United States Anti-Depressant Drugs Market Size, Share, and COVID-19 Impact Analysis, By Medication Type (Generic and Branded), By Drug Class (Tricyclic Antidepressants, Monoamine Oxidase Inhibitors, Selective Serotonin Reuptake Inhibitors, Atypical Antidepressants, Norepinephrine-Dopamine Reuptake Inhibitor, Serotonin & Noradrenaline Reuptake Inhibitors, and Others), By Route of Administration (Injectable, Oral, Nasal, and Transdermal), By Application (Generalized Anxiety Disorder, Major Depressive Disorder, Panic Disorder, Obsessive-Compulsive Disorder, and Others), By Distribution Channel (Retail Pharmacies, Online Pharmacies, and Hospital Pharmacies), and US Anti-Depressant Drugs Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareUSA Anti-Depressant Drugs Market Insights Forecasts to 2035

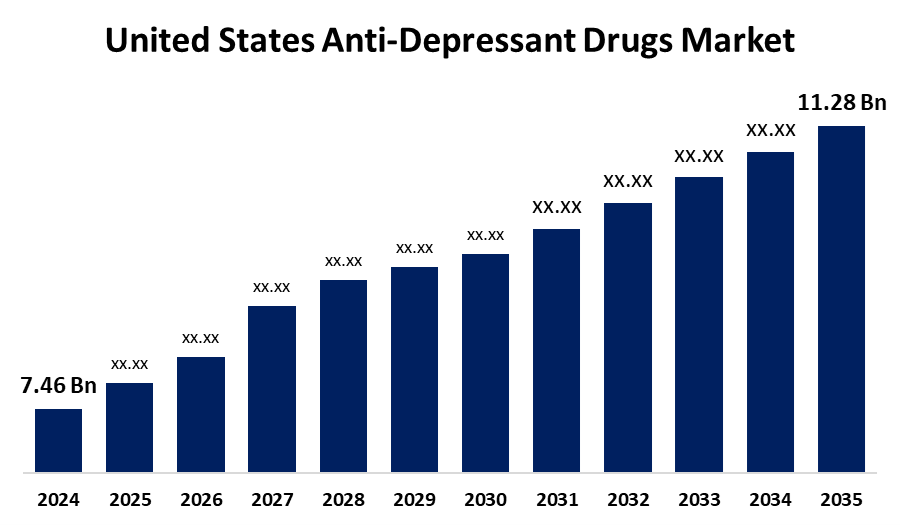

- The US Anti-Depressant Drugs Market Size Was Estimated at USD 7.46 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 3.83% from 2025 to 2035

- The USA Anti-Depressant Drugs Market Size is Expected to Reach USD 11.28 Billion by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The US Anti-Depressant Drugs Market Size is anticipated to reach USD 11.28 Billion by 2035, Growing at a CAGR of 3.83% from 2025 to 2035.

Market Overview

The US Antidepressant Drugs Market Size is the industry that develops, produces, distributes, and consumes medications for treating depression, anxiety, and other mental health conditions by modifying brain neurotransmitter activity. Antidepressants are drugs that are used to treat chronic pain, bulimia, anxiety, and clinical depression. Neurologists utilize them extensively because they stimulate the dopaminergic, serotonergic, and noradrenergic systems. They are a diverse class of medications used to treat anxiety, depression, and other non-motor symptoms in Parkinson's disease (PD). The symptoms of depression, a psychoneurotic condition, include sorrow, decreased activity, trouble thinking, loss of focus, changes in eating and sleep patterns, and feelings of hopelessness and despair. In the United States, depression is a prevalent and recurring illness that significantly increases morbidity and mortality. The five categories of antidepressants are used to treat anxiety, pain, and depression. By blocking the reuptake of neurotransmitters via particular receptors, these medications raise the levels of particular neurotransmitters in the brain. One such antidepressant that alters serotonin levels in the brain is a selective serotonin reuptake inhibitor (SSRI). The marketed products of the antidepressants are Prozac (fluoxetine), Cymbalta (duloxetine), Zolofit (sertraline), etc.

The increasing prevalence of depression escalates the demand for antidepressant treatment, which leads to the growth of the market. For instance, the data provided by the Centers for Disease Control and Prevention states that in 2020, 18.4% of US adults are estimated to be diagnosed with depression in the United States.

Report Coverage

This research report categorizes the market for the US anti-depressant drugs market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the US anti-depressant drugs market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the US anti-depressant drugs market.

United States Anti-Depressant Drugs Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 7.46 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 3.83% |

| 2035 Value Projection: | USD 11.28 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 215 |

| Tables, Charts & Figures: | 113 |

| Segments covered: | By Medication Type, By Drug Class, By Route of Administration, By Application, By Distribution Channel |

| Companies covered:: | GlaxoSmithKline plc, Pfizer Inc., Johnson and Johnson, Eli Lilly and Company, Amneal Pharmaceutical Inc., Avet Pharmaceuticals Inc., Novartis AG, AbbVie Inc., Allergan, and Other Key Companies. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Conventional therapies for major depressive disorder (MDD) have a poor track record of efficacy, making it a leading cause of disability in the US. As a result, new medications are now required to treat mental illnesses. Leading pharmaceutical corporations collaborate with scientists, researchers, and medication developers to find new therapeutic paths to boost efficacy. It is anticipated that research and development efforts will impact this market expansion. A vast patient pool in need of treatment is presented by the increasing frequency of mental diseases and the emphasis on early diagnosis. Despite significant financial backing from the USA and governmental healthcare institutions, anticipated to accelerate market expansion, industry participants are concentrating on research and development to launch novel therapies for mental health conditions. In the quest for novel medicinal compounds, partnerships with government organizations and research universities are being investigated.

