United States Antiviral Drugs Market Size, Share, and COVID-19 Impact Analysis, By Drug Class (Protease Inhibitors, Neuraminidase Inhibitors, DNA Polymerase Inhibitors, Reverse Transcriptase Inhibitors, and Others), By Type (Generics and Branded), By Application (Herpes, HIV, Influenza, Hepatitis, and Others), By Distribution Channel (Retail Pharmacy, Online Pharmacy, and Hospital Pharmacy), and US Antiviral Drugs Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareUSA Antiviral Drugs Market Insights Forecasts to 2035

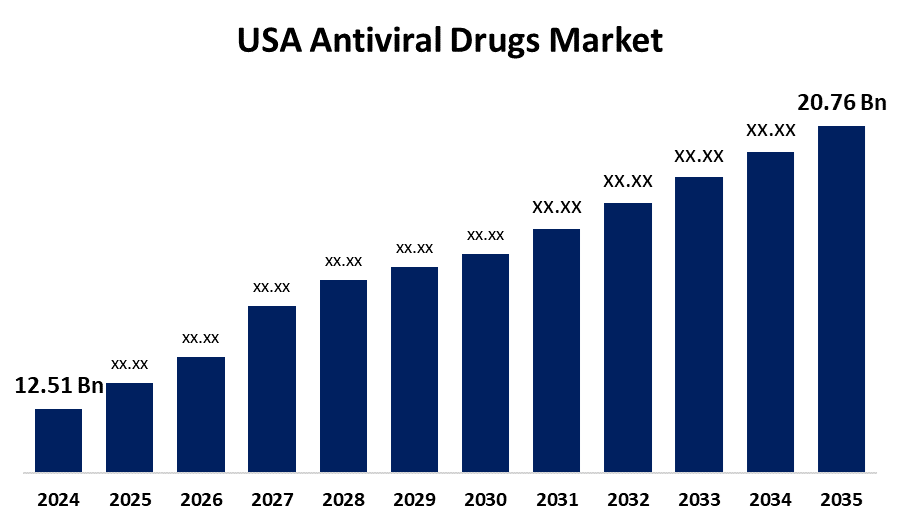

- The US Antiviral Drugs Market Size Was Estimated at USD 12.51 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.71% from 2025 to 2035

- The USA Antiviral Drugs Market Size is Expected to reach USD 20.76 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the US Antiviral Drugs Market is anticipated to reach USD 20.76 billion by 2035, growing at a CAGR of 4.71% from 2025 to 2035. The market expansion is attributed to the rising cases of viral infections, the increasing proportion of the geriatric population, growing awareness of viral diseases, and development in genetic research.

Market Overview

The United States antiviral drugs market is categorized under the pharmaceutical sector, which includes the development, production, and distribution of antiviral medications in the USA for the management of viral infections. Antiviral medications are used to treat viral infections, which are significant pathogens that cause human, animal, and plant diseases. The development of antiviral medication techniques focuses on either host cell components or viruses themselves. Virus attachment, entrance, uncoating, polymerase, protease, nucleoside, nucleotide reverse transcriptase, and integrase inhibitors are examples of direct targets. Among these are raltegravir, valganciclovir, acyclovir, tenofovir, ritonavir, atazanavir, darunavir, and acyclovir. Protease, viral DNA polymerase, and integrase are also inhibited by these medications.

Various government initiatives propel the market growth. For instance, the US Department of Health and Human Services launched a program as the Viral Hepatitis National Strategic Plan. The Viral Hepatitis National Strategic Plan aims to eliminate viral hepatitis as a public health threat in the United States by 2030. The plan aims to prevent new infections, provide high-quality healthcare, and eliminate stigma and discrimination. It includes all people, regardless of age, sex, sexual orientation, race, ethnicity, religion, disability, geographic location, or socioeconomic circumstance. The plan also aims to increase vaccination uptake, access to harm reduction services, substance use treatment, and peer navigation. It also seeks to implement universal screening guidelines, hepatitis B testing, and linkage to care. Therefore, growing diagnosis and vaccination of antiviral drugs for the management of viral diseases are being facilitated through several government initiatives.

Report Coverage

This research report categorizes the market for the US antiviral drugs market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the US antiviral drugs market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the US antiviral drugs market.

