United States Aerosol Can Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Steel-Tinplate, Aluminum, and Others), By End-User (Household & Automotive, Personal Care & Cosmetics, and Others), and United States Aerosol Can Market Insights, Industry Trend, Forecasts to 2035

Industry: Advanced MaterialsUS Aerosol Can Market Insights Forecasts to 2035

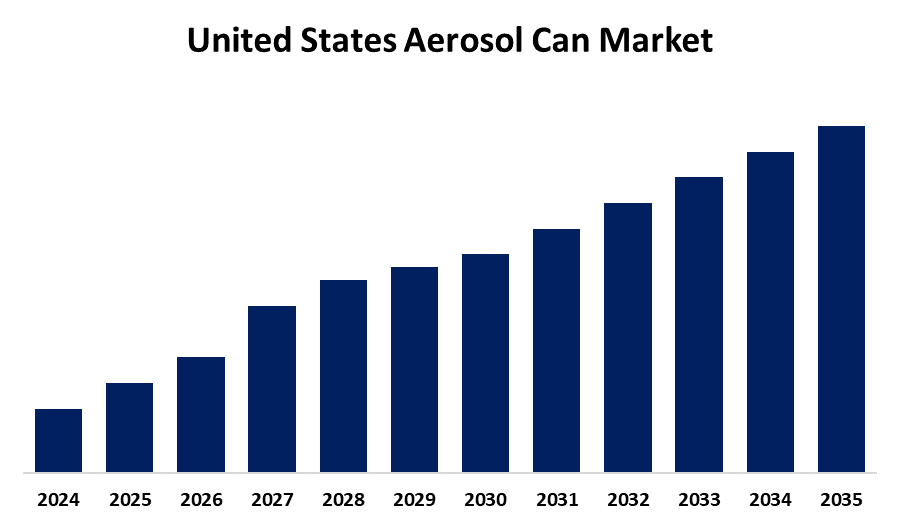

- The United States Aerosol Can Market Size is Expected to Grow at a CAGR of around 1.27% from 2025 to 2035

- The USA Aerosol Can Market Size is Expected to Hold a Significant Share by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the US Aerosol Can Market Size Size is Anticipated to Hold a Significant Share by 2035, Growing at a CAGR of 1.27% from 2025 to 2035. The growing use of shampoos, packaging products, sprays, and deodorants drives the market growth.

Market Overview

The US aerosol market specializes in pressurized containers that provide convenience, controlled dispensing, and a long shelf life for products used across a variety of applications. Independent dispensing devices, known as aerosol cans, hold chemicals in containers and release them as a fine spray, mist, or foam. They feature a valve system for accurate application and are sealed to prevent leaks. The advantages of aerosol cans, along with their use of recyclable materials, are the main reasons for their increasing demand, especially in the food, paint, personal care, pharmaceutical, and automotive industries. The market for aerosol cans is becoming more competitive due to the trend toward environmentally friendly packaging. Suppliers and brands are developing packaging that is both aesthetically pleasing and environmentally conscious. Additionally, the can industry supports businesses in their sustainability initiatives.

Report Coverage

This research report categorizes the market for US aerosol can market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the US aerosol can market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the US aerosol can market.

United States Aerosol Can Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 1.27% |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 160 |

| Tables, Charts & Figures: | 132 |

| Segments covered: | By Product Type, By End-User, and COVID-19 Impact Analysis. |

| Companies covered:: | Crown Holdings, Inc., Chemical Packaging, BWAY Corporation, Mitsubishi Chemical Packaging, Ardagh Group, Montellano, Ball Corporation, Tin Can Manufacturer, Exal Corporation, and Others. |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The demand for cleaning supplies, such as hand sanitizers and disinfectants, has surged due to the pandemic's heightened consumer awareness of cleanliness and hygiene. Urbanization, changing lifestyles, and increased spending on sanitary and cleaning products are the primary factors driving this market's growth. Brands aiming to promote circular initiatives are increasingly opting for metal packaging, particularly aluminum aerosol cans. High-purity aluminum is used to manufacture these cans, providing superior packaging and a competitive advantage over alternative materials. They are widely utilized in the personal care and cosmetics sector for products like body mists, deodorants, shaving creams, sunscreens, and hairsprays. Additionally, the growth of this market is being fueled by rising disposable incomes in emerging economies.

Restraining Factors

The unusual mixture of substances stored under pressure in aerosol cans makes them unsafe for use in a variety of industries. They are an enormous concern at work because they can explode or ignite other dangerous chemicals and may restrict the growth of the market.

Market Segmentation

The USA aerosol can market share is classified into product type and end-user.

- The aluminum segment accounted to grow at the fastest CAGR rate in 2024.

The US aerosol can market is segmented by product type into steel-tinplate, aluminum, and others. Among these, the aluminum segment accounted to grow at the fastest CAGR rate in 2024. The growth is driven by the recyclability, ease of use, lightweight, leakage proof, cost effectiveness, and maintaining the cold temperature for a longer time.

- The personal care and cosmetics segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The US aerosol can market is segmented by end-user into household & automotive, personal care & cosmetics, and others. Among these, the personal care and cosmetics segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The personal care segment in the United States is growing due to its application in various products, particularly in hair, body, and deodorants. The growing trend of beautification, urbanization, and increased self-care spending is driving this growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the US aerosol can market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Crown Holdings, Inc.

- Chemical Packaging

- BWAY Corporation

- Mitsubishi Chemical Packaging

- Ardagh Group

- Montellano

- Ball Corporation

- Tin Can Manufacturer

- Exal Corporation

- Others

Recent Developments:

- In June 2022, Ball Corporation launched its most sustainable aluminum aerosol can globally, with only half the carbon footprint of a standard can, to support its 2030 science-based targets and net-zero emissions by 2050, as climate change impacts become more visible.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the US aerosol can market based on the below-mentioned segments:

US Aerosol Can Market, By Product Type

- Steel-Tinplate

- Aluminum

- Others

US Aerosol Can Market, By End-User

- Household & Automotive

- Personal Care & Cosmetics

- Others

Need help to buy this report?