United States Ammonia Market Size, Share, and COVID-19 Impact Analysis, By Product (Aqueous and Anhydrous), By Application (Fertilizers, Refrigerants, Pharmaceuticals, Textile, and Others), and United States Ammonia Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsUnited States Ammonia Market Insights Forecasts to 2035

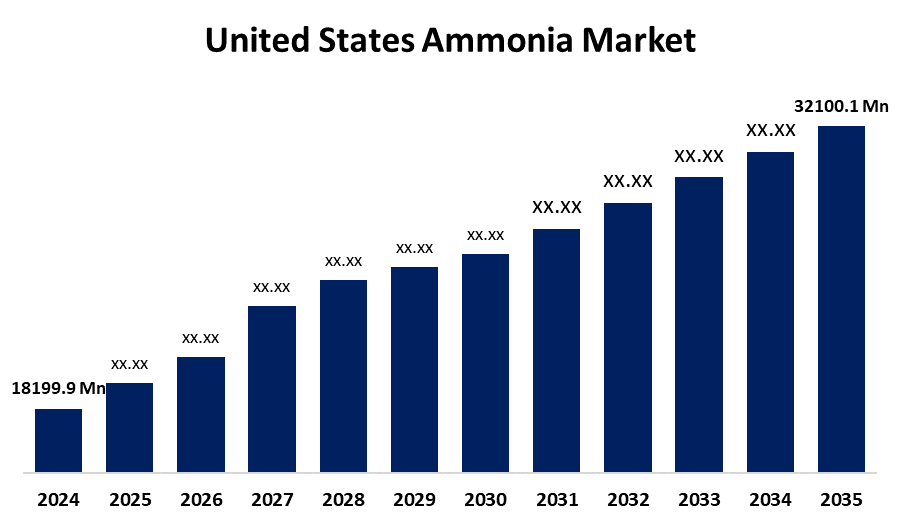

- The US Ammonia Market Size Was Estimated at USD 18199.9 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.29% from 2025 to 2035

- The US Ammonia Market Size is Expected to Reach USD 32100.1 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The United States Ammonia Market Size is anticipated to reach USD 32100.1 Million by 2035, growing at a CAGR of 5.29% from 2025 to 2035. The expansion of the United States' ammonia market is propelled by the rising demand for ammonia, especially in fertilizers and refrigerants, and the increase in population, which has led to a growing demand for food.

Market Overview

Ammonia, an inorganic molecule with the chemical formula NH3, is made up of three hydrogen atoms and one nitrogen atom bound together. One of the central driving forces of market growth in the US, currently, is the advancement of catalysis and process enhancements for the improvement of the Haber-Bosch process for reductions in energy use and operational costs. The industry is also benefiting from the growth of green ammonia plants that are starting to employ renewable energy sources such as hydroelectric, solar, and wind energy. This advances efforts to reduce carbon emissions while increasing the sustainability of ammonia production. The growth of the market is furthered by increasing ammonia consumption in agriculture as a principal nitrogen source, made into fertilisers to improve yield. Food demand in the US drives the demand for ammonia fertilisers due to the country having a lot of land under agriculture.

The U.S. government has started a number of key projects to support a cleaner, more sustainable ammonia market, with a special emphasis on lowering greenhouse gas emissions through infrastructure, financial incentives, and innovation. The Department of Energy (DOE) committed up to 7 billion Dollar towards regional hydrogen-ammonia hubs under the Infrastructure Investment and Jobs Act and the Inflation Reduction Act (IRA). This commitment fuelled efforts to decarbonise ammonia production and support scalable "green" and "blue" ammonia plants with low-carbon credentials.

Report Coverage

This research report categorizes the market for the United States ammonia market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States ammonia market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States ammonia market.

United States Ammonia Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 18199.9 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 5.29% |

| 2035 Value Projection: | USD 32100.1 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 156 |

| Tables, Charts & Figures: | 102 |

| Segments covered: | By Product and By Application |

| Companies covered:: | CF Industries Holdings Inc, Koch Industries, Nutrien Ltd., AdvanSix Inc., Coffeyville Resources Nitrogen Fertilizers, Apache Nitrogen Products, Monolith Inc., Woodside Energy, ExxonMobil, and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the United States ammonia market is boosted because agricultural production has risen dramatically, which produces foods in greater quantity, of higher quality, and higher yields. The agriculture sector contributes a significant portion of a country's GDP. When agriculture grows, there is a need for fertilizers and other agrochemicals, which indirectly leads to a need for ammonia. The ever-growing need for fertilizers has directly led to an increase in ammonia consumption, which would enhance the whole industry value over the forecast period. Additionally, farmers will benefit from government fertiliser subsidies, which will raise the demand for ammonia in the area.

Restraining Factors

The United States ammonia market faces obstacles for manufacturers, including the production of higher-grade ammonia, which is safer to work with for individuals and animals, expanding on more uses, and competitiveness may be the main issues.

Market Segmentation

The United States ammonia market share is classified into product and application.

- The anhydrous segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States ammonia market is segmented by product into aqueous and anhydrous. Among these, the anhydrous segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven by nitrogenous fertilisers, which feature NH3 exhibit shorter production cycles, quality crop protection, and yield increases. For their nitrogen content, with ammonium featuring 82 percent concentration, nitrogenous fertilisers are predominantly viewed as the concentrated, anhydrous form on-farm. Although nitrogenous fertilisers performed better in warmer climates as opposed to cooler ones. Due to its strong pungent odour and heat energy required for vaporisation, the anhydrous ammonia would be used in a couple of other ways, with the use as a solvent and refrigerant.

- The fertilizers segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the application, the United States ammonia market is segmented into fertilizers, refrigerants, pharmaceuticals, textile, and others. Among these, the fertilizers segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is propelled because farmers are increasing the usage of nitrogenous fertilisers. Because of their high solubility, these fertiliser types can be absorbed quickly, effectively, and readily into plants. Therefore, they can provide the nitrogen the plants require quicker than organic fertilisers, because organic fertilisers require time to decompose and supply nutrients.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States ammonia market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- CF Industries Holdings Inc

- Koch Industries

- Nutrien Ltd.

- AdvanSix Inc.

- Coffeyville Resources Nitrogen Fertilizers

- Apache Nitrogen Products

- Monolith Inc.

- Woodside Energy

- ExxonMobil

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States ammonia market based on the following segments:

United States Ammonia Market, By Product

- Aqueous

- Anhydrous

United States Ammonia Market, By Application

- Fertilizers

- Refrigerants

- Pharmaceuticals

- Textile

- Others

Need help to buy this report?