United States Agricultural Adjuvants Market Size, Share, and COVID-19 Impact Analysis, By Product (Activator Adjuvants and Utility Adjuvants), By Application (Herbicides, Insecticides, Fungicides, and Others), and United States Agricultural Adjuvants Market Insights, Industry Trend, Forecasts to 2035

Industry: AgricultureUnited States Agricultural Adjuvants Market Insights Forecasts to 2035

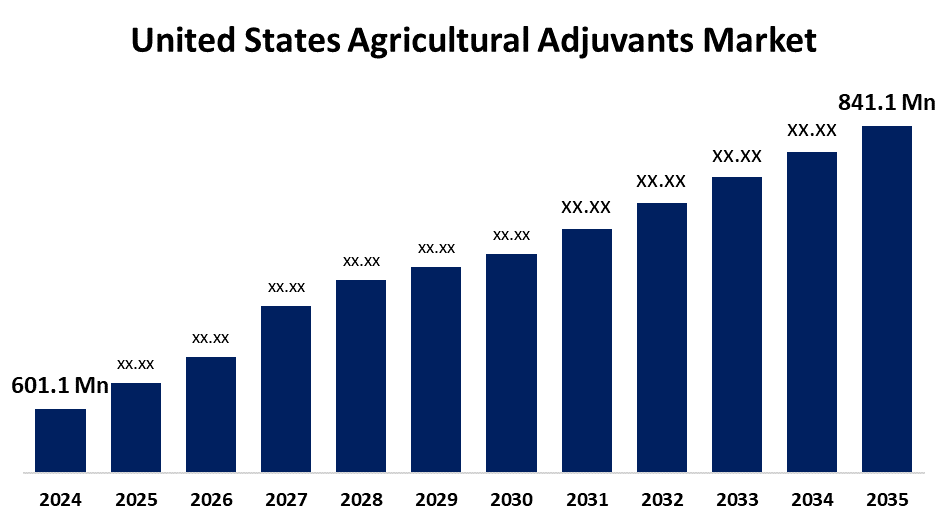

- The US Agricultural Adjuvants Market Size Was Estimated at USD 601.1 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 3.10% from 2025 to 2035

- The US Agricultural Adjuvants Market Size is Expected to Reach USD 841.1 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The United States Agricultural Adjuvants Market Size is anticipated to reach USD 841.1 Million by 2035, growing at a CAGR of 3.10% from 2025 to 2035. The expansion of the U.S. agricultural adjuvants market is propelled by the growing need in the agriculture industry for crop protection solutions. Crop protection chemicals are essential for maintaining crops, increasing yields, and improving output in general.

Market Overview

Agricultural adjuvants are chemicals that are added to insecticide, fungicide, and herbicide formulations to boost their efficacy and maximize application. The future of the US agricultural adjuvants market is being influenced by a number of key trends. One major factor is farmers' growing desire for efficient and sustainable farming methods. Activator adjuvants are chemical agents designed to make crop protection chemicals more effective. Adjuvants are being used by farmers to improve the efficiency of their crop protection products while meeting these environmentally friendly standards. The industry offers a lot of chances for research and development of advanced adjuvant compositions as well as for innovation. This includes using technologies that allow precision agriculture and establishing new products that will help increase agricultural productivity in different climatic conditions. Since the United States is among the top ten producers of corn, soybeans, sorghum, blueberries, and almonds, the country's agricultural output is substantial and is one of the biggest catalysts for market growth. Additionally, having several important product manufacturers in the United States has a significant effect on market expansion and reduces the nation's need for imported agrochemicals. Because of this, agrochemicals are now accessible directly from the domestic market by farmers and businesses in the U.S. agricultural industry, increasing demand for these goods domestically.