United States Antiviral Drugs Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 12.51 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 4.71% |

| 2035 Value Projection: | USD 20.76 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 194 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Drug Class, By Type, By Application, By Distribution Channel and COVID-19 Impact Analysis |

| Companies covered:: | Merck and Co. Inc., Bristol-Myers Squibb Co, Roche Holdings AG, Aurobindo Pharma, AbbVie Inc., GlaxoSmithKline plc and others key players. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growing opportunities are being presented by the development of broad-spectrum antivirals to fight a variety of viral infections, which drives the US antiviral drug market. The continuous threat of pandemics and new viruses necessitates the development of medications that can swiftly adjust to novel situations. Federal programs provide funds and incentives to promote innovation in the study and development of antiviral treatments. To improve access to antiviral drugs and speed up approval procedures, government organizations and pharmaceutical corporations are working together more now. Telemedicine and digital health solutions are becoming more popular as patients use technology to receive therapy, monitor health, and consult with doctors, which improves patient outcomes. The market is also significantly driven by the growing proportion of the aging population in the United States.

Restraining Factors

The antiviral drugs market in the USA faces challenges such as stringent regulatory guidelines, limited awareness of viral infections and their medications, high cost of the branded antivirals, causing adverse effects due to repeated use of the antiviral medicines, which hinders the market growth.

Market Segmentation

The USA antiviral drugs market share is classified into drug class, type, application, and distribution channel.

- The protease inhibitors segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The US antiviral drugs market is segmented by drug class into protease inhibitors, neuraminidase inhibitors, DNA polymerase inhibitors, reverse transcriptase inhibitors, and others. Among these, the protease inhibitors segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental expansion is attributed to inhibiting the viral replication, preventing the formation of the viral protein, patient compliance, tolerability, effectiveness, and safety, minimizing side effects, and reducing the risk of drug resistance.

- The branded segment accounted for the largest share in 2024 and is predicted to grow at a significant CAGR during the forecast period.

The US antiviral drugs market is segmented by type into generics and branded. Among these, the branded segment accounted for the largest share in 2024 and is predicted to grow at a significant CAGR during the forecast period. This segment growth is attributed to the rising adaptability, target-specific viral cells and tissues, easy availability, and branded drugs, which go under the effective and safety studies which increasing the consumption due to their effectiveness.

- The HIV segment held the largest share in 2024 and is predicted to grow at a significant CAGR during the forecast period.

The US antiviral drugs market is segmented by application into herpes, HIV, influenza, hepatitis, and others. Among these, the HIV segment held the largest share in 2024 and is predicted to grow at a significant CAGR during the forecast period. The segmental dominance is owing to the rising prevalence of the HIV infection, government initiatives, and increasing focus on the advancements and development of the anti-retroviral therapies.

- The hospital pharmacy segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

The US antiviral drugs market is segmented by distribution channel into retail pharmacy, online pharmacy, and hospital pharmacy. Among these, the hospital pharmacy segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The sector growth is attributed to the growing proportion of hospital admissions in emergency wards, personalized medications, availability of a wide range of antiviral medications, collaborations of the hospital pharmacy with hospitals to improve patient care, and the offer and discount on medicines.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the US antiviral drugs market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Merck and Co. Inc.

- Bristol-Myers Squibb Co

- Roche Holdings AG

- Aurobindo Pharma

- AbbVie Inc.

- GlaxoSmithKline plc

- Others

Recent Developments:

- In February 2025, Gilead Sciences received FDA approval for its twice-yearly injectable HIV-1 capsid inhibitor, lenacapavir, for HIV prevention as pre-exposure prophylaxis. The FDA's approval follows data from the Phase 3 PURPOSE 1 and PURPOSE 2 trials. In PURPOSE 1, lenacapavir demonstrated zero infections and 100% risk reduction in cisgender women, while in PURPOSE 2, it showed 99.9% of participants did not acquire HIV infection, a 96% risk reduction, and superiority compared to background HIV.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the US antiviral drugs market based on the below-mentioned segments:

US Antiviral Drugs Market, By Drug Class

- Protease Inhibitors

- Neuraminidase Inhibitors

- DNA Polymerase Inhibitors

- Reverse Transcriptase Inhibitors

- Others

US Antiviral Drugs Market, By Type

- Generics

- Branded

US Antiviral Drugs Market, By Application

- Herpes

- HIV

- Influenza

- Hepatitis

- Others

US Antiviral Drugs Market, By Distribution Channel

- Retail Pharmacy

- Online Pharmacy

- Hospital Pharmacy

Need help to buy this report?