United States Anti-Migraine Drugs Market Size, Share, and COVID-19 Impact Analysis, By Drug Type (Triptans, Ergot Alkaloids, CGRP Monoclonal Antibodies, and Others), By Route of Administration (Oral, Injectable, Nasal Sprays, and Others), By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, Online Pharmacies, and Others), and United States Anti-Migraine Drugs Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareUnited States Anti-Migraine Drugs Market Insights Forecasts to 2035

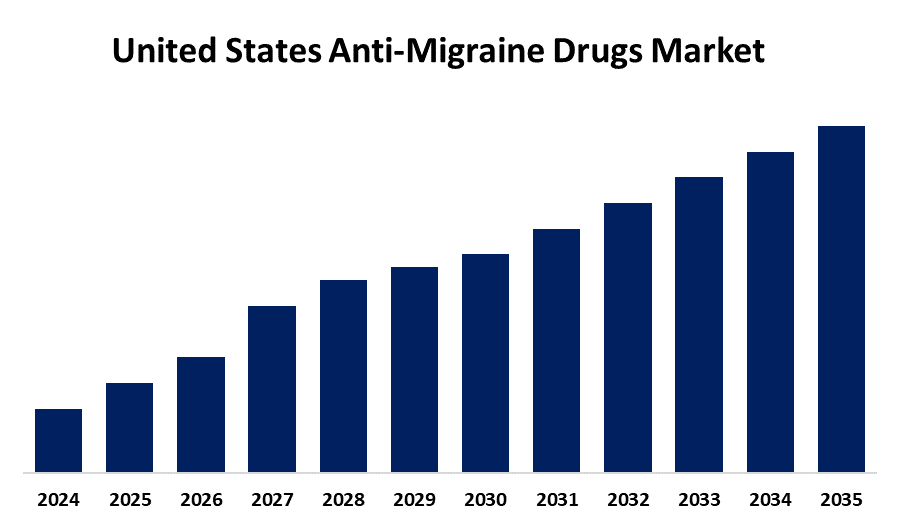

- The USA Anti-Migraine Drugs Market Size is Expected to Grow at a CAGR of around 8.9% from 2025 to 2035.

- The U.S. Anti-Migraine Drugs Market Size is Expected to Hold a Significant Share by 2035.

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the USA anti-migraine drugs market is expected to hold a significant share by 2035, growing at a CAGR of 8.9% from 2025 to 2035. The U.S. anti-migraine drugs market is growing due to increasing migraine cases, better diagnosis rates, and rising awareness of effective treatment options. The launch of advanced drugs like CGRP inhibitors, along with improved healthcare access, supports this trend. Additionally, patient demand for faster relief and preventive therapies fuels innovation and market expansion across various treatment segments.

Market Overview

The U.S. anti-migraine drugs market defines a wide range of prescription medications aimed at both acute relief and long-term prevention of migraine attacks. These include triptans, CGRP inhibitors, ergot alkaloids, and non-steroidal anti-inflammatory drugs (NSAIDs). The market is driven by a rising prevalence of migraine, growing awareness of available treatment options, and increased healthcare access. Advancements in drug delivery systems and the introduction of newer, more targeted therapies like CGRP antagonists have significantly improved patient outcomes and treatment adherence. Strengths of the market include a strong pharmaceutical pipeline, increased investment in research and development, and growing availability of telemedicine platforms offering easier access to migraine care. Opportunities exist in expanding the use of digital health solutions for diagnosis and treatment monitoring, along with targeting underserved populations. Government initiatives, including fast-track FDA approvals and efforts to expand insurance coverage for newer migraine treatments, support market expansion.

Report Coverage

This research report categorizes the market for the United States anti-migraine drugs market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States anti-migraine drugs market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States anti-migraine drugs market.

