United States Anti-static Agents Market Size, Share, and COVID-19 Impact Analysis, By Product (Diethanolamides, Glycerol Monostearate, Ethoxylated Fatty Acid Amines, and Others), By Form (Powder, Liquid, and Others), By Polymer (Polyvinyl Chloride, Polypropylene, Acrylonitrile Butadiene Styrene, Polyethylene, and Others), By End-User (Electronics, Packaging, Textile, Automotive, and Others), and US Anti-static Agents Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsUSA Anti-static Agents Market Insights Forecasts to 2035

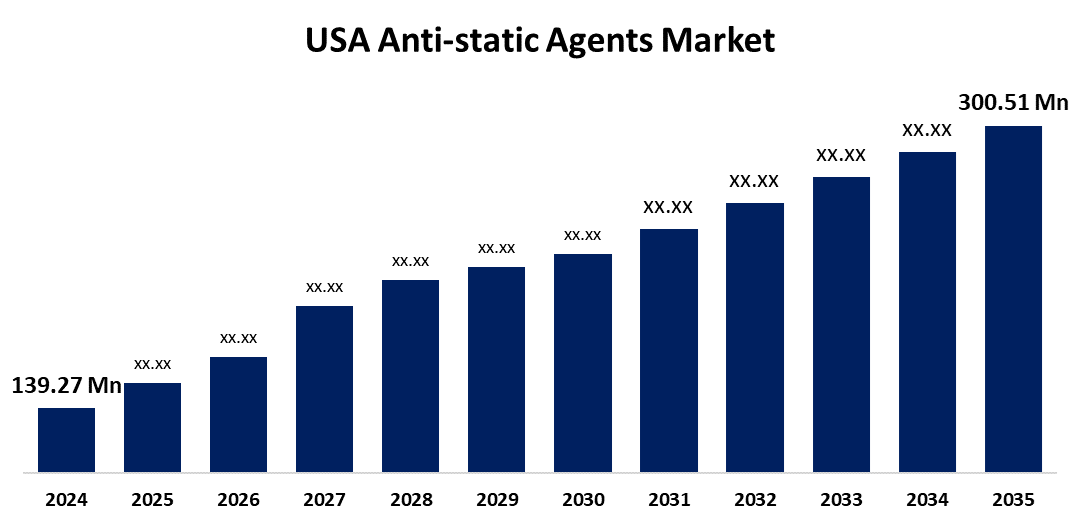

- The US Anti-static Agents Market Size Was Estimated at USD 139.27 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 7.24% from 2025 to 2035

- The USA Anti-static Agents Market Size is expected to reach USD 300.51 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the US Anti-static Agents Market is anticipated to reach USD 300.51 Million by 2035, growing at a CAGR of 7.24% from 2025 to 2035. The market for antistatic agents is expanding significantly due to rising demand from various industries that recognize the importance of static control in production processes, including electronics, automotive, packaging, and textiles.

Market Overview

The US market for anti-static compounds is centered on chemical additives that minimize electrostatic discharge, dust collection, and material damage by reducing the development of static electricity in materials such as plastics, textiles, electronics, and packaging. Amphiphilic compounds known as antistatic agents are utilized in the furniture and plastics industries to lower resistance and static electricity by coating surfaces with a conductive layer. They can be applied directly to the surface as an antistatic coating or mixed in during the compounding step. Hygroscopic substances called antistatic agents, which are frequently electrolytes, ensure the existence of a surface water layer. They have FDA approval and can be either ionic or non-ionic. Polyolefins and polypropylene injection molding applications frequently use non-ionic antistatic chemicals. Antistatic compounds often have both hydrophilic and hydrophobic properties. The hydrophilic part of the molecule attracts water molecules, while the hydrophobic part interacts with the polymer to create a thin layer of moisture that improves surface conductivity. Hence, the growing use of anti-static compounds in several industries drives the market growth.

Report Coverage

This research report categorizes the market for the US anti-static agents market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the US anti-static agents market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the US anti-static agents market.

