United States Aminoethylethanolamine Market Size, Share, and COVID-19 Impact Analysis, By Grade, By Application (Chelating Agents, Surfactants, Textile Additives, Fabric Softeners, Lubricants, and Others), and United States Aminoethylethanolamine Market Insights, Industry Trend, Forecasts to 2035.

Industry: Chemicals & MaterialsUnited States Aminoethylethanolamine Market Insights Forecasts to 2035

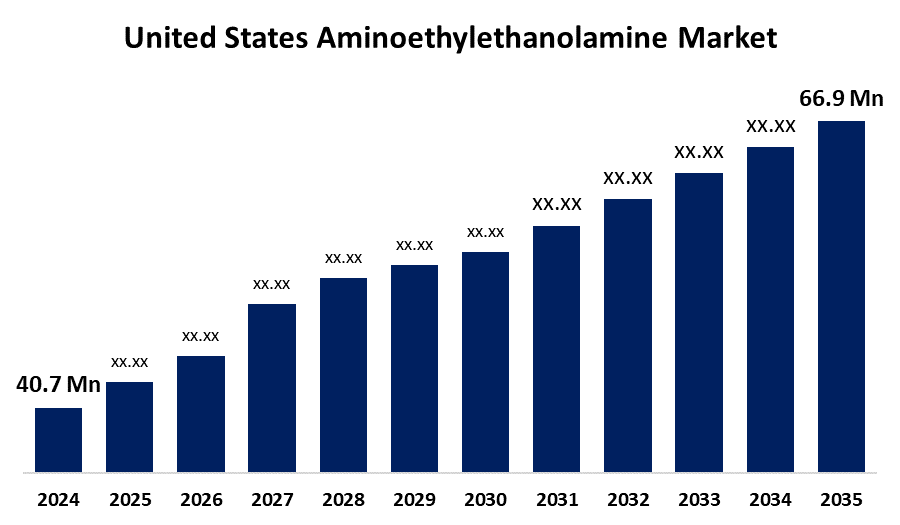

- The US Aminoethylethanolamine Market Size Was Estimated at USD 40.7 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.62% from 2025 to 2035

- The US Aminoethylethanolamine Market Size is Expected to Reach USD 66.9 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the United States Aminoethylethanolamine Market is anticipated to reach USD 66.9 million by 2035, growing at a CAGR of 4.62% from 2025 to 2035. The expansion of the United States aminoethylethanolamine market is propelled by a growing demand for detergents and cleaning products.

Market Overview

Aminoethylethanolamine refers to an organic compound that is colourless, viscous, and has a faint ammonia-like odour. Metal ions and chelating agents create a water-soluble complex. Manufacturers of cleaners and detergents continuously strive to develop formulas that lessen the degree to which these minerals attach themselves to surfaces, whether it is clothing or appliances. When the soap and detergent blend with the calcium and magnesium found in hard water, it tends to produce an insoluble scum that can be very difficult to remove. AEEA has multiple good emulsification and corrosion-inhibiting properties, so it is an interesting component to use for new formulation development in many different industries. Studying and developing bio-based and eco-friendly derivatives of AEEA increases its potential for sustainable product development. It is important to create stronger partnerships with customer-centric sectors to help accelerate innovation and discover new business opportunities. The material's demand is skyrocketing due to the growing need to use aminoethylethanolamine rather than other amines for creating fuel additives, solvents, lubricants, and other chemicals, as well as fabric softeners.

Report Coverage

This research report categorizes the market for the United States aminoethylethanolamine market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States aminoethylethanolamine market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States aminoethylethanolamine market.

United States Aminoethylethanolamine Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 40.7 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 4.62% |

| 2035 Value Projection: | USD 66.9 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 225 |

| Tables, Charts & Figures: | 119 |

| Segments covered: | By Grade, By Application |

| Companies covered:: | Huntsman International LLC, Dow Inc, AkzoNobel N.V., BASF SE, Ashland, Tosoh Corporation, Sachem, Inc., Restek Corporation, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the United States aminoethylethanolamine market is boosted by due to its unique ability to chelate and emulsify molecules. AEEA is often contained in surfactants and water treatment chemicals. There is a growing need from industrial operators and water treatment plants to propel the industry with better wastewater and cleaning application treatments. Because of its capacity to remove scale and stop corrosion, AEEA has a great deal of potential for application in industrial maintenance. From an environmental perspective, AEEA is likely far more favourable when compared to its harsher chemical competitors available on the market. AEEA will likely replace a vast portion of typical chemical formulations as there is a move towards sustainability, and thus will quickly be viewed by the market as readily accepted and adopted.

Restraining Factors

The United States aminoethylethanolamine market faces obstacles because of its new sustainability objectives and environmental legislation. End-user customers can look to a myriad of potential alternatives that can provide both improved functionality, reduced toxicity, and greater sustainability.

Market Segmentation

The United States aminoethylethanolamine market share is classified into grade and application.

- The 99% segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States aminoethylethanolamine market is segmented by grade into >99% and <99%. Among these, the >99% segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven because its high percentage can be explained by the grade type's more widespread usage across a wider variety of end-use segments. A variety of industries use aminoethylethanolamine due to its high viscosity, low vapour pressure, and versatility.

- The lubricants segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the application, the United States aminoethylethanolamine market is segmented into chelating agents, surfactants, textile additives, fabric Softeners, lubricants, and others. Among these, the lubricants segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is propelled due to its ability to increase stability, viscosity, and the properties of the final mixture. Aminoethylethanolamine is a multi-functional chemical molecule and integral to the formulation of advanced lubricants. Particularly in the automotive industry, which is a major user of lubricants and deals with increasing production and sales of vehicles.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States aminoethylethanolamine market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Huntsman International LLC

- Dow Inc

- AkzoNobel N.V.

- BASF SE

- Ashland

- Tosoh Corporation

- Sachem, Inc.

- Restek Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States aminoethylethanolamine market based on the following segments:

United States Aminoethylethanolamine Market, By Grade

- >99%

- <99%

United States Aminoethylethanolamine Market, By Application

- Chelating Agents

- Surfactants

- Textile Additives

- Fabric Softeners

- Lubricants

- Others

Need help to buy this report?