United States Appliances Market Size, Share, and COVID-19 Impact Analysis, By Product (Major Appliances and Small Appliances), By Type (Conventional Appliances and Smart Appliances), and United States Appliances Market Insights, Industry Trend, Forecasts to 2035

Industry: Consumer GoodsUnited States Appliances Market Insights Forecasts to 2035

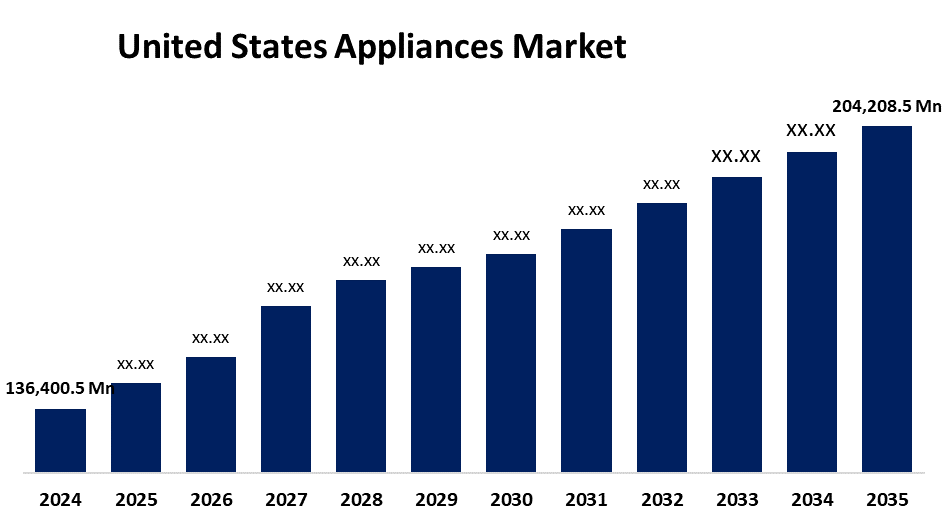

- The US Appliances Market Size Was Estimated at USD 136,400.5 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 3.74% from 2025 to 2035

- The US Appliances Market Size is Expected to Reach USD 204,208.5 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the United States Appliances Market is anticipated to reach USD 204,208.5 million by 2035, growing at a CAGR of 3.74% from 2025 to 2035. The expansion of the United States appliances market is propelled by increasing consumer demand for smart home technologies and connected appliances

Market Overview

An appliance, which is frequently fuelled by gas or electricity, is a tool or gadget made to carry out a specified task. In common parlance, it refers to domestic appliances that help with cooking, cleaning, or preserving food. Growing awareness of environmental sustainability and the use of energy-efficient appliances are forcing the business to keep expanding. The appliance industry continues to grow because technology is improving, and companies continue to advertise new products that meet changes in consumer preferences. Smart home/IoT is flourishing, and consumers are looking for ways to save energy, with a focus on connected and simply utilitarian sources of convenience. The US market is one with a lot of disposable income and a persistent emphasis on home remodelling and refurbishment. Strict energy efficiency regulations and incentive programs also promote the purchase of energy-efficient appliances. Digital marketing and e-commerce channels have made it much easier for customers to access and purchase products, including appliances. The middle class continues to grow, while urbanization is resulting in more demand for new, energy-efficient appliances. Claims for future growth potentials covering phases that appeal to upcoming technologies like the automation of the Internet of Things (IoT), and smart appliances connected with artificial intelligence, lend to this growth for convenience and energy savings. Furthermore, government initiatives that promote sustainable and energy-saving practices have a significant impact on the industry as environmental sustainability becomes more widely recognised and people and organisations look for eco-friendly and energy-efficient appliances.

Report Coverage

This research report categorizes the market for the United States appliances market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States appliances market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States appliances market.

United States Appliances Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 136,400.5 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 3.74% |

| 2035 Value Projection: | USD 204,208.5 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 113 |

| Segments covered: | By Product, By Type and COVID-19 Impact Analysis |

| Companies covered:: | General Electric, Whirlpool Corp, Amana, Maytag, KitchenAid, Roper Corp., Philips Oral Healthcare, LLC, A.O. Smith Water Products Co., Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors

The growth of the United States appliances market is boosted as it provides convenience, efficiency, and connectivity, in high demand as a result of consumers' growing use of smart home technologies. Products like smart refrigerators, washing machines, and kitchen gadgets are increasingly coming equipped with features like voice assistant compatibility, remote monitoring, and automated operations. Among tech-savvy generations looking for integrated home solutions, this tendency is especially noticeable.

Restraining Factors

The United States appliances market faces obstacles like production delays and longer lead times for essential components like metals and semiconductors, caused by ongoing supply chain problems and geopolitical concerns. The inability of manufacturers to satisfy consumer demand as a result of these disruptions has led to increased production costs and restricted appliance availability.

Market Segmentation

The United States appliances market share is classified into product and type.

- The major appliances segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States appliances market is segmented by product into major appliances and small appliances. Among these, the major appliances segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is powered by appliances that serve basic day-to-day needs, such as refrigerators, washing machines, stoves, and dishwashers. Technical advancements over the years of these products, such as intelligent features and energy-saving technologies, are capturing a diverse range of customers. It is important to note that ongoing demand is driven by the increasing trend of smart homes, in which main appliances integrate and operate using smart devices.

- The conventional appliances segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the type, the United States appliances market is segmented into conventional appliances and smart appliances. Among these, the conventional appliances segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven by ovens, air conditioners, washing machines, and refrigerators that have widespread usage with a firm brand identity. Their historical reliability and performance have made them relevant in many households.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States appliances market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- General Electric

- Whirlpool Corp

- Amana

- Maytag

- KitchenAid

- Roper Corp.

- Philips Oral Healthcare, LLC

- A.O. Smith Water Products Co.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States appliances market based on the following segments:

United States Appliances Market, By Product

- Major Appliances

- Small Appliances

United States Appliances Market, By Type

- Conventional Appliances

- Smart Appliances

Need help to buy this report?