submersible pumps (ESPs) segment has the largest revenue share over the forecast period. The electric submersible pumps (ESPs) segment's dominance can be attributed to a number of factors that align with the industry's evolving landscape. Electric submersible pumps have proven to be extremely effective in increasing oil production from reservoirs, particularly in mature fields, unconventional plays, and deepwater projects. Because of their ability to handle large volumes of fluid, as well as advancements in pump technology and downhole equipment, electric submersible pumps (ESPs) have become the preferred choice for maximizing hydrocarbon recovery.

- In 2023, the onshore segment accounted for the largest revenue share over the forecast period.

Based on the application, the United States artificial lift market is segmented into onshore, and offshore. Among these, the onshore segment has the largest revenue share over the forecast period. Several factors contribute to the onshore segment's dominance, reflecting the market's dynamics and operational landscape. The widespread development of unconventional oil and gas resources, such as shale plays like the permian basin, bakken, and eagle ford formations, is driving the prominence of onshore applications. These areas have seen significant onshore drilling activity, with a plethora of wells that frequently require artificial lift mechanisms to optimize production.

- In 2023, the pump assisted segment accounted for the largest revenue share over the forecast period.

Based on the mechanism, the United States artificial lift market is segmented into pump assisted and gas assisted. Among these, the pump assisted segment has the largest revenue share over the forecast period. This dominance is supported by a number of key factors that correspond to the industry's operational landscape and evolving technological advancements. Pump assisted mechanisms, which include methods such as electric submersible pumps (ESP) and progressive cavity pumps (PCP), have grown in popularity due to their adaptability in optimizing oil and gas production from a wide range of well types and reservoir conditions. These mechanisms provide effective solutions for a wide range of well profiles, including high-viscosity fluids, deeper wells, and unconventional reservoirs.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States artificial lift market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Schlumberger Limited

- Baker Hughes Company

- Halliburton Company

- Weatherford International plc

- National Oilwell Varco, Inc.

- Dover Corporation

- NOVOMET Group

- Borets International Limited

- General Electric Company (GE)

- Occidental Petroleum Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

In June 2023, TechLift Solutions, a key player in the United States artificial lift market, unveiled its next-generation lift systems, ushering in a new era of efficient oil and gas extraction. The innovative systems optimize production rates and reservoir recovery by utilizing advanced materials and data-driven analytics. The emphasis on technological advancement and operational efficiency at TechLift Solutions aligns with the industry's pursuit of cutting-edge solutions in the face of changing well conditions and market demands.

Market Segment

This study forecasts country revenue from 2022 to 2033. Spherical Insights has segmented the United States artificial lift market based on the below-mentioned segments:

United States Artificial Lift Market, By Lift Type

- Reciprocating Rod Lift

- Electric Submersible Pumps (ESP)

- Gas lift Progressing Cavity Pumps

- Jet Pump

- Others

United States Artificial Lift Market, By Application

- Onshore

- Offshore

United States Artificial Lift Market, By Mechanism

- Pump Assisted

- Gas Assisted

United States Artificial Lift Market, By Well Type

- Horizontal

- Vertical

Need help to buy this report?