Restraining Factors

The negative effects of current medications for depression and other mental illnesses, such as weight gain, light-headedness, and blurred vision, are frequently investigated. As a result, the market growth is restricted in the USA region.

Market Segmentation

The USA anti-depressant drugs market share is classified into medication type, drug class, route of administration, application, and distribution channel.

- The branded segment accounted for the largest share in 2024.

The US anti-depressant drugs market is segmented by medication type into generic and branded. Among these, the branded segment accounted for the largest share in 2024. The segment growth is attributed to the safer, more effective, and fewer adverse effects, branded antidepressants are more widely used. Their expansion is further supported by novel medications for depression that are resistant to treatment. Strong marketing efforts and brand loyalty contribute to their large market share.

- The selective serotonin reuptake inhibitors segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The US anti-depressant drugs market is segmented by drug class into tricyclic antidepressants, monoamine oxidase inhibitors, selective serotonin reuptake inhibitors, atypical antidepressants, norepinephrine-dopamine reuptake inhibitor, serotonin & noradrenaline reuptake inhibitors, and others. Among these, the selective serotonin reuptake inhibitors segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is attributed to the strong efficacy and safety profile, which makes them first-line therapies for anxiety and depression, driving this segment's market expansion. Patients with comorbid diseases and the elderly can benefit from these medicines since they are more palatable. PTSD, panic disorder, OCD, and anxiety are also treated with them. They are additionally more accessible and affordable due to the availability of generic variants such as Sertraline and Prozac.

- The oral segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The US anti-depressant drugs market is segmented by route of administration into injectable, oral, nasal, and transdermal. Among these, the oral segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is attributed to the ease of use, affordability, and convenience of oral antidepressants, such as tablets and capsules, which makes them the favored option. They serve a wide range of patients and come in both branded and generic varieties. They are the first-line treatment for disorders like anxiety and depression because of their proven safety and effectiveness.

- The major depressive disorder segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The US anti-depressant drugs market is segmented by application into generalized anxiety disorder, major depressive disorder, panic disorder, obsessive-compulsive disorder, and others. Among these, the major depressive disorder segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is attributed to the increasing prevalence of depression, there is a growing need for efficient therapies. The need for antidepressant drugs, especially SSRIs, rises as more people seek treatment, as stigma around mental health declines, and knowledge of mental health issues grows. For the depressive illness category to continue to dominate the segment, long-term management of depression is essential.

- The hospital pharmacies segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The US anti-depressant drugs market is segmented by distribution channel into retail pharmacies, online pharmacies, and hospital pharmacies. Among these, the hospital pharmacies segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is ascribed to providing specialist drugs, close monitoring, and a large number of prescriptions for patients with serious mental health issues. Centralized dispensing systems and the increasing need for specialized services, particularly in the wake of the epidemic, are factors in their supremacy.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the US anti-depressant drugs market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- GlaxoSmithKline plc

- Pfizer Inc.

- Johnson and Johnson

- Eli Lilly and Company

- Amneal Pharmaceutical Inc.

- Avet Pharmaceuticals Inc.

- Novartis AG

- AbbVie Inc.

- Allergan

- Others

Recent Developments:

- In January 2025, Johnson & Johnson received FDA approval for SPRAVATO® (esketamine) CIII nasal spray, making it the first monotherapy for adults with major depressive disorder who have had an inadequate response to at least two oral antidepressants. The treatment targets glutamate, the most abundant excitatory neurotransmitter in the brain, and showed rapid and superior improvement compared to placebo. The mechanism of esketamine's antidepressant effect remains unknown.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the US anti-depressant drugs market based on the below-mentioned segments:

US Anti-Depressant Drugs Market, By Medication Type

- Generic

- Branded

US Anti-Depressant Drugs Market, By Drug Class

- Tricyclic Antidepressants

- Monoamine Oxidase Inhibitors

- Selective Serotonin Reuptake Inhibitors

- Atypical Antidepressants

- Norepinephrine-Dopamine Reuptake Inhibitor

- Serotonin & Noradrenaline Reuptake Inhibitors

- Others

US Anti-Depressant Drugs Market, By Route of Administration

- Injectable

- Oral

- Nasal

- Transdermal

US Anti-Depressant Drugs Market, By Application

- Generalized Anxiety Disorder

- Major Depressive Disorder

- Panic Disorder

- Obsessive-Compulsive Disorder

- Others

US Anti-Depressant Drugs Market, By Distribution Channel

- Retail Pharmacies

- Online Pharmacies

- Hospital Pharmacies

Need help to buy this report?