United States Agriculture IoT Market Size, Share, and COVID-19 Impact Analysis, By Component (Hardware, Software, and Services), By Deployment (On-premise and Cloud), and United States Agriculture IoT Market Insights, Industry Trend, Forecasts to 2035

Industry: AgricultureUnited States Agriculture IoT Market Insights Forecasts to 2035

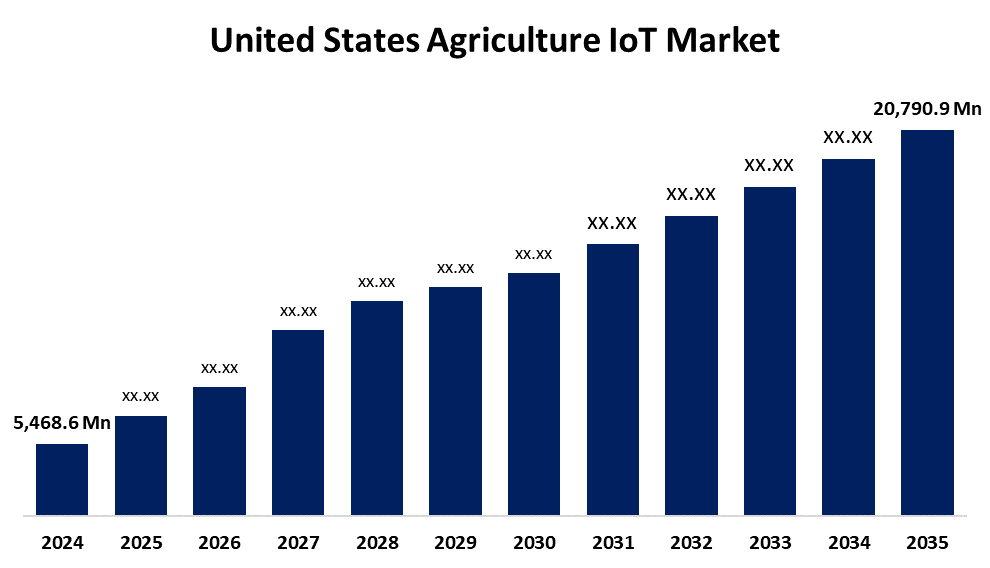

- The US Agriculture IoT Market Size Was Estimated at USD 5,468.6 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 12.91% from 2025 to 2035

- The US Agriculture IoT Market Size is Expected to Reach USD 20,790.9 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the United States Agriculture IoT Market Size is anticipated to reach USD 20,790.9 Million by 2035, Growing at a CAGR of 12.91% from 2025 to 2035. The expansion of the United States agriculture IoT market is propelled by the requirement for operational efficiency, the growing need for automation, and the development of smart farming technologies that allow for accurate crop monitoring and management.

Market Overview

The term agricultural Internet of things (IoT) represents how smart devices, sensors, and data analytics are introduced into farming methods to improve efficiency, sustainability, and productivity. IoT makes it possible for real-time monitoring, automation, and data-driven decision-making in crop and animal management by integrating connected technologies into various aspects of agriculture. In the upcoming years, there should be significant opportunities for the agriculture IoT sector as a result of the increasing integration of artificial intelligence (AI) and machine learning with IoT systems. This collaboration is expected to improve predictive analytics capabilities and allow better decision-making in farming operations. One of the most important recent advances in the agriculture IoT sector is the integration of machine learning (ML) and artificial intelligence (AI) with IoT technology. The enormous amount of data that IoT devices gather can be evaluated by AI and ML algorithms, which may offer automated decision-making and predictive insights. With this combination, farmers may maximize crop yields, improve operational efficiency, and identify issues before they become serious. Traditional farming practices are being changed by the growing use of AI and ML along with IoT, which makes agriculture more intelligent, accurate, and productive.

