United States Agricultural Biotechnology Market Size, Share, and COVID-19 Impact Analysis, By Organism (Plants, Animals, and Microbes), By Application (Vaccine Development, Flower Culturing, Biofuels, Transgenic Crops & Animals, Antibiotic Development, and Nutritional Supplements), and United States Agricultural Biotechnology Market Insights, Industry Trend, Forecasts to 2035

Industry: AgricultureUnited States Agricultural Biotechnology Market Insights Forecasts to 2035

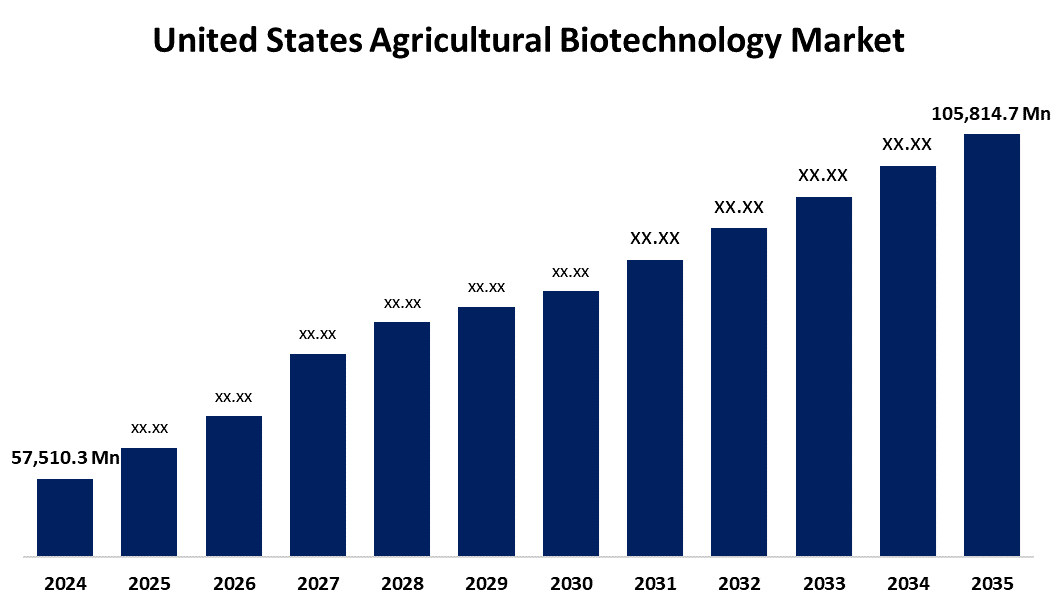

- The US Agricultural Biotechnology Market Size Was Estimated at USD 57,510.3 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.70% from 2025 to 2035

- The US Agricultural Biotechnology Market Size is Expected to Reach USD 105,814.7 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the United States Agricultural Biotechnology Market Size is anticipated to reach USD 105,814.7 Million by 2035, Growing at a CAGR of 5.70% from 2025 to 2035. The expansion of the United States Agricultural Biotechnology market is propelled by the development of gene editing technologies like CRISPR-Cas9, which greatly improve crop yields by making crops resistant to environmental stress and pests. The industry is also growing as a result of the growing demand for environmentally friendly farming methods and less chemical use.

Market Overview

Agricultural biotechnology is the application of scientific techniques to modify and enhance microorganisms, plants, and animals for use in agriculture. To increase agricultural productivity, resistance to pests and diseases, and environmental adaptability, it uses technologies like as tissue culture, genetic engineering, and molecular markers. The increased production of biotech crops, along with significant investment in agricultural research and development, has made the agricultural biotechnology market one of the fastest-growing sectors. Agricultural biotechnology is essential for making plants more resilient to diseases and adverse environmental conditions. Additionally, it is increasing the productivity of agriculture. Because more biotech crops are being grown in the US, there is a growing need for agricultural biotechnology. This factor is anticipated to support the market expansion for nanobiotechnology. When it comes to the broad domain of biotech plant agriculture, the United States is a leading region. The US planted 72.9 million hectares of biotech crops in 2016, up from 70.9 million hectares in 2015, according to the International Service for the Acquisition of Agri-biotech Applications. Throughout the projected period, the market's expansion will be encouraged by the growing cultivation of biotech plants.

The U.S. government is a strong supporter of biotech innovations, providing USD 7.5 million to the Agricultural Biotechnology Education and Outreach Initiative (U.S. Food and Drug Administration, July 2024 article). Through its collaboration with the Environmental Protection Agency (EPA) and the U.S. Department of Agriculture (USDA), the FDA brings out a number of initiatives that focus on increasing visible knowledge and comprehension of agricultural biotechnology, particularly as it relates to genetically modified food and animal feed ingredients. Such programs show a region's attention to educating its people and promoting biotech solutions in agriculture.

Report Coverage

This research report categorizes the market for United States agricultural biotechnology market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States agricultural biotechnology market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States agricultural biotechnology market.

United States Agricultural Biotechnology Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 57,510.3 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 5.70% |

| 2035 Value Projection: | USD 105,814.7 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 178 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Organism, By Application, and COVID-19 Impact Analysis |

| Companies covered:: | FMC Corporation, Corteva, DuPont, Valent BioSciences LLC, AgBiome, Inc., Arcadia Biosciences, Benson Hill, Corteva Inc, and Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

The growth of the United States agricultural biotechnology market is fueled by enhanced properties, including high yield, high nutritional content, and increased food-processing capabilities. Genetic modification is increasing the productivity of feed and food crops. Some of the key factors propelling the agricultural biotechnology market are the requirement for pest resistance for specific plants, an increase in outbreaks of insects in agricultural produce, and growing awareness of superior quality farm produce.

Restraining Factors

The United States agricultural biotechnology market faces obstacles related to agriculture and intellectual property rights, which include patents and seed rights. Large firms' patents make it extremely difficult for start-ups or medium-sized businesses to enter the market, which restricts total innovation and slows down the growth of the sector.

Market Segmentation

The United States agricultural biotechnology market share is classified into organism and application.

- The plants segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States agricultural biotechnology market is segmented by organism into plants, animals, and microbes. Among these, the plants segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The growing demand for crops with better attributes, such as higher yield, pest resistance, and nutritional value, is fueling the segment's rise. Furthermore, biotechnology provides innovative methods to create durable plant varieties as farmers deal with issues like soil erosion and climate change. Additionally, the market is expanding due to the growing customer preference for organic and sustainable farming methods, leading to the use of genetically modified crops that use fewer chemicals.

- The transgenic crops & animals segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the application, the United States agricultural biotechnology market is segmented into vaccine development, flower culturing, biofuels, transgenic crops & animals, antibiotic development, and nutritional supplements. Among these, the transgenic crops & animals segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment growth is fueled by their efficiency and broad availability. They work reliably for ordinary agricultural equipment, but they may require more frequent replacements than synthetic alternatives.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States agricultural biotechnology market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- FMC Corporation

- Corteva

- DuPont

- Valent BioSciences LLC

- AgBiome, Inc.

- Arcadia Biosciences

- Benson Hill

- Corteva Inc

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States agricultural biotechnology market based on the following segments:

United States Agricultural Biotechnology Market, By Organism

- Plants

- Animals

- Microbes

United States Agricultural Biotechnology Market, By Application

- Vaccine Development

- Flower Culturing

- Biofuels

- Transgenic Crops & Animals

- Antibiotic Development

- Nutritional Supplements

Need help to buy this report?