United States AI in Diagnostics Market Size, Share, and COVID-19 Impact Analysis, By Component (Software, Hardware, and Services), By Diagnosis (Neurology, Radiology, Cardiology, Oncology, Chest and Lung, Pathology, and Others), and United States AI in Diagnostics Market Insights, Industry Trend, Forecasts to 2035.

Industry: HealthcareUnited States AI in Diagnostics Market Insights Forecasts to 2035

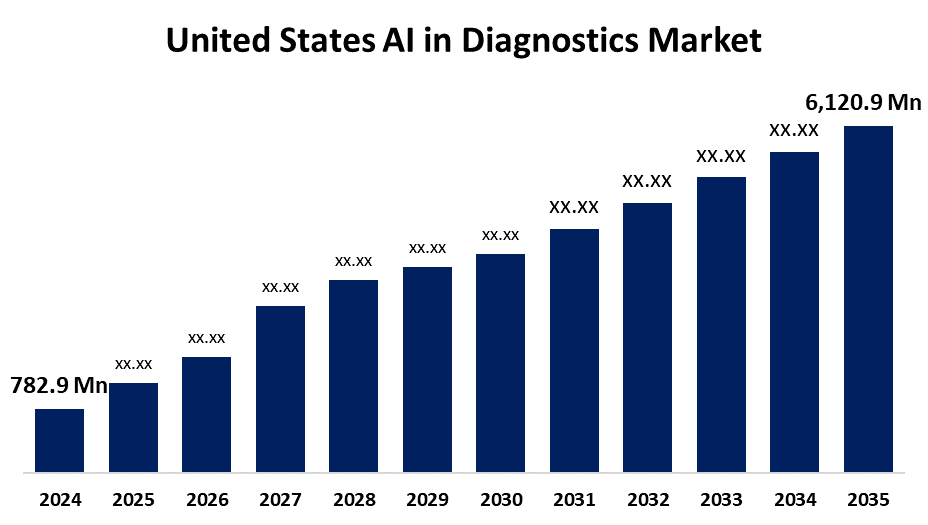

- The United States AI in Diagnostics Market Size was estimated at USD 782.9 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 20.56% from 2025 to 2035

- The United States AI in Diagnostics Market Size is Expected to Reach USD 6,120.9 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the United States AI in Diagnostics Market Size is anticipated to reach USD 6,120.9 Million by 2035, growing at a CAGR of 20.56% from 2025 to 2035. The U.S. AI-powered diagnostics market is growing due to advanced machine learning, rising chronic disease cases, and the need for faster, accurate diagnoses. Clinician shortages and burnout boost AI adoption to streamline workflows. Government support and funding also drive the integration of AI solutions, accelerating the market's rapid expansion.

Market Overview

The United States AI in diagnostics market refers to the application of artificial intelligence technologies, such as machine learning, natural language processing, and computer vision, to support and enhance medical diagnostics. These technologies assist healthcare professionals in analyzing complex data, detecting patterns, and making faster, more accurate decisions. Market growth is driven by the rising prevalence of chronic diseases, demand for early detection, and the increasing strain on healthcare systems due to workforce shortages. AI’s ability to interpret vast datasets from imaging, pathology, and genomics with speed and accuracy is a key strength, helping improve diagnostic efficiency and patient outcomes. Opportunities lie in the integration of AI with existing diagnostic tools, the push for personalized medicine, and expanding telehealth applications. Additionally, rising investments from tech companies and healthcare start-ups further fuel innovation. Government initiatives, such as funding from the National Institutes of Health (NIH) and policy support from the FDA for AI-based medical devices, are accelerating market development.

Report Coverage

This research report categorizes the market for the United States AI in diagnostics market based on various segments and regions, and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States AI in diagnostics market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States AI in diagnostics market.

United States AI in Diagnostics Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 782.9 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 20.56% |

| 2035 Value Projection: | USD 6,120.9 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Component, By Diagnosis |

| Companies covered:: | Riverain Technologies, Digital Diagnostics Inc., Microsoft Healthcare, NVIDIA Corporation, BM Watson Health, Butterfly Network, HeartFlow, Inc., Google Health, GE Healthcare, Arterys, Inc., Tempus AI, Enlitic, Inc., PathAI, Aidoc, Viz.ai, and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The increasing prevalence of chronic diseases such as cancer, diabetes, and cardiovascular conditions is driving the demand for early and accurate diagnostics. Advancements in machine learning and data analytics enable faster and more precise interpretation of medical data, improving clinical decision-making. The growing burden on healthcare systems, including clinician shortages and burnout, has accelerated the need for AI to streamline workflows and enhance efficiency. Supportive government initiatives and funding are encouraging AI adoption in healthcare. Additionally, increasing awareness of personalized medicine, integration of AI with imaging technologies, and rising investments from tech giants and healthcare start-ups further drive the market’s growth and innovation.

Restraining Factors

The United States AI in diagnostics market faces restraints such as high implementation costs, data privacy concerns, and limited interoperability with existing healthcare systems. Regulatory challenges and a shortage of skilled professionals also hinder adoption. Additionally, reliance on large datasets for training AI models raises ethical issues and potential biases, slowing wider acceptance and integration.

Market Segmentation

The United States AI in diagnostics market share is classified into component and diagnosis.

- The software segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States AI in diagnostics market is segmented by component into software, hardware, and services. Among these, the software segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is attributed to the increasing use of diagnostic software to speed up medical evaluations. These advanced tools use AI to quickly analyze large volumes of data, helping doctors make faster, more accurate decisions.

- The neurology segment held a substantial share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States AI in diagnostics market is segmented by diagnosis into neurology, radiology, cardiology, oncology, chest and lung, pathology, and others. Among these, the neurology segment held a substantial share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to the growing number of neurodegenerative disorders. AI-powered diagnostic tools play a key role by analyzing MRI and CT scans to spot even the smallest irregularities. This helps doctors detect conditions early and manage them more effectively, improving patient outcomes.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States AI in diagnostics market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Riverain Technologies

- Digital Diagnostics Inc.

- Microsoft Healthcare

- NVIDIA Corporation

- BM Watson Health

- Butterfly Network

- HeartFlow, Inc.

- Google Health

- GE Healthcare

- Arterys, Inc.

- Tempus AI

- Enlitic, Inc.

- PathAI

- Aidoc

- Viz.ai

- Others

Recent Developments:

- In May 2024, GE HealthCare (Nasdaq: GEHC) announced Revolution RT, a new radiation therapy computed tomography (CT) solution featuring innovative hardware and software designed to increase imaging accuracy and simplify the simulation workflow. The launch aimed to support a more personalized and seamless oncology care pathway experience for both clinicians and patients.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the USA, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States AI in diagnostics market based on the below-mentioned segments:

U.S. AI in Diagnostics Market, By Component

- Software

- Hardware

- Services

U.S. AI in Diagnostics Market, By Diagnosis

- Neurology

- Radiology,

- Cardiology

- Oncology

- Chest and Lung

- Pathology

- Others

Need help to buy this report?