United States Agricultural Lubricants Market Size, Share, and COVID-19 Impact Analysis, By Product (Engine Oil, UTTO, Coolant, and Grease), By Type (Mineral Oil-Based, Synthetic Oil-Based, and Bio-Based), and United States Agricultural Lubricants Market Insights, Industry Trend, Forecasts to 2035

Industry: AgricultureUnited States Agricultural Lubricants Market Insights Forecasts to 2035

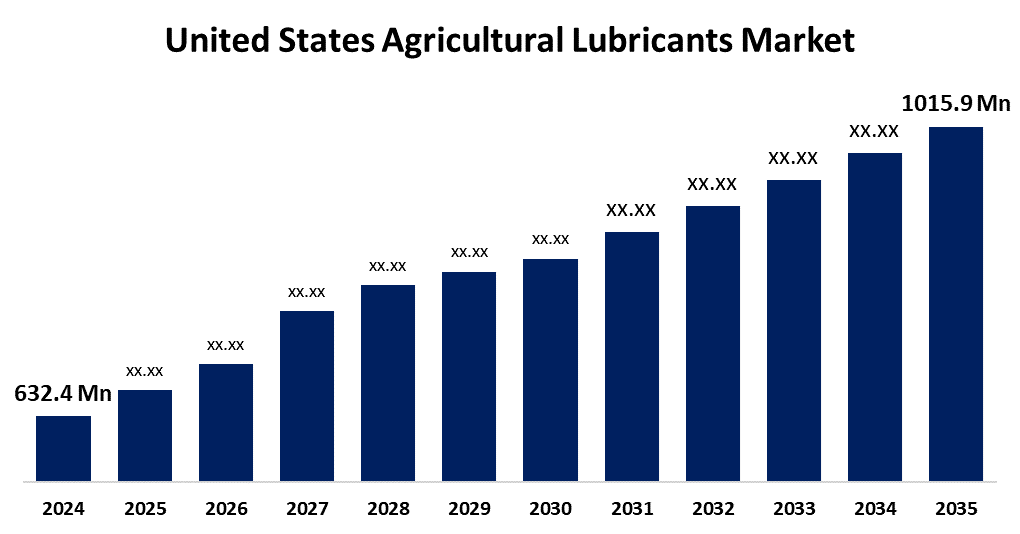

- The US Agricultural Lubricants Market Size Was Estimated at USD 632.4 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.40% from 2025 to 2035

- The US Agricultural Lubricants Market Size is Expected to Reach USD 1015.9 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the United States Agricultural Lubricants Market Size is anticipated to reach USD 1015.9 Million by 2035, Growing at a CAGR of 4.40% from 2025 to 2035. The expansion of the United States Agricultural Lubricants market is propelled by the growing demand to increase agricultural output. Using high-performance lubricants in tractors, harvesters, and other equipment has become crucial as farms grow increasingly mechanized in order to ensure smooth operation, minimize wear and tear, and improve fuel efficiency.

Market Overview

Specialized oils and greases called agricultural lubricants are used to protect and lubricate machinery and equipment in the agricultural industry. Agricultural lubricants allow agricultural machinery to operate in extreme conditions such as high temperatures, high humidity, and continuous usage by minimizing friction and wear. Farmers and agricultural companies are increasingly turning to lubricants with high-performance specifications that regard sustainability. In response to sustainability goals, biodegradable and environmentally conscious oils are becoming more widely used due to the negative impact on the environment from agricultural activities. The demand for agricultural lubricants is expected to increase with more scrutiny placed on soil and water contamination compliance, which will benefit the agricultural lubricants sector as well. Agricultural lubricants in the US are poised for growth with greater mechanization, resulting in agricultural lubricants being developed for a variety of uses. Regulatory reform and changing consumer preferences related to the environment are forcing the industry into long-term, bio-based solutions, which will lead to innovation and opportunities for the development of environmentally friendly products. Additionally, improving the productivity of advanced agricultural machines using specialized agricultural practices for high-quality demonstration lubricants increases the growth potential of the market. Market growth is related to improvements in the agricultural industry. More advanced and more specialized products have caused the demand for innovative agricultural technologies to grow.

