United States Agriculture Analytics Market Size, Share, and COVID-19 Impact Analysis, By Offering (Solutions and Services), By Application (Precision Farming, Livestock Farming, Aquaculture Farming, and Other), By Field Size (Small, Medium, and Large), and United States Agriculture Analytics Market Insights, Industry Trend, Forecasts to 2035

Industry: AgricultureUnited States Agriculture Analytics Market Insights Forecasts to 2035

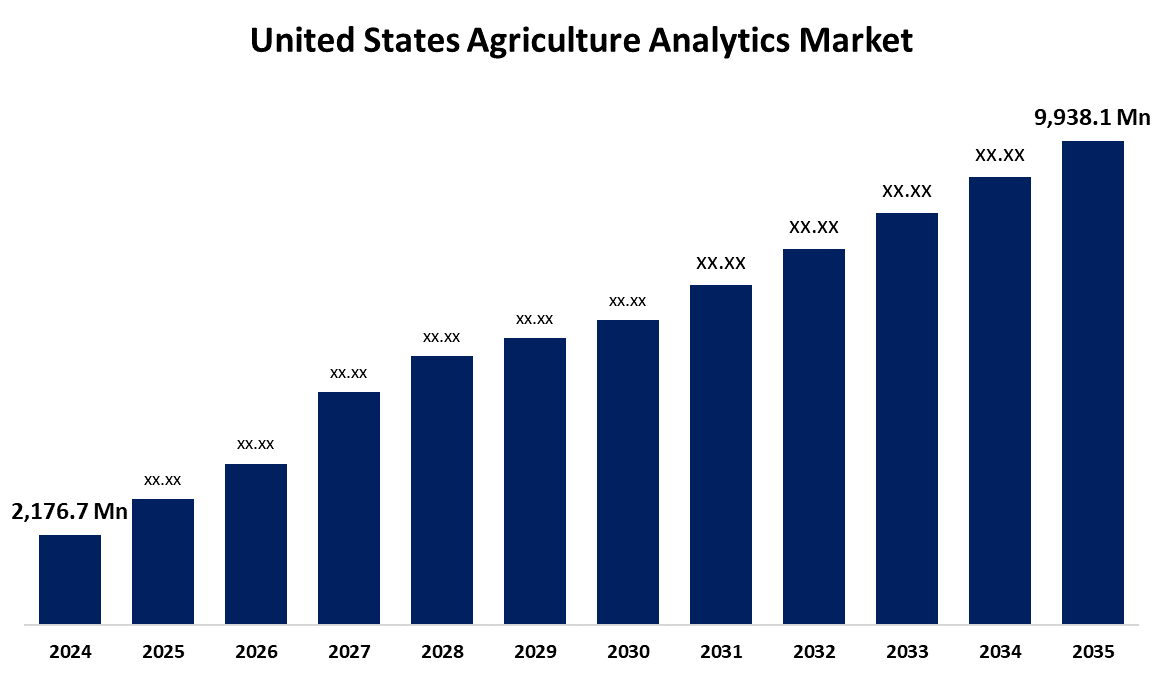

- The US Agriculture Analytics Market Size Was Estimated at USD 2,176.7 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 14.80% from 2025 to 2035

- The US Agriculture Analytics Market Size is Expected to Reach USD 9,938.1 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the United States Agriculture Analytics Market Size is Anticipated to Reach USD 9,938.1 Million by 2035, Growing at a CAGR of 14.80% from 2025 to 2035. The expansion of the United States agriculture analytics market is propelled by the growing application of machine learning (ML) and predictive analytics in this field. Because of these cutting-edge technologies, farmers are using previous and current data to predict future results.

Market Overview

The systematic application of data analysis to improve farming methods, boost production, and advance sustainability is known as agriculture analytics. Farmers are able to assess real-time data on crops, weather, moisture, soil, and many other topics due to the emergence of analytics in the agriculture and farming industry. Also, it assists in the organization of the production and post-harvesting operations plan. Furthermore, by optimizing farming performance in response to events, weather, or disease outbreaks, the use of big data analytics assists farmers in uncovering new agricultural opportunities. Precision farming, which is successfully developed by the application of statistical analysis of data in the agriculture sector, will help farmers save time and money while simultaneously enhancing crop output. After collecting several field crop images and using sensors to reduce crop spoiling and food-borne diseases, analytics in the farming industry make it easier to produce helpful data and reports. The US market for efficient analysis and decision-making systems associated with farm-related concerns is expanding as a result of the increased focus on boosting agribusiness profitability. Crop production depends on several factors, including soil type, condition, fertilizers, application, climatic conditions, and seed type. The United States Department of Agriculture (USDA) reported in an article that more than 60,000 farms, including more than 25 million acres of active farmland, are using climate-smart production strategies. The techniques include forestry and grazing management, nitrogen management, cover crops, and no-till farming.

In the 2024 farm bill, the U.S. government expanded financing to support digital agricultural methods by investing $850 million in rural digital infrastructure. The agriculture innovation agenda, which the USDA has also put into effect, aims to increase food production by 40% through technology while reducing farming-related carbon emissions by 10% by 2025. More than 7,00,000 farmers benefited in 2024 from government-funded training programs that emphasized digital technologies and smart farming, which may save $2 billion a year by increasing productivity.

