United States Aquafeed Market Size, Share, and COVID-19 Impact Analysis, By Ingredients (Soybean, Fish Meal, Corn, Fish Oil, Additives, Others), By Additives (Amino Acids, Vitamins & Minerals, Prebiotics & Probiotics, Enzymes, Antibiotics, Other), By Species (Carps, Marine Shrimps, Tilapias, Catfishes, Marine Fishes, Salmons, Freshwater Crustaceans, Trout, Others), By Product Form (Pellets, Extruded, Powdered, Liquid), and United States Aquafeed Market Insights Forecasts to 2033

Industry: Food & BeveragesUnited States Aquafeed Market Insights Forecasts to 2033

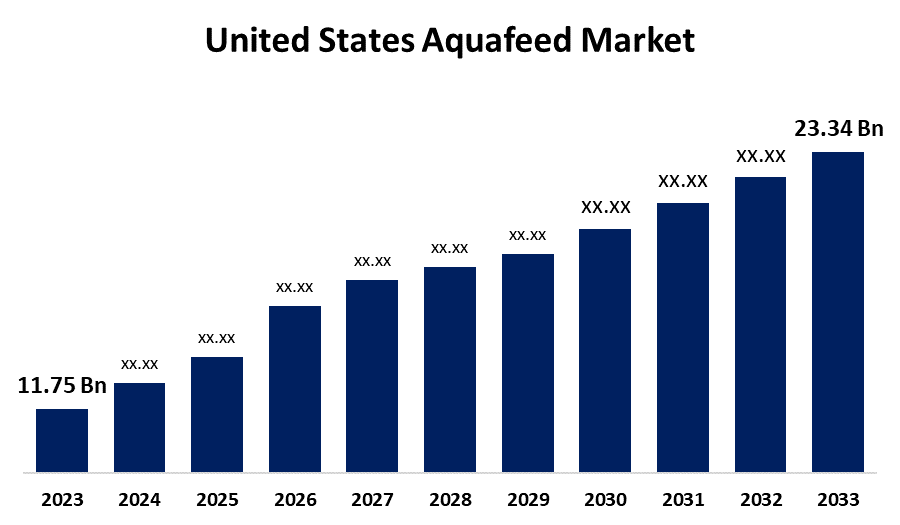

- The United States Aquafeed Market Size was valued at USD 11.75 Billion in 2023

- The Market Size is Growing at a CAGR of 7.1% from 2023 to 2033

- The United States Aquafeed Market Size is Expected to Reach USD 23.34 Billion by 2033

Get more details on this report -

The United States Aquafeed Market Size is expected to reach USD 23.34 Billion by 2033, at a CAGR of 7.1% during the forecast period of 2023–2033.

Market Overview

Aquafeed is a type of feed that is made up of a wide variety of ingredients and then fed to animals. The aquafeeds are primarily intended to provide nutritional requirements for the animal’s normal physiological functions. These functions include maintaining the body's highly effective natural immune system, as well as reproduction and growth. The aquafeed has a limited shelf life and specific handling requirements. These feeds must be handled carefully. Aquafeeds are compounded meals made for seafaring animals by combining various raw materials and additives. These mixtures are organized based on the specific requirements of the species and the animal's age. Aquafeed has become critical to the aquaculture industry due to its nutritional, safe-resistance, and growth-promoting properties. Owing to its balanced and need-specific composition, high-quality aquafeed is significantly more beneficial to fish, mollusks, shellfish, and other aquatic animals than farm-made feed.

Report Coverage

This research report categorizes the market for the United States aquafeed market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States aquafeed market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States aquafeed market.

Driving Factors

The increasing consumption of seafood, as well as rising consumer spending on fish and fish products such as fish oil, fish meal, and fish silage, are expected to increase aquaculture production, thereby boosting market growth. Furthermore, increased demand for animal protein in established economies, as well as increased seafood trade across the U.S. economies, are expected to drive market growth during the forecast period. Also, increased investments by market players and associations in the research and development of innovative products are expected to boost U.S. aquafeed market growth. Furthermore, the increase in government investment across the United States has driving the market. To reduce the trade deficit, the U.S. government has invested in federal funding for aquaculture research and development through the National Oceanic and atmospheric administration. The policy is consistent with the United States government's America first policy, which seeks to reduce imports while increasing job opportunities in the country. This favorable initiative by the government is expected to help the aquaculture industry and, ultimately, the aquafeed market in the United States.