United States Anti-Migraine Drugs Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 8.9% |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 125 |

| Segments covered: | By Drug Type, By Route of Administration, By Distribution Channel and COVID-19 Impact Analysis |

| Companies covered:: | BioDelivery Sciences International Inc., Bausch Health Companies Inc., Supernus Pharmaceuticals Inc., Collegium Pharmaceutical Inc., Satsuma Pharmaceuticals Inc., Zosano Pharma Corporation, Currax Pharmaceuticals LLC, Axsome Therapeutics Inc., Impel NeuroPharma Inc., Endo International plc, Eli Lilly and Company, Neurelis Inc., AbbVie Inc., Amgen Inc., Pfizer Inc., Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors

The rising prevalence of migraines, affecting millions of individuals and prompting greater demand for effective treatments, has increased awareness about migraine as a serious neurological condition has leading to more diagnoses and proactive treatment approaches. Advancements in drug development, particularly the introduction of CGRP inhibitors, have significantly improved therapeutic outcomes and patient satisfaction. Growing healthcare access, favourable reimbursement policies, and a surge in telemedicine consultations have further boosted market growth. Additionally, pharmaceutical companies are investing heavily in research and development to create innovative, targeted therapies with fewer side effects. The growing preference for personalized medicine and preventive migraine treatments continues to drive demand across both acute and chronic migraine segments.

Restraining Factors

The high treatment costs limit access for uninsured or underinsured patients. Side effects and inconsistent efficacy of some medications reduce patient adherence. Additionally, over-reliance on over-the-counter options delays proper diagnosis. Patent expirations and generic competition also affect profitability, while strict FDA regulations can slow the approval of new therapies.

Market Segmentation

The United States anti-migraine drugs market share is classified into drug type, route of administration, and distribution channel.

- The triptans segment held the highest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States anti-migraine drugs market is segmented by drug type into triptans, ergot alkaloids, CGRP monoclonal antibodies, and others. Among these, the triptans segment held the highest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is because their proven efficacy in rapidly relieving migraine symptoms. Triptans have been widely prescribed for decades, offering targeted serotonin receptor activation that reduces inflammation and pain. Their established safety profile and availability in various formulations drive strong patient and physician preference.

- The oral segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States anti-migraine drugs market is segmented by route of administration into oral, injectable, nasal sprays, and others. Among these, the oral segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to its convenience, ease of use, and widespread patient acceptance. Oral medications offer effective migraine relief without the discomfort or complexity of injections or nasal sprays. Additionally, a broad range of oral formulations is available, making them accessible and preferred for both acute and preventive migraine treatments.

- The hospital pharmacies segment held a substantial share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States anti-migraine drugs market is segmented by distribution channel into hospital pharmacies, retail pharmacies, online pharmacies, and others. Among these, the hospital pharmacies segment held a substantial share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth is attributed to direct access to specialized healthcare providers and immediate availability of advanced migraine treatments. Hospitals cater to severe and complex migraine cases, ensuring proper diagnosis and prescription, which drives higher demand for anti-migraine drugs through their pharmacies compared to other channels.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States anti-migraine drugs market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- BioDelivery Sciences International Inc.

- Bausch Health Companies Inc.

- Supernus Pharmaceuticals Inc.

- Collegium Pharmaceutical Inc.

- Satsuma Pharmaceuticals Inc.

- Zosano Pharma Corporation

- Currax Pharmaceuticals LLC

- Axsome Therapeutics Inc.

- Impel NeuroPharma Inc.

- Endo International plc

- Eli Lilly and Company

- Neurelis Inc.

- AbbVie Inc.

- Amgen Inc.

- Pfizer Inc.

- Others

Recent Developments:

- In January 2025, the U.S. FDA approved Axsome Therapeutics' migraine drug. The oral drug, branded Symbravo, was approved for the acute treatment of the condition characterized by recurrent attacks of moderate to severe throbbing and pulsating pain on one side of the head.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the USA, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the U.S. anti-migraine drugs market based on the below-mentioned segments:

United States Anti-Migraine Drugs Market, By Drug Type

- Triptans

- Ergot Alkaloids

- CGRP Monoclonal Antibodies

- Others

United States Anti-Migraine Drugs Market, By Route of Administration

- Oral

- Injectable

- Nasal Sprays

- Others

United States Anti-Migraine Drugs Market, By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

- Others

Need help to buy this report?