In the United States, government programs often provide farmers with loans to buy tractors, harvesters, sprayers, and other equipment. As machinery use grows, the need for lubricants for these machines also increases.

Report Coverage

This research report categorizes the market for the United States agricultural lubricants market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States agricultural lubricants market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States agricultural lubricants market.

United States Agricultural Lubricants Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 632.4 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 4.40% |

| 2035 Value Projection: | USD 1015.9 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 187 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product, By Type, and COVID-19 Impact Analysis |

| Companies covered:: | Chevron Corporation, Exxon Mobil Corporation, Frontier Performance Lubricants, Inc., Phillips 66, Valvoline, AMSOIL, Quaker Chemical Corp., and Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

The growth of the United States agricultural lubricants market is fueled by resistance to high temperatures, large loads, and various environmental factors. These lubricants improve the life of essential parts, improve machine efficiency, decrease shutdowns, and boost adoption in the agricultural industry. Another significant factor is the switch to biodegradable and sustainable lubricants, which is being driven by strict rules and growing environmental concerns. Permanent lubricating solutions that lower emissions and reduce pollution of soil and water are rapidly chosen by farmers and equipment makers. This tendency promotes innovation in plant-based and biodegradable lubricants, which extends market expansion.

Restraining Factors

The agricultural lubricants market in the United States is hampered by some challenges, such as the fluctuating price of base oils and additives, which ultimately impact production costs. Increases in raw material prices could lead to increased lubricant costs, negatively affecting the profit margins of manufacturers. While these lubricants provide enhanced performance and environmental benefits, the high cost could limit commercialization, particularly among small farmers and price-sensitive consumers.

Market Segmentation

The United States agricultural lubricants market share is classified into product and type.

- The engine oil segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States agricultural lubricants market is segmented by product into engine oil, UTTO, coolant, and grease. Among these, the engine oil segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segmental growth is driven by guaranteeing outstanding engine performance, minimizing wear and tear, and improving fuel efficiency are necessary for tractors, harvesters, and other farm machinery. Engine oils are being created specifically to satisfy the demands of these high-performance engines as agricultural machinery grows increasingly complex with cutting-edge technology, which is helping to propel the market's expansion.

- The mineral oil-based segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the type, the United States agricultural lubricants market is segmented into mineral oil-based, synthetic oil-based, and bio-based. Among these, the mineral oil-based segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment growth is fueled by their efficiency and broad availability. For common agricultural equipment, they operate dependably, but they might need to be replaced more frequently than synthetic substitutes.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States agricultural lubricants market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Chevron Corporation

- Exxon Mobil Corporation

- Frontier Performance Lubricants, Inc.

- Phillips 66

- Valvoline

- AMSOIL

- Quaker Chemical Corp.

- Others

Recent Development

- In June 2024, Aerospace Lubricants was purchased by AMSOIL Inc., a synthetic lubricant company with headquarters in the United States. Through this acquisition, AMSOIL's current product portfolio is complemented by its increased capacity to produce specialty lubricants for the aerospace sector.

- In June 2022, Chevron Corporation was involved in the lubricants industry; most notably, it purchased Renewable Energy Group, an Ames, Iowa-based biodiesel production company. Chevron's plan to diversify its energy portfolio and improve its standing in the renewable energy market is in line with this acquisition.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States Agricultural Lubricants market based on the following segments:

United States Agricultural Lubricants Market, By Product

- Engine Oil

- UTTO

- Coolant

- Grease

United States Agricultural Lubricants Market, By Type

- Mineral Oil-Based

- Synthetic Oil-Based

- Bio-Based

Need help to buy this report?