United States Anti-static Agents Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 139.27 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 7.24% |

| 2035 Value Projection: | USD 300.51 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 192 |

| Tables, Charts & Figures: | 102 |

| Segments covered: | By Product, By Polymer, By End-User and COVID-19 Impact Analysis |

| Companies covered:: | Arkema, Clariant, Croda International Plc, Mitsubishi Chemical Group Corporation, 3M, BASF, Evonik Industries AG, Nouryon and others key players. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Antistatic agents play a critical role in mitigating these risks by preventing the buildup of static electricity on surfaces and materials used in electronic assembly and packaging. Advanced antistatic solutions are being adopted to improve product performance and reliability in electronic applications, and investments in the packaging sector are also driving the growth of the antistatic agent market. The electronics industry's increasing static control requirements are the driving force behind the demand for antistatic agents. The use of antistatic agents in packaging materials is crucial because they stop static accumulation, which can draw dust, detract from the appearance of products, and be dangerous in delicate areas. In developed countries where consumer tastes favor sustainable products, the move towards environmentally friendly and compliant antistatic chemicals has a substantial and positive impact on market dynamics.

Restraining Factors

The availability of substitutes, stringent safety and environmental regulations, fluctuations in raw material prices, and a lack of knowledge in some industries, price changes for raw materials have an effect on pricing and manufacturing costs, which may impede the market growth.

Market Segmentation

The USA anti-static agents market share is classified into product, form, polymer, and end-user.

- The ethoxylated fatty acid amines segment held the largest share of 28.98% in 2024 and is expected to grow at a significant CAGR during the forecast period.

The US anti-static agents market is segmented by product into diethanolamides, glycerol monostearate, ethoxylated fatty acid amines, and others. Among these, the ethoxylated fatty acid amines segment held the largest share of 28.98% in 2024 and is expected to grow at a significant CAGR during the forecast period. This is attributed to their adaptability and is frequently used in the electronics and packaging industries to shield delicate components from electrostatic discharge, improving operational efficiency and product quality.

- The liquid segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The US anti-static agents market is segmented by form into powder, liquid, and others. Among these, the liquid segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is driven by their surface migration, even coverage, and simplicity of application. Their usage of liquid anti-static compounds is encouraged as they improve product quality, operational efficiency, safety, and regulatory compliance.

- The polypropylene segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The US anti-static agents market is segmented by polymer into polyvinyl chloride, polypropylene, acrylonitrile butadiene styrene, polyethylene, and others. Among these, the polypropylene segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment growth is attributed to the growing need for high-performance materials and the expansion of e-commerce-driven packaging, polypropylene, which is lightweight, strong, and resistant to chemicals.

- The packaging segment accounted for the largest share in 2024 and is predicted to grow at a significant CAGR during the forecast period.

The US anti-static agents market is segmented by end-user into electronics, packaging, textile, automotive, and others. Among these, the packaging segment accounted for the largest share in 2024 and is predicted to grow at a significant CAGR during the forecast period. This is attributed to the anti-static compounds are widely used in the packaging sector, especially in industrial, food, pharmaceutical, and electronics packaging. Anti-static coatings and additives have advanced as a result of the growing popularity of eco-friendly and biodegradable packaging. The deployment of these agents is being driven by technology developments and regulatory compliance.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the US anti-static agents market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Arkema

- Clariant

- Croda International Plc

- Mitsubishi Chemical Group Corporation

- 3M

- BASF

- Evonik Industries AG

- Nouryon

- Others

Recent Developments:

- In February 2025, Semtech Corporation introduced the RClamp10022PWQ, a two-line transient voltage suppressor designed for automotive Ethernet applications. This device is fully compliant with Open Alliance specifications for 10BASE-T1S, 100BASE-T1, and 1000BASE-T1 automotive Ethernet interfaces.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the US anti-static agents market based on the below-mentioned segments:

US Anti-static Agents Market, By Product

- Diethanolamides

- Glycerol Monostearate

- Ethoxylated Fatty Acid Amines

- Others

US Anti-static Agents Market, By Form

- Powder

- Liquid

- Others

US Anti-static Agents Market, By Polymer

- Polyvinyl Chloride

- Polypropylene

- Acrylonitrile Butadiene Styrene

- Polyethylene

- Others

US Anti-static Agents Market, By End-User

- Electronics

- Packaging

- Textile

- Automotive

- Others

Need help to buy this report?