United States Agriculture Drones Market Size, Share, and COVID-19 Impact Analysis, By Type (Fixed Wing, and Rotary Wing), By Component (Hardware, Software, and Services), By Farming Environment (Indoor, and Outdoor), and United States Agriculture Drones Market Insights, Industry Trend, Forecasts to 2035

Industry: AgricultureUnited States Agriculture Drones Market Insights Forecasts to 2035

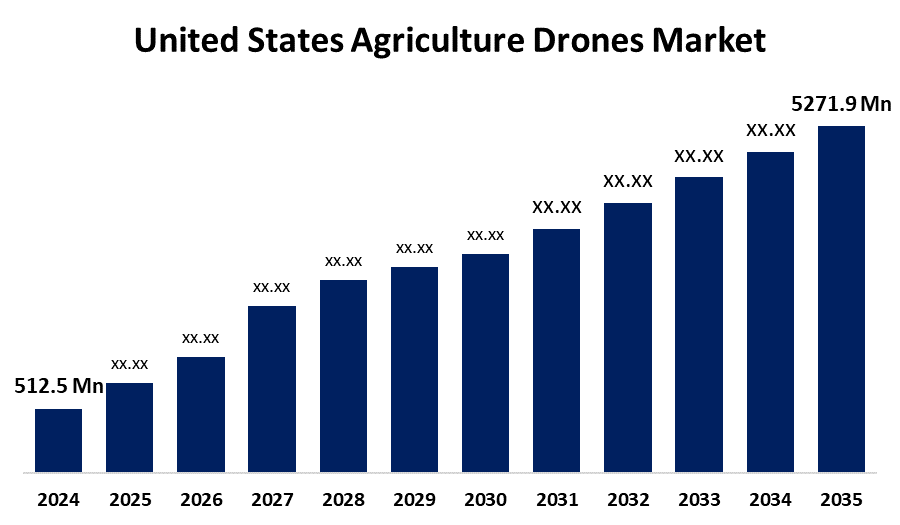

- The US Agriculture Drones Market Size Was Estimated at USD 512.5 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 23.60% from 2025 to 2035

- The US Agriculture Drones Market Size is Expected to Reach USD 5271.9 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The United States Agriculture Drones Market Size is anticipated to reach USD 5271.9 Million by 2035, growing at a CAGR of 23.60% from 2025 to 2035. The expansion of the United States' agriculture drone market is propelled by the increasing demand for precision farming. The use of resources like water, fertilizer, and pesticides is reduced while crop yields are maximized through precision farming techniques.

Market Overview

An agriculture drone is a type of unmanned aerial vehicle (UAV) that helps farmers with a variety of agricultural chores, including mapping fields, monitoring crops, applying fertilizer, and assessing soil health. Farmers may collect detailed information on crop health, soil conditions, and moisture levels using drones outfitted with high-resolution cameras, multispectral sensors, and GPS technology. Drones and other precision farming solutions are becoming more and more in demand as the agricultural sector is under pressure to become more sustainable and efficient. Further market innovation is also fueled by the growth of AI-powered and autonomous drones. Artificial intelligence (AI) enabled autonomous drones can complete more difficult jobs with little help from humans. These drones can accurately administer pesticides or fertilizers, autonomously traverse fields, and detect problems with crop health. Drones with AI capabilities can also process and evaluate enormous volumes of data in real time, enabling farmers to make accurate and quick decisions. Large-scale farms that need constant monitoring and quick reactions to shifting field conditions will find this capability especially useful.

Government support, smaller farmers who would not have the funds to engage in drone technology, are finding it easier to enter the market. For instance, in October 2024, the U.S. Department of Agriculture (USDA) announced up to USD 7.7 Billion in aid for fiscal year 2025 to support agricultural and forestry producers in implementing conservation practices on working lands. This amount is more than twice as much as 2023 and is the greatest amount of conservation funds ever given to USDA conservation programs in U.S. history. While providing crucial conservation and operational benefits, such as increased soil productivity, cleaner water and air, healthier wildlife habitats, improved connectivity, and the preservation of natural resources for future generations, the funding aim is to maximize climate benefits across the country.

