United States Aptamers Market Size, Share, and COVID-19 Impact Analysis, By Type (Nucleic Acid Aptamer and Peptide Aptamer), By Application (Diagnostics, Therapeutics, Research & Development, and Others), and United States Aptamers Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareUnited States Aptamers Market Insights Forecasts to 2035

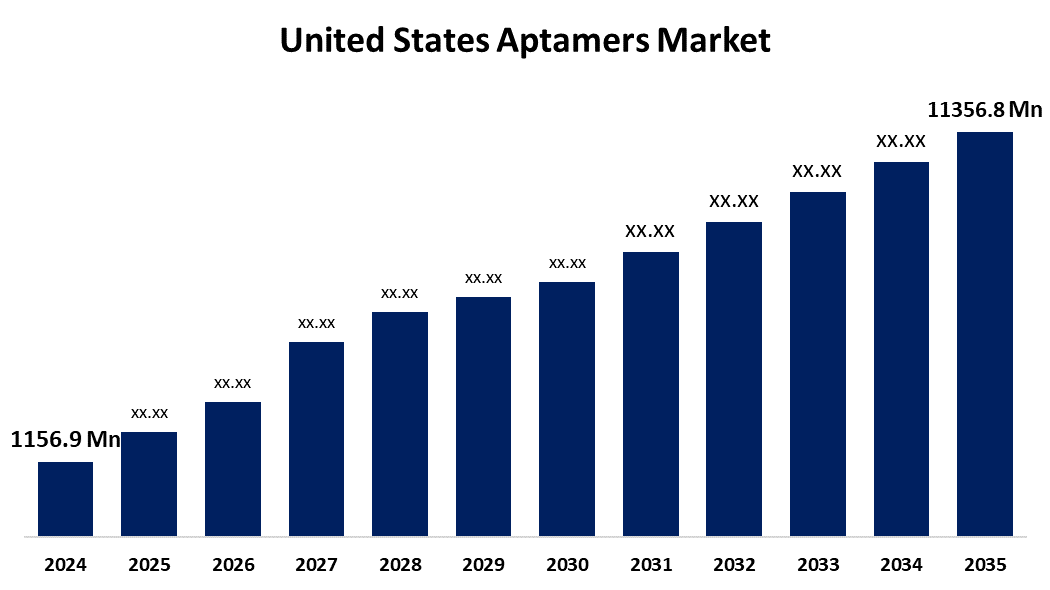

- The US Aptamers Market Size Was Estimated at USD 1156.9 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 23.08% from 2025 to 2035

- The US Aptamers Market Size is Expected to Reach USD 11356.8 Million by 2035

Get more details on this report -

According to a Research Report published by Spherical Insights & Consulting, the United States Aptamers Market Size is Anticipated to reach USD 11356.8 Million by 2035, Growing at a CAGR of 23.08% from 2025 to 2035. The expansion of the United States' aptamer market is propelled by new developments in medication delivery, purification, and synthesis to target and eradicate specific cells.

Market Overview

Aptamers are small, single-stranded DNA or RNA molecules that can fold into certain three-dimensional configurations. This enables them to attach to a target molecule precisely and firmly. The market has profited from the enormous potential of nucleic acid therapeutics, such as aptamers, to cure a variety of diseases, including cancer, genetic disorders, and infectious diseases. In response to the increasing demand for therapeutics, a number of Commercial Development Manufacturing Organizations (CDMOs) in the United States have invested in expanded facilities. For example, in January 2023, Agilent Technologies, Inc. announced that it would invest USD 725.0 million to expand its capacity for manufacturing nucleic acid-based therapeutics. The objective of this investment in manufacturing capacity was to support the company's production of antisense and small interfering RNA (siRNA) molecules. This investment is expected to expand the company’s CRISPR-guided RNA programs significantly. The U.S. aptamers market generated over 41.0% of the aptamers market in 2023. Market drivers are likely to include greater investments, increased clinical trials, faster development of drug programs, and a burgeoning gene therapy pipeline. With increasing demand for aptamer-based diagnostics, diagnostic and pathology labs are expected to experience a progressively higher level of patient traffic for conditions like cancer, AMD, and CVD, increasing the need for aptamers.

Report Coverage

This research report categorizes the market for the United States aptamers market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States aptamers market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States aptamers market.

United States Aptamers Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1156.9 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 23.08% |

| 2035 Value Projection: | USD 11356.8 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 130 |

| Segments covered: | By Type, By Application and COVID-19 Impact Analysis. |

| Companies covered:: | Altermune Technologies, Aptagen, SomaLogic, Base Pair Biotechnologies, TriLink BioTechnologies, Vivonics, Altermune LLC, AM Biotechnologies, Aptamer Group, and Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the United States' aptamers market is boosted by clinical diagnostics methods, which are used to detect a disease from the symptoms of patients. Aptamers are used in diagnostics to classify biomarkers, antigens, infectious pathogens, or any combination. So, aptamers become a tool for the detection of not only cancer, but also a range of bacterial, parasitic, and viral conditions. Conjugates of aptamers and nanoparticles are the most widely utilised detection agents. The aptamer navigates to the biological target, and the detection is based on optical change. Aptamer-nanoparticle conjugates can be used to detect a wide variety of cancer metabolites or biomarkers.

Restraining Factors

The United States aptamers market faces obstacles like the longevity and half-life of the aptamer in vivo. There is also a high manufacturing cost that limits the use of the aptamer for many research institutions and ultimately limits the scalability of this type of diagnostic approach.

Market Segmentation

The United States aptamers market share is classified into type and application.

- The nucleic acid aptamer segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States aptamers market is segmented by type into nucleic acid aptamer and peptide aptamer. Among these, the nucleic acid aptamer segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven because several companies are currently investigating the processes by which nucleic acid-based aptamers can treat multiple diseases, including AMD. In order to launch the GATHER2 phase 3 clinical study of Zimura with Special Protocol Assessment (SPA), IVERIC BIO obtained FDA authorization. Zimura was designed for individuals with AMD-related geographic atrophy (GA). These initiatives will assist in driving the segment's growth.

- The research & development segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the application, the United States aptamers market is segmented into diagnostics, therapeutics, research & development, and Others. Among these, the research & development segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is propelled by several strategic maneuvers undertaken by major players in the market, including agreements, alliances, and collaborations for the research and development of advanced aptamer-based therapeutic and diagnostic products.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States aptamers market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Altermune Technologies

- Aptagen

- SomaLogic

- Base Pair Biotechnologies

- TriLink BioTechnologies

- Vivonics

- Altermune LLC

- AM Biotechnologies

- Aptamer Group

- Others

Recent Development

- In May 2023, Life Edit Therapeutics, Inc. and Novo Nordisk announced a research & development collaboration to discover & develop gene editing therapies against a set of therapeutic targets.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States aptamers market based on the following segments:

United States Aptamers Market, By Type

- Nucleic Acid Aptamer

- Peptide Aptamer

United States Aptamers Market, By Application

- Diagnostics

- Therapeutics

- Research & Development

- Others

Need help to buy this report?