United States ADAS Radar Systems Market Size, Share, and COVID-19 Impact Analysis, By Vehicle Type (Heavy Commercial Vehicle (HCV), Light Commercial Vehicle (LCV), Passenger Vehicle), By System Type (Blind Spot Detection, Parking Assistance, Lane Departure Warning System, Autonomous Emergency Braking, Intelligent Headlights, Adaptive Cruise Control, Heads-up Display), By Component (Radar, Lidar, Sensors, Camera), and United States ADAS Radar Systems Market Insights Forecasts to 2033

Industry: Automotive & TransportationUnited States ADAS Radar Systems Market Insights Forecasts to 2033

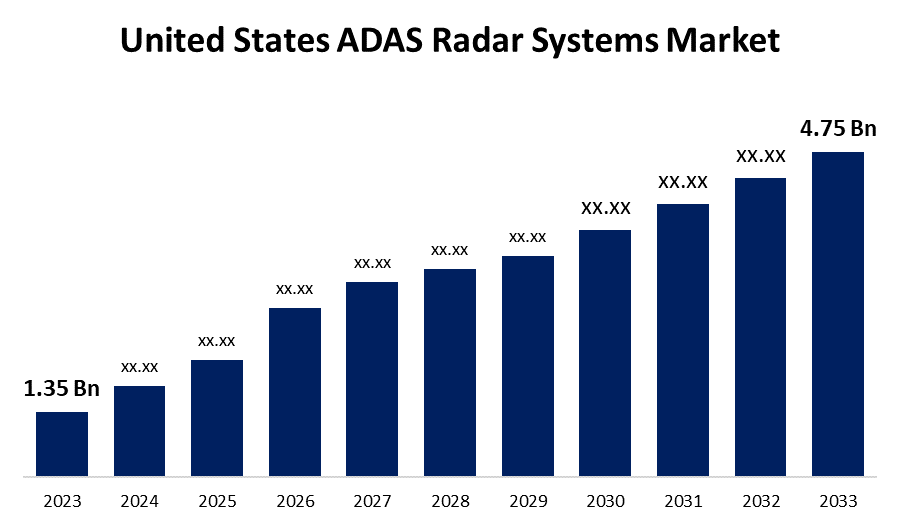

- The United States ADAS Radar Systems Market Size was valued at USD 1.35 Billion in 2023.

- The Market Size is Growing at a CAGR of 13.4% from 2023 to 2033.

- The United States ADAS Radar Systems Market Size is Expected to Reach USD 4.75 Billion by 2033.

Get more details on this report -

The United States ADAS Radar Systems Market Size is Expected to reach USD 4.75 Billion by 2033, at a CAGR of 13.4% during the forecast period 2023 to 2033.

Market Overview

The United States ADAS radar systems market has witnessed robust growth driven by the increasing integration of advanced safety features in vehicles. The rising demand for enhanced driver assistance, collision avoidance, and autonomous driving capabilities is primarily responsible for this market expansion. Automotive manufacturers have increased their efforts to deploy radar-based systems that provide precision in object detection, adaptive cruise control, and automated emergency braking in order to improve road safety and reduce accidents. Furthermore, regulatory initiatives focusing on safety standards, as well as the proliferation of electric and autonomous vehicles, drive the adoption of ADAS radar systems across the automotive landscape. As technology advances, fostering innovations in sensor capabilities and signal processing, the ADAS radar systems market in the United States is poised for sustained growth, catering to the growing demand for safer and more sophisticated driving experiences.

Report Coverage

This research report categorizes the market for United States ADAS radar systems market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States ADAS radar systems market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the United States ADAS radar systems market.

United States ADAS Radar Systems Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 1.35 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 13.4% |

| 2033 Value Projection: | USD 4.75 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Vehicle Type, By System Type, By Component and COVID-19 Impact Analysis. |

| Companies covered:: | Continental AG, Robert Bosch GmbH, Aptiv PLC, Veoneer Inc., Denso Corporation, Valeo SA, Texas Instruments Incorporated, Infineon Technologies AG, ZF Friedrichshafen AG, NXP Semiconductors NV and Other Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

A stringent regulatory landscape emphasizing vehicle safety standards has a significant impact on the market for ADAS radar systems in the United States. Government agencies, such as the National Highway Traffic Safety Administration (NHTSA), have played an important role in promoting the use of advanced driver-assistance systems. The inclusion of safety features such as automatic emergency braking (AEB), lane departure warning systems, and adaptive cruise control has increased demand for radar-based technologies. These regulations serve as catalysts, causing automakers to incorporate radar systems into their vehicles in order to meet safety standards and gain consumer trust. Furthermore, ongoing collaborations between regulatory bodies and industry stakeholders aim to continuously improve safety protocols, fostering a steady demand for ADAS radar systems across the automotive industry. Another critical driver in the market for ADAS radar systems in the United States is the advancement of radar technology. Continuous improvements in sensor capabilities, signal processing, and radar algorithms have improved the performance and reliability of these systems significantly. Radar sensors now have higher precision in object detection, improved range, and accuracy, allowing for pedestrian detection, blind-spot monitoring, and cross-traffic alerts.

