United States Anti-Hypertensive Drugs Market Size, Share, and COVID-19 Impact Analysis, By Type (Primary Hypertension and Secondary Hypertension), By Drug Class (Calcium Channel Blockers, Diuretics, Vasodilators, Beta-Adrenergic Blockers, Angiotensin Converting Enzyme Inhibitors, and Others), By Route of Administration (Injectables, Oral, and Others), By Distribution Channel (Hospital Pharmacy, Online Pharmacy, and Retail Pharmacy), and US Anti-Hypertensive Drugs Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareUSA Anti-Hypertensive Drugs Market Insights Forecasts to 2035

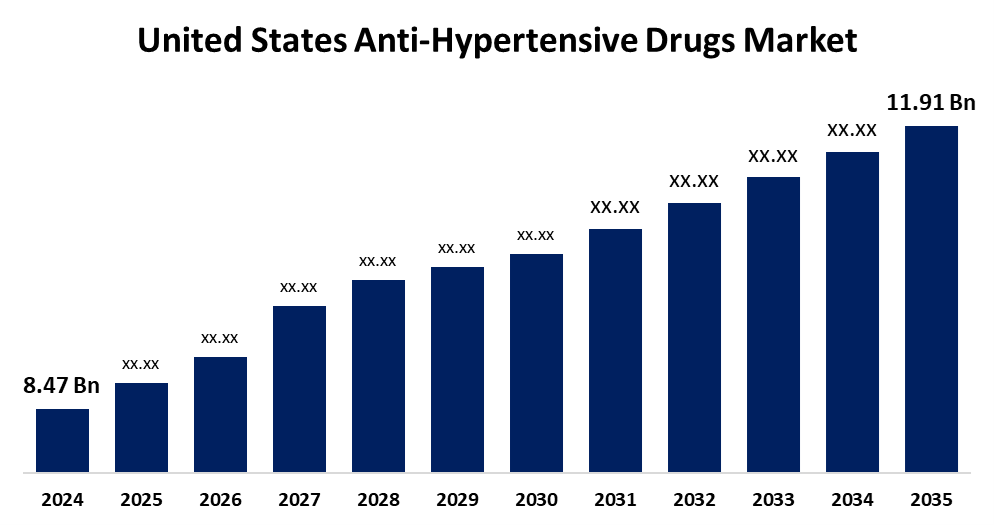

- The US Anti-Hypertensive Drugs Market Size was Estimated at USD 8.47 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 3.15% from 2025 to 2035

- The USA Anti-Hypertensive Drugs Market Size is Expected to Reach USD 11.91 Billion by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The US Anti-Hypertensive Drugs Market Size is anticipated to reach USD 11.91 Billion by 2035, Growing at a CAGR of 3.15% from 2025 to 2035. The market size growth is attributed to the increasing prevalence of hypertension in the United States and the growing proportion of the geriatric population.

Market Overview

The United States Hypertension Market Size is categorized under the pharmaceutical sector, which involves the development, production, and distribution of antihypertensive drugs that are used in the management of hypertension. Hypertension refers to high blood pressure. A chronic condition known as hypertension is characterized by abnormally elevated blood pressure (BP) in blood vessels, which increases the risk of cardiovascular disease and death. " It can be categorized as primary or secondary and impacts about 50 million individuals in the US. Being overweight, eating a diet high in salt, not exercising, and drinking alcohol can all contribute to primary hypertension, which is estimated to be more than 90% of cases and becomes more prevalent as people age. Endocrine disorders and renal issues are among the underlying diseases that lead to secondary hypertension. Other factors that affect blood pressure include age, family history, weight, physical activity, eating habits, and alcohol consumption. High cholesterol, diabetes, medications, smoking, and stress are other concerns. Sometimes, drugs that treat arthritis, steroids, and oral contraceptives can also raise blood pressure. The marketed products of the anti-hypertensive drugs are Telmikind-H, Captoguard, COTRAZID, etc.

The rising prevalence of hypertension in the United States accelerates the demand for hypertension treatment, which leads to an increasing need for antihypertensive drugs, resulting in the growth of the market. For instance, the data provided by the Centers for Disease Control and Prevention (CDC) states that nearly 48% of adults in the United States between August 2021 and August 2023 had hypertension, a treatable chronic ailment that is more common in men and rises with age, with over 70% of persons 60 and older having hypertension.

Report Coverage

This research report categorizes the market for the US anti-hypertensive drugs market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the US anti-hypertensive drugs market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the US anti-hypertensive drugs market.