Report Coverage

This research report categorizes the market for the United States agriculture analytics market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States agriculture analytics market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States agriculture analytics market.

United States Agriculture Analytics Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 2,176.7 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 14.80% |

| 2035 Value Projection: | USD 9,938.1 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 160 |

| Tables, Charts & Figures: | 130 |

| Segments covered: | By Offering, By Application, By Field Size and COVID-19 Impact Analysis. |

| Companies covered:: | Trimble Inc., Xylem Inc., Iteris Inc., PrecisionHawk, IBM Corporation, Deere & Company, Oracle Corporation, Conservis Corporation, DTN, SAS Institute and Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis |

Get more details on this report -

Driving Factors

The growth of the United States agriculture analytics market is fueled by the sustainable agriculture dependence on how efficiently resources are used on the farm. Agricultural analytics solutions can help farmers maximize and utilize their resources. To take advantage of that reporting, it is often useful for farmers to combine data from multiple systems, including weather stations, the field, and equipment sensors. The availability of these data points allows the farmer to make intelligent resource distribution decisions using advanced statistical tools. For example, a farmer can analyze the weather data and field sensor soil moisture data and make the best watering plan for their crops. In this case, they can reduce water consumption while ensuring their crops get an adequate amount of moisture.

Restraining Factors

The United States Agriculture analytics market faces obstacles, such as the significant initial costs associated with implementing precision farming technology, which typically range from $50,000 to $100,000 per farm, often inhibiting the adoption of agriculture analytics in the United States.

Market Segmentation

The United States agriculture analytics market share is classified into offering, application, and field size.

- The solutions segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States agriculture analytics market is segmented by offering into solutions and services. Among these, the solutions segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven by the increasing demand for user-friendly, mobile-compatible solutions. Farmers are seeking more and more solutions that offer real-time information through user-friendly interfaces that are available on tablets and smartphones. Farmers may manage equipment performance, keep updated on field conditions, and analyze crop health using these mobile applications. These solutions' accessible layouts make it simpler for farmers to use analytics tools without requiring a lot of technical skill. Mobile and user-friendly solutions are contributing to the expansion of agriculture analytics across all farm sizes and locations by improving the data collection and analysis process.

- The precision farming segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the application, the United States agriculture analytics market is segmented into precision farming, livestock farming, aquaculture farming, and others. Among these, the precision farming segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment growth is fueled by variable rate technology (VRT) and precision fertilization, which are becoming increasingly common in the precision farming market. Depending on the soil and crop conditions, VRT enables farmers to use fertilizers and other inputs at various rates over various parts of a field. By guaranteeing that inputs are used more effectively, this approach lowers expenses and its impact on the environment. In order to analyze field data and calculate the best rates for applying pesticides, fertilizers, and herbicides, analytics platforms are essential. The demand for analytics tools that expand precision fertilization is being driven by growing awareness of the advantages of VRT in increasing agricultural yields and resource efficiency. Precision farming technology in 2021 increased farmers' output by 4%, reduced fertilizer uses by 7%, dropped herbicide applications by 9%, reduced the use of fossil fuels by 6%, and reduced water use by 4%, according to the Association of Equipment Manufacturers.

- The large segment held the highest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States agriculture analytics market is segmented by field size into small, medium, and large. Among these, the large segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is being fueled by the growing investment and adoption of IoT-farm management systems. IoT devices, such as soil sensors, weather stations, and moisture probes, are deployed over wide fields to provide real-time data on environmental conditions. These devices are wirelessly connected to agricultural analytics systems that receive and analyze the data to provide recommendations on when to fertilize, irrigate, or harvest crops. Where manual monitoring would be impossible, IoT technologies provide a scalable solution for efficient management of resources. More large-scale farms are using IoT technology to enhance field management by collecting real-time information as their cost and capabilities reduce.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States agriculture analytics market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Trimble Inc.

- Xylem Inc.

- Iteris Inc.

- PrecisionHawk

- IBM Corporation

- Deere & Company

- Oracle Corporation

- Conservis Corporation

- DTN

- SAS Institute

- Others

Recent Development

- In March 2023, IBM and The Climate Corporation, a Monsanto subsidiary, announced their collaboration to create and sell a new agriculture analytics product. The system will gather and analyze data from a range of sources, such as weather, soil, and crop data, using IBM's Watson IoT platform. Farmers will be able to make better crop management decisions with the use of the data.

- In January 2023, Nutrien Ag Solutions and John Deere collaborated on digital connectivity. By streamlining logistics and facilitating the smooth transfer of variable rate agronomic suggestions to their equipment for implementation, this link helps both businesses provide growers with superior services.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States Agriculture Analytics market based on the following segments:

United States Agriculture Analytics Market, By Offering

- Solutions

- Service

United States Agriculture Analytics Market, By Application

- Precision Farming

- Livestock Farming

- Aquaculture Farming

- Other

United States Agriculture Analytics Market, By Field Size

- Small

- Medium

- Large

Need help to buy this report?