United States Agriculture Equipment Market Size, Share, and COVID-19 Impact Analysis, By Equipment Type (Agriculture Tractors, Harvesting Equipment, Irrigation & Crop Processing Equipment, Agriculture Spraying & Handling Equipment, Soil Preparation & Cultivation Equipment, and Others) and By Application (Land Development, Threshing and Harvesting, Plant Protection, and After Agro Processing), and United States Agriculture Equipment Market Insights, Industry Trend, Forecasts to 2035.

Industry: AgricultureUnited States Agriculture Equipment Market Insights Forecasts to 2035

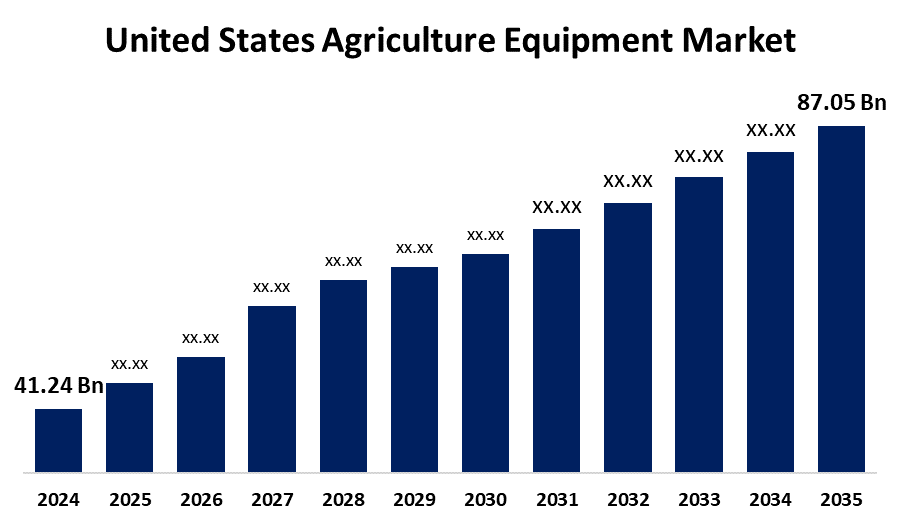

- The U.S. Agriculture Equipment Market Size was estimated at USD 41.24 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 7.03% from 2025 to 2035a

- The USA Agriculture Equipment Market Size is Expected to Reach USD 87.05 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The US Agriculture Equipment Market Size is Anticipated to reach USD 87.05 Billion By 2035, Growing at a CAGR of 7.03% from 2025 to 2035. The U.S. agriculture equipment market is growing steadily, driven by automation, precision farming, and sustainability demands, with tractors and harvesting machinery leading in adoption across large-scale farming operations.

Market Overview

The United States agriculture equipment market is a market that deals with agriculture machinery and equipment used in the United States in the farming sector. This entails various equipment that is aimed at helping in farming, including crop growth, animal husbandry, and land tillage. Moreover, new trends such as autonomous tractors, AI-based crop monitoring, regenerative farming practices, and government incentives for climate-resilient agriculture are driving distinctive growth in the U.S. farm equipment market. Moreover, increasing rural broadband penetration and data-based precision farming are unlocking demand for connected, intelligent machinery in historically underserved farming areas. Furthermore, the major players, including John Deere, AGCO, and CNH Industrial, are driving expansion by introducing innovations in electric tractors, autonomous equipment, and precision agriculture platforms. Efforts such as subscription-based software services, remote diagnostics, and tech startup partnerships are speeding digital transformation and sustainability in the U.S. agriculture equipment market.

Report Coverage

This research report categorizes the U.S. agriculture equipment market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States agriculture equipment market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the USA agriculture equipment market.

United States Agriculture Equipment Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 41.24 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 7.03% |

| 2035 Value Projection: | USD 87.05 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 230 |

| Tables, Charts & Figures: | 106 |

| Segments covered: | By Equipment Type, By Application and COVID-19 Impact Analysis |

| Companies covered:: | Deere and Company, CNH Industrial, Mahindra Agriculture North America, AGCO Corporation, KUBOTA Corporation, Farmtrac Tractor Europe, Deutz-Fahr, Claas KGaA mbH, Kuhn Group Inc., Kverneland Group, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Driving influences are the aging farm population creating increased need for labor-saving equipment, increasing farm consolidation demanding increased capacity equipment, and consumer demand for more organic and specialty crops needing specialized tools. Additionally, tax benefits for machinery improvement, unstable labor availability, and climate change effects necessitating adoption of resilient, adaptable equipment are each independently fueling long-term growth in the U.S. agriculture equipment market.

Restraining Factors

High initial costs of advanced models, growing concerns over noise and emissions from gas-powered mowers, and limited battery life in electric variants are key factors restraining the U.S. agriculture equipment market.

Market Segmentation

The United States agriculture equipment market share is classified into equipment type and end application.

- The agriculture tractors segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States agriculture equipment market is segmented by equipment type into agriculture tractors, harvesting equipment, irrigation & crop processing equipment, agriculture spraying & handling equipment, soil preparation & cultivation equipment, and others. Among these, the agriculture tractors segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to their versatility, essential role across farming operations, and continuous technological advancements. Widely used for plowing, planting, and towing, tractors remain a core investment for farmers, supported by strong demand for high-horsepower and precision farming-compatible models.

- The threshing and harvesting segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States agriculture equipment market is segmented by application into land development, threshing and harvesting, plant protection, and after agro processing. Among these, the threshing and harvesting segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is driven by the need for high-efficiency machinery to manage large-scale crop operations. Increased adoption of combine harvesters and mechanized solutions helps reduce labor dependency, improve productivity, and support timely harvesting across major crops like corn, wheat, and soybeans.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the US agriculture equipment market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Deere and Company

- CNH Industrial

- Mahindra Agriculture North America

- AGCO Corporation

- KUBOTA Corporation

- Farmtrac Tractor Europe

- Deutz-Fahr

- Claas KGaA mbH

- Kuhn Group Inc.

- Kverneland Group

- Others

Recent Developments:

- In April 2023, Oxbo, the leader in specialty harvesting and controlled application equipment, has effectively acquired the full product line of Westside Equipment Company, including all its products and United States facilities.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the USA agriculture equipment market based on the below-mentioned segments

United States Agriculture Equipment Market, By Equipment Type

- Agriculture Tractors

- Harvesting Equipment

- Irrigation & Crop Processing Equipment

- Agriculture Spraying & Handling Equipment

- Soil Preparation & Cultivation Equipment

- Others

United States Agriculture Equipment Market, By Application

- Land Development

- Threshing and Harvesting

- Plant Protection

After Agro Processing

Need help to buy this report?