Restraining Factors

Due to a lack of infrastructure development in developing countries, the advanced driver assistance market is likely to face challenges. Vehicles with advanced driver assistance systems are prohibitively expensive, which is expected to hamper market growth.

Market Segment

- In 2023, the passenger vehicle segment accounted for the largest revenue share over the forecast period.

Based on the vehicle type, the United States ADAS Radar Systems market is segmented into heavy commercial vehicle (HCV), light commercial vehicle (LCV), and passenger vehicle. Among these, the passenger vehicle segment has the largest revenue share over the forecast period. The rising consumer demand for enhanced safety features and automakers' emphasis on offering advanced driver-assistance technologies, passenger vehicles have been at the forefront of ADAS radar system integration. Rising consumer safety awareness, combined with regulatory initiatives requiring safety features, have accelerated the adoption of radar-based ADAS systems in passenger vehicles.

- In 2022, the radar segment accounted for the largest revenue share over the forecast period.

Based on the component, the United States ADAS radar systems market is segmented into radar, lidar, sensors, and camera. Among these, the radar segment has the largest revenue share over the forecast period. Radars are essential components of ADAS systems, providing critical capabilities such as object detection, range assessment, and collision avoidance in a variety of driving scenarios. Radar technology's robustness, dependability, and versatility have established it as a cornerstone of advanced safety features in vehicles. Radar systems excel at long-range detection and perform well in adverse weather conditions, making them essential for ensuring comprehensive safety functions.

- In 2022, the adaptive cruise control segment accounted for the largest revenue share over the forecast period.

Based on the system type, the United States ADAS radar systems market is segmented into blind spot detection, parking assistance, lane departure warning system, autonomous emergency braking, intelligent headlights, adaptive cruise control, and heads-up display. Among these, the adaptive cruise control segment has the largest revenue share over the forecast period. Adaptive cruise control systems, which rely heavily on radar technology, provide a refined driving experience by automatically adjusting the vehicle's speed to keep a safe distance from the vehicle ahead. The growing consumer preference for convenience, combined with the desire for safer driving experiences, has accelerated the widespread adoption of adaptive cruise control systems in vehicles. Radar sensors in adaptive cruise control systems enable precise detection of surrounding vehicles, allowing for smooth acceleration, deceleration, and automated speed control, particularly in congested traffic and highway driving scenarios.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States ADAS radar systems market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Continental AG

- Robert Bosch GmbH

- Aptiv PLC

- Veoneer Inc.

- Denso Corporation

- Valeo SA

- Texas Instruments Incorporated

- Infineon Technologies AG

- ZF Friedrichshafen AG

- NXP Semiconductors NV

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In August 2023, SafetyFirst Solutions, a leading ADAS technology provider, has launched a comprehensive driver safety enhancement program, demonstrating its commitment to promoting safer driving practices. The program employs cutting-edge radar-based ADAS systems, such as lane departure warning and intelligent headlight control, to reduce collision risks and improve overall road safety. The emphasis on driver safety placed by SafetyFirst Solutions reflects the growing importance of proactive safety measures and regulatory compliance in the ADAS radar systems market in the United States.

Market Segment

This study forecasts country revenue from 2022 to 2033. Spherical Insights has segmented the United States ADAS radar systems market based on the below-mentioned segments:

United States ADAS Radar Systems Market, By Vehicle Type

- Heavy Commercial Vehicle (HCV)

- Light Commercial Vehicle (LCV)

- Passenger Vehicle)

- Others

United States ADAS Radar Systems Market, By System Type

- Blind Spot Detection

- Parking Assistance

- Lane Departure Warning System

- Autonomous Emergency Braking

- Intelligent Headlights

- Adaptive Cruise Control

- Heads-up Display

United States ADAS Radar Systems Market, By Component

- Radar

- Lidar

- Sensors

- Camera

Need help to buy this report?