United States Anti-Hypertensive Drugs Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 8.47 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 3.15% |

| 2035 Value Projection: | USD 11.91 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 223 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Type, By Drug Class, By Route of Administration, By Distribution Channel |

| Companies covered:: | Sanofi SA, Lupin, Boehringer Ingelheim Pharma, AstraZeneca PLC, Pfizer Inc., Merck & Co, Inc., Sun Pharmaceutical Industries, and Other Key Companies. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market for antihypertensive medications is growing as a result of rising prevalence, improvements in medication development, rising awareness regarding the risk of hypertension, and digital health solutions. Fixed-dose combinations, or FDCs, are more common due to their ability to streamline treatment plans and improve patient adherence. Pharmacogenomics and genomics developments are opening the door to individualized hypertension therapies that take into account a patient's genetic profile for less harmful side effects. Patient data is being analysed by AI and machine learning to find successful therapies and create novel medications with specific mechanisms, which facilitates the market expansion. Researchers are looking at using nanotechnology to enhance medicine delivery systems, increase bioavailability, and reduce side effects. As healthcare practitioners look for more efficient and specialized treatments for their patients, the market is expanding significantly due to the availability of a large variety of medications and the growing use of personalized medicine.

Restraining Factors

The side effects obtained from the long-term use of the anti-hypertensive medications, such as fatigue, dizziness, stringent regulatory framework, high cost of the branded medications, and lack of awareness of hypertension and its therapeutic drugs, may limit the growth of the market.

Market Segmentation

The USA anti-hypertensive drugs market share is classified into type, drug class, route of administration, and distribution channel.

- The primary hypertension segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The US anti-hypertensive drugs market is segmented by type into primary hypertension and secondary hypertension. Among these, the primary hypertension segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The sectoral growth is owing to the sedentary lifestyles, genetic predisposition, high intake of salt through meals, excessive alcohol consumption, and lack of physical activity.

- The calcium channel blockers segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The US anti-hypertensive drugs market is segmented by drug class into calcium channel blockers, diuretics, vasodilators, beta-adrenergic blockers, angiotensin-converting enzyme inhibitors, and others. Among these, the calcium channel blockers segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental expansion is attributed to the greater safety, efficacy, normalizes the blood pressure, dilates the blood vessels, and reduces the heart rate.

- The oral segment accounted for the largest share in 2024 and is predicted to grow at a significant CAGR during the forecast period.

The US anti-hypertensive drugs market is segmented by route of administration into injectables, oral, and others. Among these, the oral segment accounted for the largest share in 2024 and is predicted to grow at a significant CAGR during the forecast period. The segment growth is driven by the ease of administration, adaptability, oral medications are cost-effective, enhanced efficacy, growing use of antihypertensive tablets, patient convenience, and non-invasiveness.

- The hospital pharmacy segment dominated the United States anti-hypertensive drugs market in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

The US anti-hypertensive drugs market is segmented by distribution channel into hospital pharmacy, online pharmacy, and retail pharmacy. Among these, the hospital pharmacy segment dominated the United States anti-hypertensive drugs market in 2024 and is anticipated to grow at a significant CAGR during the forecast period. This segmental growth is ascribed to the presence of skilled pharmacists, dispensing and compounding medications to the patients for better health. The collaboration of the hospital pharmacies with healthcare professionals of the hospital improves patient treatment and overall health.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the US anti-hypertensive drugs market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Sanofi SA

- Lupin

- Boehringer Ingelheim Pharma

- AstraZeneca PLC

- Pfizer Inc.

- Merck & Co, Inc.

- Sun Pharmaceutical Industries

- Others

Recent Developments:

- In March 2025, Mineralys Therapeutics, a biopharmaceutical company, announced positive results from its Launch-HTN Phase 3 and Advance-HTN Phase 2 trials evaluating the efficacy and safety of lorundrostat for treating uncontrolled hypertension and resistant hypertension. Both trials achieved statistical significance and demonstrated a favorable safety and tolerability profile.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the US anti-hypertensive drugs market based on the below-mentioned segments:

US Anti-Hypertensive Drugs Market, By Type

- Primary Hypertension

- Secondary Hypertension

US Anti-Hypertensive Drugs Market, By Drug Class

- Calcium Channel Blockers

- Diuretics

- Vasodilators

- Beta-Adrenergic Blockers

- Angiotensin Converting Enzyme Inhibitors

- Others

US Anti-Hypertensive Drugs Market, By Route of Administration

- Injectables

- Oral

- Others

US Anti-Hypertensive Drugs Market, By Distribution Channel

- Hospital Pharmacy

- Online Pharmacy

- Retail Pharmacy

Need help to buy this report?