Due to government and programs that support the use of modern agricultural technology and promote an environment that is supportive of innovation and investment, the U.S. agriculture IoT market had a dominant position in 2024. Integration of IoT solutions will be needed due to labor shortages and rising input costs, as these technologies automate various tasks and optimize operations, allowing farmers to effectively manage challenges.

Report Coverage

This research report categorizes the market for the United States agriculture IoT market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States agriculture IoT market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States agriculture IoT market.

United States Agriculture IoT Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 5,468.6 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 12.91% |

| 2035 Value Projection: | USD 20,790.9 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 189 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Component, By Deployment, and COVID-19 Impact Analysis |

| Companies covered:: | Trimble Inc., Deere & Company, AGCO Corporation, Blue River Technology, Valmont Industries, Inc., FarmWise Labs, Topcon Positioning Systems, AgJunction, DICKEY-john, AG Leader Technology, AgEagle, and Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

The growth of the United States agriculture IoT market is fueled by the increased focus on protecting the environment and sustainability in agriculture. In addition to increasing agricultural output, precision agriculture reduces the environmental effects of farming operations by maximizing the use of inputs like water, fertilizer, and pesticides using the Internet of Things. IoT technologies support more sustainable and environmentally friendly farming methods by empowering farmers to deploy resources more effectively and keep their sights on environmental issues.

Restraining Factors

The United States agriculture IoT market faces obstacles like the demand for large initial expenditures, a lack of skilled labor, and concerns about data privacy and security. Precision farming necessitates trained personnel to operate these technologically advanced tools in addition to a significant upfront financial investment for the deployment of GPS, drones, GIS, VRT, and satellite equipment.

Market Segmentation

The United States agriculture IoT market share is classified into components and deployment.

- The hardware segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States agriculture IoT market is segmented by component into hardware, software, and services. Among these, the hardware segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segmental growth is driven by the growing need for real-time data collecting and monitoring systems that improve performance. In order to collect essential information on crop health, soil moisture, and environmental conditions, farmers utilize a variety of Internet of Things devices, such as sensors, drones, and automated machinery. This real-time monitoring enables optimal decision-making, reduces resource wastage, and enhances total yields. Advanced IoT hardware is becoming essential to farmers looking to increase efficiency and sustainability in their operations as the trend toward precision farming gains popularity.

- The on-premise segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the deployment, the United States agriculture IoT market is segmented into on-premise and cloud. Among these, the on-premise segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment growth is fueled by the significance of continuous operations and dependable data management in areas with poor internet access. On-premises deployments are vital to ensure agricultural activities continue without depending on external cloud services, as many rural and remote farms struggle with irregular or slow internet access. These methods solve privacy and data security issues by giving farmers total control over their data. In addition, real-time analysis and processing of critical agricultural data are made possible by on-premises solutions, guaranteeing that farmers can make quick choices to maximize their operations even in areas with poor connectivity.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States agriculture IoT market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Trimble Inc.

- Deere & Company

- AGCO Corporation

- Blue River Technology

- Valmont Industries, Inc.

- FarmWise Labs

- Topcon Positioning Systems

- AgJunction

- DICKEY-john

- AG Leader Technology

- AgEagle

- Others

Recent Development

- In January 2025, at CES 2025, John Deere presented new autonomous machinery to increase production in commercial landscaping, construction, and agriculture. In order to solve the severe labor shortages in these sectors, our second-generation autonomy kit incorporates cutting-edge technology, including computer vision and artificial intelligence.

- In January 2021, for harvesting operations, Raven Industries unveiled its first autonomous agricultural technology. By establishing field plans, modifying speeds, and keeping an eye on site activities, it assists farmers in keep an eye on autonomous vehicles.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States agriculture IoT market based on the following segments:

United States Agriculture IoT Market, By Component

- Hardware

- Software

- Service

United States Agriculture IoT Market, By Deployment

- On-premise

- Cloud

Need help to buy this report?