United States Amines Market Size, Share, and COVID-19 Impact Analysis, By Product (Ethanolamine Fatty Amines, Alkyl Amines, and Others), By Application (Crop Protection, Surfactants, Water Treatment, Personal Care, Gas Treatment, and Others), and United States Amines Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsUnited States Amines Market Insights Forecasts to 2035

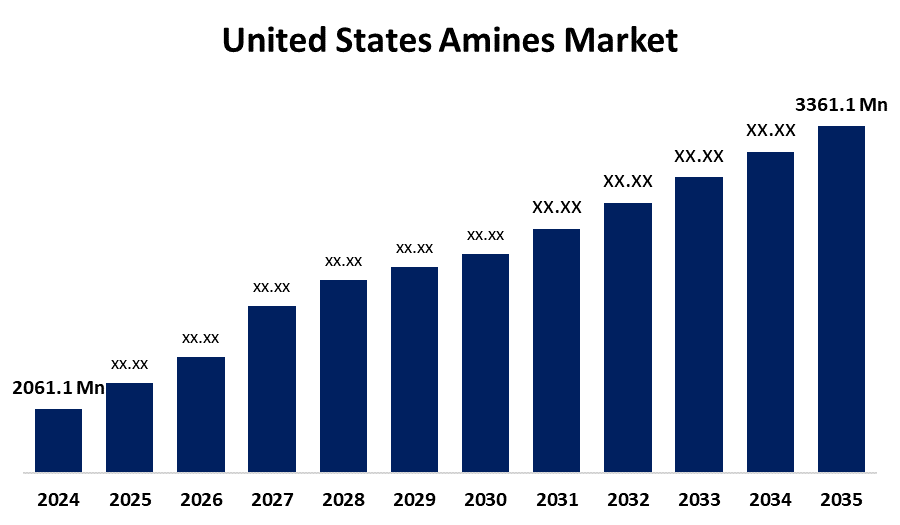

- The US Amines Market Size Was Estimated at USD 2061.1 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.55% from 2025 to 2035

- The US Amines Market Size is Expected to Reach USD 3361.1 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The United States Amines Market Size is anticipated to reach USD 3361.1 Million by 2035, growing at a CAGR of 4.55% from 2025 to 2035. The expansion of the United States amines market is propelled by the growing demand for surfactants as well as heightened public consciousness regarding food safety and health.

Market Overview

Amines are a type of organic compound that are made from ammonia (NH3) and have alkyl or aryl groups in place of one or more hydrogen atoms. The synthesis of surfactants frequently uses amines, especially fatty and ethanolamines. The market should benefit from the expansion of surfactants used in manufacturing across a variety of industries throughout the projected period. During the forecast period, the detergents market in the United States is expected to grow as increased hygiene awareness leads to increased demand for detergents. In chemical operations, specialty products are often used as additives, catalysts, and intermediates and play an important part in changing selectivity and improving kinetics in chemical reactions, as well as in petrochemical, agrochemical, and pharmaceutical applications. As these industries expand, they will increasingly demand highly specialized amines that meet specific chemical needs. The healthcare industry is a growing driver of demand for special amines as they are key components of pharmaceuticals, which enable the manufacture of valuable medicines and therapies that save lives.

The U.S. government has vigorously strengthened regulation and support frameworks for the amines industry through the Environmental Protection Agency (EPA) and related water infrastructure projects under the Toxic Substances Control Act (TSCA).

Report Coverage

This research report categorizes the market for the United States amines market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States amines market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States amines market.

United States Amines Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 2061.1 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 4.55% |

| 2035 Value Projection: | USD 3361.1 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 167 |

| Tables, Charts & Figures: | 101 |

| Segments covered: | By Product and By Application |

| Companies covered:: | Celanese Corp Class A, Eastman Chemical Co, Huntsman Corp, Dow Inc, GFS Chemicals, Arkema S.A, Solvay S.A, INEOS Group, DuPont, Tosoh Corporation, and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the United States amines market is boosted by the incremental demand from the personal care segment. In the personal care industry, the compound is primarily used in moisturizers and creams, whereas the ammonia compound serves as an emulsifier and foaming agent, and its consumption is anticipated to grow. The consumption of amine products is also estimated to be driven by the higher demand for personal hygiene and self-care products, which will significantly affect " the amines market share over the next few years.

Restraining Factors

The United States amines market faces obstacles as there are many requirements set by the government for the use of products in many sectors, and the government has strict regulations in place for product consumption to protect consumers and employees, as improper use of amine can lead to serious health issues.

Market Segmentation

The United States amines market share is classified into product and application.

- The ethanolamine fatty amines segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States amines market is segmented by product into ethanolamine fatty amines, alkyl amines, and others. Among these, the ethanolamine fatty amines segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven by their wide range of applications in gas treatment, textiles, corrosion inhibitors, surfactants, and personal care products. This compound has both amine (NH2) and alcohol (OH) functional groups. These materials are used in textile applications as intermediates to create emulsifiers, softeners, and textile processing chemicals.

- The surfactants segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the application, the United States amines market is segmented into crop protection, surfactants, water treatment, personal care, gas treatment, and others. Among these, the surfactants segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is propelled as it’s a large part to the extensive use of surfactants in agrochemicals, oil and gas, personal care, and domestic cleaning, which have significantly contributed to the segment's dominance, surfactants are key ingredients in shampoos, soaps, detergents, and other cleaning products to remove oil and grime from surfaces.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States amines market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Celanese Corp Class A

- Eastman Chemical Co

- Huntsman Corp

- Dow Inc

- GFS Chemicals

- Arkema S.A

- Solvay S.A

- INEOS Group

- DuPont

- Tosoh Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States amines market based on the following segments:

United States Amines Market, By Product

- Ethanolamine Fatty Amines

- Alkyl Amines

- Others

United States Amines Market, By Application

- Crop Protection

- Surfactants

- Water Treatment

- Personal Care

- Gas Treatment

- Others

Need help to buy this report?