Report Coverage

This research report categorizes the market for the United States agriculture drones market based on various segments and regions, and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States agriculture drones market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States agriculture drones market.

United States Agriculture Drones Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 512.5 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 23.60% |

| 2035 Value Projection: | USD 5271.9 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 246 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Type, By Component and By Farming Environment |

| Companies covered:: | Sanofi, GlaxoSmithKline (GSK), Boehringer Ingelheim, Teva Pharmaceutical Industries Ltd., AstraZeneca, Novartis, Roche, Merck & Co., Inc., Laboratoires Expanscience, Mylan (part of Viatris), and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the United States agriculture drone market is fueled by population expansion and concerns about food security. The U.S. agriculture industry is under increasing pressure to produce high-yield crops. Farmers, therefore, search for methods to increase agricultural yields without using more land. By giving farmers accurate, useful information that helps them improve their planting and fertilization techniques, drones play a critical role in raising agricultural yields. Drones help farmers in taking immediate corrective measures by detecting issues in fields early on, such as pest infestations or nutrient deficits, which improves crop health and productivity. One of the main factors promoting drone use in the US agriculture business is the demand for increased crop yields.

Restraining Factors

The United States agriculture drones market faces obstacles like one major obstacle to the broad adoption of these drones is the high initial costs of purchase and maintenance. Because they can be costly, advanced drones with complex sensors and imaging capabilities are out of reach for small and medium-sized farmers.

Market Segmentation

The United States Agriculture Drone Market share is classified into type, component, and farming environment.

- The rotary wing segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States agriculture drones market is segmented by type into fixed-wing and rotary-wing. Among these, the rotary wing segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven by the rising acceptance of precision irrigation. As the importance of water scarcity increases, many farmers are prioritizing effective water management. Drones with thermal imaging sensors measure the moisture content of the soil and identify spots that need watering. Farmers can apply water only where necessary due to drones' precise data, which reduces waste and conserves resources. This specific strategy reduces expenses and supports sustainable water management techniques, which are in line with more general environmental objectives.

- The hardware segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the component, the United States agriculture drone market is segmented into hardware, software, and services. Among these, the hardware segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment growth is fueled by the growth of vertical integration in the agriculture industry. Drones with innovative electronics are essential for tracking agricultural processes from farm to table as farmers, processors, and retailers look to improve traceability and optimize their supply chains. Drones check supply chain operations, track agricultural development, and make sure food safety regulations are being fulfilled. The demand for advanced drone technology that can provide accurate information along the supply chain is driven by the requirement for end-to-end visibility in agriculture.

- The outdoor segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the farming environment, the United States agriculture drones market is segmented into indoor and outdoor. Among these, the outdoor segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment growth is fueled by the growth of cooperative groups and agribusinesses offering drone services. Many farmers might search for outside vendors who specialize in agricultural drone applications because they lack the tools or knowledge necessary to operate drones efficiently. With the help of these service providers, farmers may utilize modern technology without having to make large investments in equipment or training. Their solutions include precision spraying, crop monitoring, and aerial images. As more farmers look to outside professionals to improve their operations, the availability of these services is propelling the outdoor farming market's expansion.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States Agriculture Drones market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Sanofi

- GlaxoSmithKline (GSK)

- Boehringer Ingelheim

- Teva Pharmaceutical Industries Ltd.

- AstraZeneca

- Novartis

- Roche

- Merck & Co., Inc.

- Laboratoires Expanscience

- Mylan (part of Viatris)

- Others

Recent Developments:

- In September 2024, at INTERGEO 2024, Trimble Inc. announced the release of its new Trimble APX RTX line of direct georeferencing products designed for UAV mapping. This cutting-edge portfolio, which incorporates Trimble CenterPoint RTX technology, improves productivity and usability for original equipment makers and drone payload integrators by enabling centimetre-level accuracy without the requirement for base stations.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States agriculture drones market based on the following segments:

United States Agriculture Drones Market, By Type

- Fixed Wing

- Rotary Wing

United States Agriculture Drones Market, By Component

- Hardware

- Software

- Services

United States Agriculture Drones Market, By Farming Environment

- Indoor

- Outdoor

Need help to buy this report?