United States Antidiabetics Market Size, Share, and COVID-19 Impact Analysis, By Drug Class (GLP-1 Receptor Agonists, Insulin, DPP-4 Inhibitors, SGLT2 Inhibitors, and Others), By Diabetes Type (Type 1 and Type 2), and United States Antidiabetics Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareUnited States Antidiabetics Market Insights Forecasts to 2035

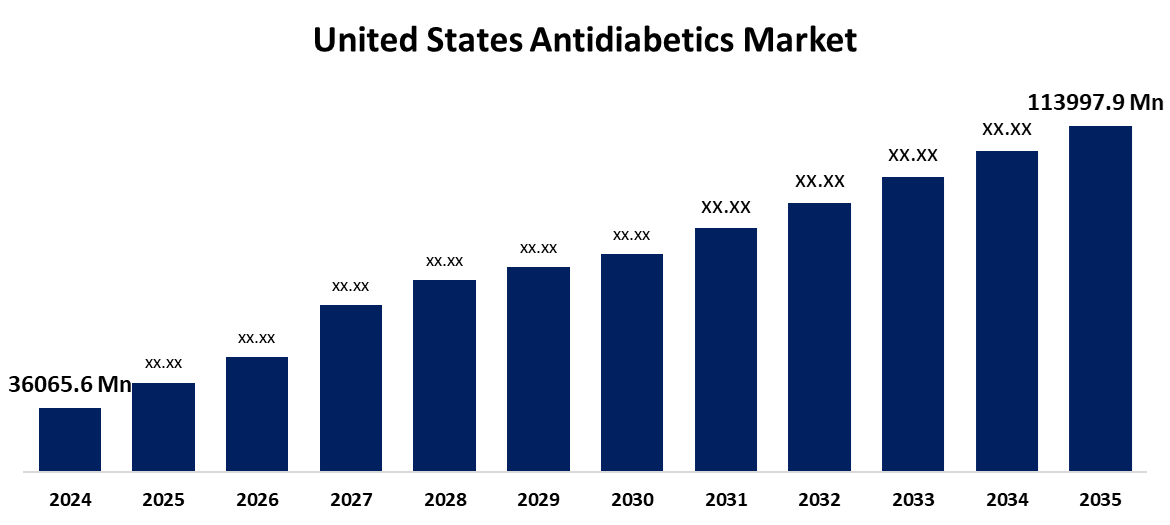

- The US Antidiabetics Market Size Was Estimated at USD 36065.6 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 11.03% from 2025 to 2035

- The US Antidiabetics Market Size is Expected to Reach USD 113997.9 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The United States Antidiabetics Market Size is anticipated to Reach USD 113997.9 Million by 2035, Growing at a CAGR of 11.03% from 2025 to 2035. The expansion of the United States antidiabetics market is propelled by increased rates of diabetes, improvements in SGLT2 inhibitors and GLP-1 receptor agonists, and growing use of combination treatments.

Market Overview

Antidiabetics are drugs intended to reduce high blood sugar levels and assist in keeping them within a normal range, reducing diabetes mellituss immediate and long-term consequences. The insulin market is benefiting from the expansion of biosimilar insulin and regulatory approvals, as well as cardiovascular benefits. Progress is occurring more rapidly due to an influx of AI in R&D and personalised medicine as it relates to the delivery of drugs. Also, the diabetes treatment space has benefited from pharmaceutical investments due to favourable reimbursement policies, turnaround, and healthcare expansion in emerging regions that encourage uptake. The antidiabetics market is likely to expand due to the integration of technology into diabetes medicine development. Utilising drug formulation technologies makes drugs easily tailored and personalised, based on patient-specific characteristics, such as patient genetics, metabolism, or disease progression. This personalised approach to antidiabetic therapy contributes to enhanced patient care more effectively while reducing side effects. Also, the technological advancements open up the exploration of alternate routes for delivering antidiabetic agents, such as buccal delivery, transdermal patches, and inhalation. These alternative delivery routes would have advantages, including a faster start of action, fewer systemic side effects, and better patient acceptability.

Report Coverage

This research report categorizes the market for the United States antidiabetics market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States antidiabetics market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States antidiabetics market.

United States Antidiabetics Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 36065.6 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 11.03% |

| 2035 Value Projection: | USD 113997.9 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 215 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Drug Class, By Diabetes Type |

| Companies covered:: | Eli Lilly and Co, Bristol-Myers Squibb Co, Merck & Co Inc, Pfizer Inc, Johnson & Johnson, Novo Nordisk, Sanofi, Boehringer Ingelheim, AstraZeneca, and Other Key Companies. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the United States antidiabetics market is boosted through a variety of initiatives from different government programs aimed at lowering the prevalence of diabetes. These government activities also include public health promotion activities that teach individuals how they can reduce the incidence of diabetes and how to either recognize it or manage it. The everyday teaching about lifestyle changes, screening, and following the prescribed treatment plans helps grow the need for antidiabetic medications. To make healthcare services more accessible and inexpensive for more individuals, many governments subsidise them. This includes providing access to prescription drugs for long-term diseases like diabetes. Subsidies and reimbursements reduce the out-of-pocket costs for patients, which increases adherence to treatment plans for diabetes, increasing the uptake and need for antidiabetic medications.

Restraining Factors

The United States antidiabetics market faces obstacles like the regulatory requirement for approval restricts the market for antidiabetic medications. Companies are required to complete lengthy and costly preclinical and clinical studies to demonstrate safety, efficacy, and quality.

Market Segmentation

The United States antidiabetics market share is classified into drug class and diabetes type.

- The GLP-1 receptor agonists segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States antidiabetics market is segmented by drug class into GLP-1 receptor agonists, Insulin, DPP-4 Inhibitors, SGLT2 inhibitors, and others. Among these, the GLP-1 receptor agonists segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven because of their complementary benefits in weight loss and glycaemic control, which are critical for the management of type 2 diabetes. They also promote stomach emptying, stimulate insulin secretion, and inhibit glucagon. They have also been well-received because they demonstrate cardiovascular benefits in high-profile clinical trials.

- The type 2 segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the diabetes type, the United States antidiabetics market is segmented into type 1 and type 2. Among these, the type 2 segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is propelled by the increasing prevalence of the chronic condition. The significant segment share relies on the increasing need for effective management and treatment approaches as more individuals are diagnosed with type 2 diabetes. It is projected that the development of novel treatments and technology, along with growing knowledge of diabetes prevention and management, will drive this expansion.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States antidiabetics market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Eli Lilly and Co

- Bristol-Myers Squibb Co

- Merck & Co Inc

- Pfizer Inc

- Johnson & Johnson

- Novo Nordisk

- Sanofi

- Boehringer Ingelheim

- AstraZeneca

- Others

Recent Development

- In February 2025, the U.S. FDA approved Merilog (insulin-aspart-szjj), the first rapid-acting insulin biosimilar to Novolog, for adults and children with diabetes. Approved in 3ml prefilled pen and 10ml vial forms, Merilog aims to improve mealtime glycemic control. Manufactured by Sanofi-Aventis U.S. LLC, it is the third insulin biosimilar approved in the U.S. This milestone supports the FDAs goal to expand access to cost-effective insulin therapies and foster a competitive biosimilar market for diabetes treatment.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States antidiabetics market based on the following segments:

United States Antidiabetics Market, By Drug Class

- GLP-1 Receptor Agonists

- Insulin

- DPP-4 Inhibitors

- SGLT2 Inhibitors

- Others

United States Antidiabetics Market, By Diabetes Type

- Type 1

- Type 2

Need help to buy this report?