Restraining Factors

High price volatility associated with raw materials used in feed preparation may hamper market growth during the forecast period. For Instance, a significant increase in the price of soybeans, corn, or other raw materials can have a direct impact on the final price of the product, potentially reducing sales. Furthermore, an increasing number of people opting for vegetarian diets and avoiding non-vegetarian foods is expected to reduce demand for fish, which could hamper the growth of the U.S. aquafeed market.

Market Segment

- In 2023, the soybean segment accounted for the largest revenue share over the forecast period.

Based on the ingredients, the United States aquafeed market is segmented into soybean, fish meal, corn, fish oil, additives, and others. Among these, the soybean segment has the largest revenue share over the forecast period. The reason behind the growth is, soybean is a commonly used plant-based protein source. It contains essential amino acids and is commonly used as an alternative or supplement to fishmeal. It is highly digestible and is commonly used in fish feed for both herbivorous and omnivorous species.

- In 2023, the vitamins and minerals segment accounted for the largest revenue share over the forecast period.

Based on the additives, the United States aquafeed market is segmented into amino acids, vitamins & minerals, prebiotics & probiotics, enzymes, antibiotics, and others. Among these, the vitamins and minerals segment has the largest revenue share over the forecast period. Vitamins and minerals are necessary nutrients that are included in aquafeed to promote health, growth, and development. Vitamins A, D, and E, as well as minerals such as zinc and selenium, are frequently used. These are essential for metabolism, immune function, and bone formation.

- In 2023, the carps segment accounted for the largest revenue share over the forecast period.

Based on the species, the United States aquafeed market is segmented into carps, marine shrimps, tilapias, catfishes, marine fishes, salmons, freshwater crustaceans, trout, and others. Among these, the carps segment has the largest revenue share over the forecast period. Carps are omnivorous and can adapt to a variety of feed types. Their aquafeed often includes plant-based ingredients like soybean meal, along with a moderate amount of protein and fats.

- In 2023, the pellets segment accounted for the largest revenue share over the forecast period.

Based on the product form, the United States aquafeed market is segmented into pellets, extruded, powdered, and liquid. Among these, the pellets segment has the largest revenue share over the forecast period. Pelleted feed is created by compressing a mixture of ingredients into small cylindrical shapes. These pellets are simple to handle and can be made to float or sink based on the species' feeding habits. Pellets are commonly used for larger fish and come in a variety of sizes to accommodate the size of the fish being farmed.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States aquafeed market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- The Archer Daniels Midland Company

- Ridley USA Inc.

- Cargill Animal Nutrition

- Nutreco USA Inc.

- Alltech Inc.

- Nutraid USA

- Novus International Inc.

- Skretting AS

- Purina Animal Nutrition

- Charoen Pokphand USA Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In July 2023, Skretting and BioMar announced a partnership to develop new sustainable and nutritious aquafeed ingredients, focusing on alternative protein sources like insect meal and algae.

Market Segment

This study forecasts country revenue from 2022 to 2033. Spherical Insights has segmented the United States Aquafeed Market based on the below-mentioned segments:

United States Aquafeed Market, By Ingredient

- Soybean

- Fish Meal

- Corn

- Fish Oil

- Additives

- Others

United States Aquafeed Market, By Additives

- Amino Acids

- Vitamins & Minerals

- Prebiotics & Probiotics

- Enzymes

- Antibiotics

- Other

United States Aquafeed Market, By Species

- Carps

- Marine Shrimps

- Tilapias

- Catfishes

- Marine Fishes

- Salmons

- Freshwater Crustaceans

- Trout

- Others

United States Aquafeed Market, By Product Form

- Pellets

- Extruded

- Powdered

- Liquid

Need help to buy this report?