United States Analgesics Market Size, Share, and COVID-19 Impact Analysis, By Drug Type (Opioid, Non-opioid, and Compound Medication), By Route of Administration (Oral, Parenteral, Transdermal, and Others), and United States Analgesics Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareUnited States Analgesics Market Insights Forecasts to 2035

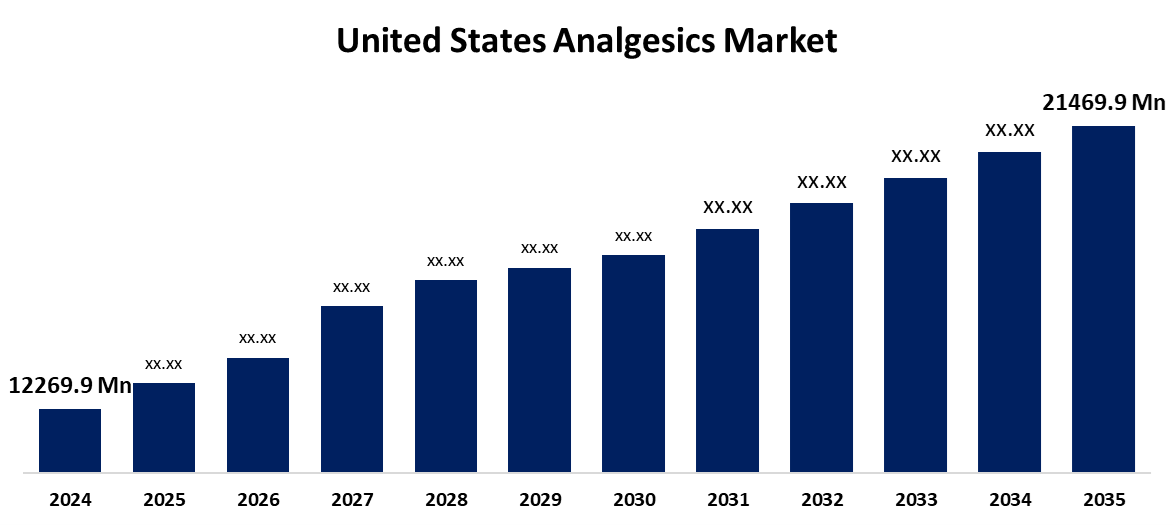

- The US Analgesics Market Size Was Estimated at USD 12269.9 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.22% from 2025 to 2035

- The US Analgesics Market Size is Expected to Reach USD 21469.9 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The United States Analgesics Market Size is anticipated to Reach USD 21469.9 Million by 2035, Growing at a CAGR of 5.22% from 2025 to 2035. The expansion of the United States analgesics market is propelled by rising rates of neuropathic diseases, cancer, and osteoarthritis and arthritis.

Market Overview

Analgesics, also known as painkillers, are medications that lessen pain without altering consciousness or emotion. Through the forecast period, the increasing number of these diseases is expected to drive growth in the market. According to CDC estimates, approximately 1 in 4 (23.7%) individuals across the US, or 58.5 million people, have been diagnosed with arthritis. Women are more likely than men to have arthritis, and as individuals age, their condition naturally worsens, resulting in more uncomfortable and unhealthy days. Due to the high levels of addiction and abuse associated with opiates, pharmacological management of pain has shifted towards safer options of non-opioid analgesics. Alternative methods, such as acetaminophen or NSAIDs likely safer. For example, Vertexs VX-548 showed potential in two big clinical trials in January 2024, showing minimal to no side effects and a significant decrease in post-operative pain as compared to the placebo group. Vertex will be submitting for FDA approval for use in moderate to severe acute pain. With the opioid crisis still prevalent, the results provide hope for a non-addictive alternative to opiate drugs. These drugs have strong efficacy for a variety of pain conditions and provide a safer alternative for treating both acute and chronic pain.

Report Coverage

This research report categorizes the market for the United States analgesics market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States analgesics market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States analgesics market.

United States Analgesics Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 12269.9 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 5.22% |

| 2035 Value Projection: | USD 21469.9 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 215 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Drug Type, By Route of Administration |

| Companies covered:: | Assertio Holdings Inc, Viatris Inc, AbbVie Inc, Johnson & Johnson, Pfizer Inc., Endo Pharmaceuticals, Bristol Myers Squibb, Eli Lilly & Co., Abbott Laboratories, and Other Key Companies. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the United States analgesics market is boosted by the rising incidence of lifestyle-related diseases, such as obesity, diabetes, and cardiovascular diseases has increased the burden of chronic pain, which is driving the expansion of the analgesics market. The burdens of chronic pain have been further exacerbated by the increased number of surgeries performed, as it has now become critical to develop safe, effective, and efficient methods of managing post-operative pain. The current trends of research by pharmaceutical companies that enhance safety and efficacy, like combination therapy, extended-release delivery methods, and abuse-deterrent opioid formulations, will help propel the market. These developments are consistent with a greater focus on personalizing care that accounts for each individuals genetic profile, patient characteristics, and any co-existing medical conditions.

Restraining Factors

The United States Analgesics market faces obstacles like regulatory approvals, particularly for opioid-based therapies. Given concerns regarding the potential for misuse and abuse, addiction, and undesirable side effects, even greater regulations have been implemented, which have negatively impacted the development and commercialization of many products.

Market Segmentation

The United States analgesics market share is classified into drug type and route of administration.

- The non-opioid segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States analgesics market is segmented by drug type into opioid, non-opioid, and compound medication. Among these, the non-opioid segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven because it has a lower risk of side effects, is also widely available as generics, as well an effort that both governments and businesses are putting towards encouraging them as pain management alternatives. Also, there have been good outcomes for non-opioids in clinical trials, which is driving up interest.

- The oral segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the route of administration, the United States analgesics market is segmented into oral, parenteral, transdermal, and others. Among these, the oral segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is propelled as it includes the non-invasive pain-relieving formulation, which acts as an analgesic, and is delivered easily through the oral route. Furthermore, the increased R&D capabilities of pharmaceutical companies to develop innovative oral analgesics that are low in side effects and risk of drug overdose are driving the growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States analgesics market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Assertio Holdings Inc

- Viatris Inc

- AbbVie Inc

- Johnson & Johnson

- Pfizer Inc.

- Endo Pharmaceuticals

- Bristol Myers Squibb

- Eli Lilly & Co.

- Abbott Laboratories

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States analgesics market based on the following segments:

United States Analgesics Market, By Drug Type

- Opioid

- Non-opioid

- Compound Medication

United States Analgesics Market, By Route of Administration

- Oral

- Parenteral

- Transdermal

- Others

Need help to buy this report?