The US agricultural adjuvants market industry is benefiting from the growing support for the agricultural industry in US regulatory policies. The Environmental Protection Agency, or EPA, has been helping new adjuvants that are harmless without sacrificing effectiveness to be registered. The EPA recently announced a 30% reduction in the average review time for new product approvals, which has sped up the introduction of novel adjuvants into the market. Because of this simple procedure, producers are more inclined to spend money on creating customized adjuvants for a number of agricultural uses, which propels expansion in a market that is changing quickly.

Report Coverage

This research report categorizes the market for the United States agricultural adjuvants market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States agricultural adjuvants market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States agricultural adjuvants market.

United States Agricultural Adjuvants Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 601.1 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 3.10% |

| 2035 Value Projection: | USD 841.1 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 266 |

| Tables, Charts & Figures: | 96 |

| Segments covered: | By Product and By Application |

| Companies covered:: | Corteva Agriscience, Huntsman International LLC., Helena Agri-Enterprises, LLC, Stepan Company, Wilbur-Ellis Agribusiness, INNVICTIS, Precision Laboratories, LLC, CHS Inc., WinField United, KALO, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the United States agricultural adjuvants market is driven by farmers who are under more pressure to produce more food grains in shorter amounts of time because of the population's rapid rise. Although small, specialized, and regional firms are also active in the agricultural adjuvants market, it is moderately concentrated, and business arrangements are structured with small numbers of large manufacturers capturing relatively high proportions of the market. Both those companies and these experts have a place that deals with sustainable solutions for all types of ways that farmers can utilize these products, even with the general trend to consolidate among the large firms. As this practice continues to impact the development of this market, it will present an equilibrium between the power of large firms and the ingenuity and expertise presented by the smaller un-integrated businesses.

Restraining Factors

The United States agricultural adjuvants market faces obstacles like the Federal Insecticide, Fungicide, and Rodenticide Act (FIFRA), the Environmental Protection Agency (EPA) regulates agricultural adjuvants. To assure their safety for the environment and human health, FIFRA requires that all adjuvants be registered with the EPA before being utilized or sold in the US.

Market Segmentation

The United States Agricultural Adjuvants Market share is classified into product and application.

- The activator adjuvants segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States agricultural adjuvants market is segmented by product into activator adjuvants and utility adjuvants. Among these, the activator adjuvants segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The improved effectiveness of agrochemicals when combined with activator adjuvants, which raise penetration and absorption rates, propels the segmental expansion. As a consequence, diseases, weeds, and insects can be controlled effectively. Activator adjuvants are chemical agents designed to make crop protection chemicals more effective. Herbicides, for instance, are good at getting into and getting rid of undesired plants and weeds, but they work more effectively when activator adjuvants are added because they make it easier for the herbicides to get into weeds.

- The herbicides segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the application, the United States agricultural adjuvants market is segmented into herbicides, insecticides, fungicides, and others. Among these, the herbicides segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The widespread use of herbicides like glyphosate and glufosinate in agriculture is driving the segmental expansion.

Over the course of the projected period, the insecticides segment is anticipated to increase at the fastest rate. The rising need for pesticides for a variety of crops, including cotton, paddy (rice), fruits, and vegetables, is also driving the expansion.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States agricultural adjuvants market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Corteva Agriscience

- Huntsman International LLC.

- Helena Agri-Enterprises, LLC

- Stepan Company

- Wilbur-Ellis Agribusiness

- INNVICTIS

- Precision Laboratories, LLC

- CHS Inc.

- WinField United

- KALO

- Others

Recent Development

- In July 2021, Vive Crop Protection and Helena Agri-Enterprises signed a distribution contract for the US market. The goal of this collaboration is to increase Vive's precision application technologies' market share in the agricultural adjuvants industry.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States agricultural adjuvants market based on the following segments:

United States Agricultural Adjuvants Market, By Product

- Activator Adjuvants

- Utility Adjuvants

United States Agricultural Adjuvants Market, By Application

- Herbicides

- Insecticides

- Fungicides

- Others

Need help to buy this report?