United States Aluminised Steel Sheet Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Hot-Dipped Aluminised Steel, Aluminised Steel with A Thin Layer, And Aluminised Steel with Additional Protective Coatings), By Application (Construction, Aerospace, HVAC, and Appliances), and United States Aluminised Steel Sheet Market Insights, Industry Trend, Forecasts to 2035

Industry: Construction & ManufacturingUnited States Aluminised Steel Sheet Market Insights Forecasts to 2035

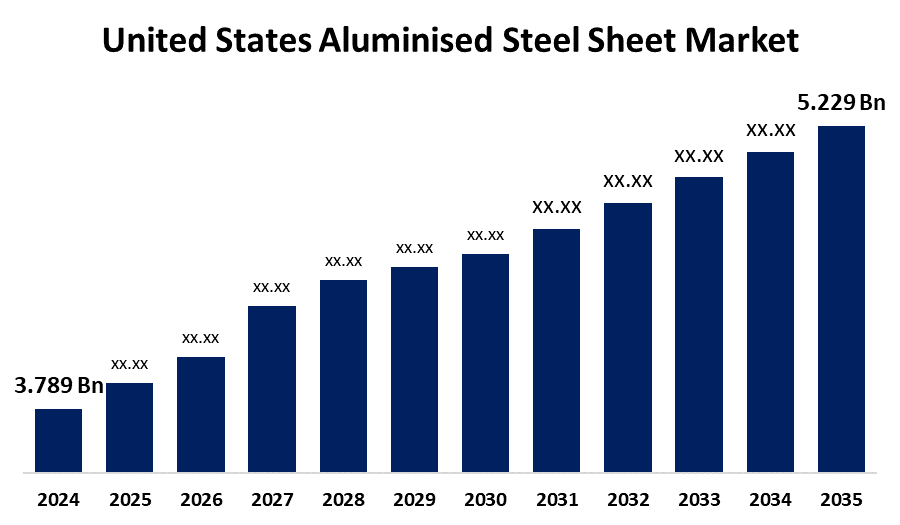

- The United States Aluminised Steel Sheet Market Size was Estimated at USD 3.789 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 2.97% from 2025 to 2035

- The United States Aluminised Steel Sheet Market Size is Expected to Reach USD 5.229 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the United States Aluminised Steel Sheet Market Size is anticipated to reach USD 5.229 Billion by 2035, Growing at a CAGR of 2.97% from 2025 to 2035. The U.S. aluminized steel sheet market grows due to rising automotive demand for lightweight, corrosion-resistant materials and expanding construction activities requiring durable roofing and cladding solutions. Strict emission regulations and the need for heat-resistant components boost usage. Additionally, increasing industrial applications and advancements in coating technologies drive market expansion and product adoption.

Market Overview

The United States aluminized steel sheet market refers to the steel sheets coated with an aluminum-silicon alloy, offering excellent corrosion resistance, heat reflectivity, and durability. These sheets are widely used in automotive exhaust systems, construction roofing, home appliances, and industrial applications. The market is driven by the automotive industry’s increasing demand for lightweight, heat-resistant materials to meet stringent emission regulations and improve fuel efficiency. Additionally, rapid growth in the construction sector, particularly in roofing and cladding, fuels demand due to aluminized steel’s ability to withstand harsh environmental conditions. Strengths of this market include the material’s cost-effectiveness compared to alternatives like stainless steel, alongside its superior heat and corrosion resistance. Opportunities lie in expanding applications in emerging sectors such as renewable energy and infrastructure upgrades, where durable, weather-resistant materials are crucial. Government initiatives promoting sustainable and energy-efficient construction and automotive manufacturing indirectly support market growth through regulatory frameworks and incentives.

Report Coverage

This research report categorizes the market for the United States aluminised steel sheet market based on various segments and regions, and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States aluminised steel sheet market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States aluminised steel sheet market.

United States Aluminised Steel Sheet Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 3.789 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 2.97% |

| 2035 Value Projection: | USD 3.789 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 189 |

| Tables, Charts & Figures: | 110 |

| Companies covered:: | Ulbrich Stainless Steels & Special Metals, Inc., Marubeni-Itochu Steel America, Inc., Ampco-Pittsburgh Corporation, Kaiser Aluminum Corporation, Premium Steel Sales LLC, Hascall Steel Company, Mill Steel Company, Majestic Steel USA, Sheffield Metals, Olympic Steel, Ryerson Inc., ONeal Steel, Atlas Steel, PAC-CLAD, and Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

The automotive industry's shift toward lightweight and corrosion-resistant materials has significantly increased demand, particularly for use in exhaust systems, heat shields, and underbody components. Construction industry growth also plays a major role, with aluminized steel sheets being favored for roofing, cladding, and structural applications due to their durability and weather resistance. The rising need for energy efficiency and fire resistance in buildings further supports this trend. Additionally, the home appliance sector continues to utilize these sheets for components requiring heat and corrosion protection. Technological advancements in coating processes and increasing awareness of long-term cost savings from durable materials also contribute to the market’s positive momentum.

Restraining Factors

The recent implementation of a 50% tariff on imported steel and aluminum has significantly increased raw material costs, impacting manufacturers' profitability and product pricing. Additionally, competition from alternative materials like galvanized and stainless steel offers similar benefits at potentially lower costs, posing challenges to market growth.

Market Segmentation

The United States aluminised steel sheet market share is classified into product type and application.

- The hot-dipped aluminised steel segment held the highest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States aluminised steel sheet market is segmented by product type into hot-dipped aluminised steel, aluminised steel with a thin layer, and aluminised steel with additional protective coatings. Among these, the hot-dipped aluminised steel segment held the highest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to its superior heat and corrosion resistance, making it ideal for automotive exhausts, industrial furnaces, and appliances. Its durable aluminum-silicon coating ensures strong adhesion and protection at high temperatures.

- The appliances segment held a substantial share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States aluminised steel sheet market is segmented by application into construction, aerospace, HVAC, and appliances. Among these, the appliances segment held a substantial share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is attributed to its high demand for heat-resistant, corrosion-proof materials in products like ovens, dryers, and water heaters. Its cost-effectiveness and durability make it ideal for appliance manufacturing.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States aluminised steel sheet market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Ulbrich Stainless Steels & Special Metals, Inc.

- Marubeni-Itochu Steel America, Inc.

- Ampco-Pittsburgh Corporation

- Kaiser Aluminum Corporation

- Premium Steel Sales LLC

- Hascall Steel Company

- Mill Steel Company

- Majestic Steel USA

- Sheffield Metals

- Olympic Steel

- Ryerson Inc.

- ONeal Steel

- Atlas Steel

- PAC-CLAD

- Others

Recent Developments:

- In March 2025, Olympic Steel Inc. (Nasdaq: ZEUS), a leading national metals service center, announced the opening of a new facility in Houston, Texas, to support operations for its Action Stainless business. The location is run by Jeff Lyons, General Manager.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the USA, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the U.S. aluminised steel sheet market based on the below-mentioned segments:

United States Aluminised Steel Sheet Market, By Product Type

- Hot-Dipped Aluminised Steel

- Aluminised Steel with A Thin Layer

- Aluminised Steel with Additional Protective Coatings

United States Aluminised Steel Sheet Market, By Application

- Construction

- Aerospace

- HVAC

- Appliances

Need help to buy this report?