United States Activewear Market Size, Share, and COVID-19 Impact Analysis, By Distribution Channel (In-store and Online), By End-use (Men, Women, and Kids), and United States Activewear Market Insights, Industry Trend, Forecasts to 2035

Industry: Consumer GoodsUnited States Activewear Market Insights Forecasts to 2035

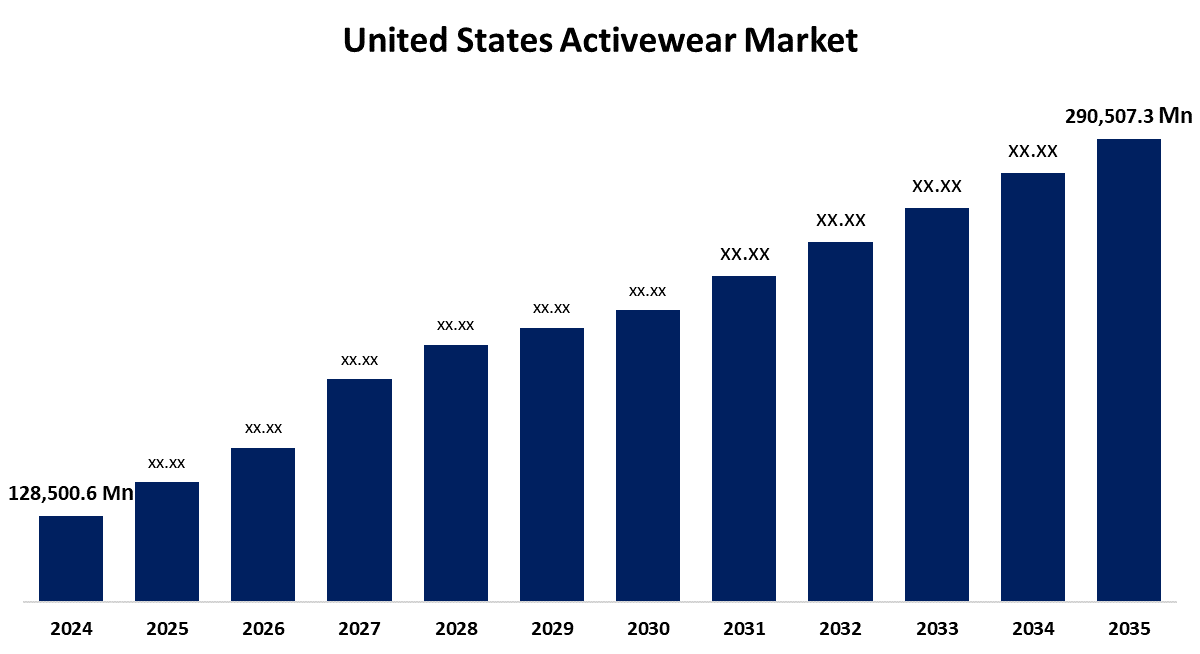

- The US Activewear Market Size Was Estimated at USD 128,500.6 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 7.70% from 2025 to 2035

- The US Activewear Market Size is Expected to Reach USD 290,507.3 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the United States Activewear Market Size is Anticipated to reach USD 290,507.3 Million by 2035, Growing at a CAGR of 7.70% from 2025 to 2035. The expansion of the United States' activewear market is propelled by the growing preference for contemporary attire for daily activities and the gym.

Market Overview

Activewear is apparel that combines comfort, functionality, and frequently style to promote physical activity. The U.S. activewear market is a developing segment of the broader sportswear business, which is expanding and growing as consumer tastes for health, fitness, and an active lifestyle shift. With the consumer need for apparel that is fashionable and functional, activewear is evolving beyond athletic wear to become a prominent apparel for everyday use. With a growing health-conscious consumer base, activewear now includes performance-based designs categorized as outdoor apparel, athleisure, and workout clothing. Multiple segments with strong demand drive the market, including values from fitness enthusiasts, casual athletes, and anyone looking for beneficial, comfortable everyday clothing. According to Statista, Nike is the market leader with 96% of the market. The rise of fitness culture and changes in consumer lifestyle are impacting the growth of the U.S. activewear segment. Customers are starting to place a higher value on apparel with performance and daily comfort features. According to the 2023 Cotton Incorporated Lifestyle MonitorTM Survey, 67% of US consumers were at least somewhat likely to prioritise performance aspects while buying sportswear (shirts, pants, and shorts).

The U.S. government supports sportswear innovation through collaboration and research and development (R&D) funding. The NSF's Regional Innovation Engines, which were created from the CHIPS and Science Act, established partnerships between universities, manufacturers, startups, and communities to provide funding ($150 million in new funding) for sustainable clothing innovation, including activewear textiles, wearable, and functional fabrics.

Report Coverage

This research report categorizes the market for the United States activewear market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States activewear market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States activewear market.

United States Activewear Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 128,500.6 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 7.70% |

| 2035 Value Projection: | USD 290,507.3 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 150 |

| Tables, Charts & Figures: | 135 |

| Segments covered: | By Distribution Channel, By End-use and COVID-19 Impact Analysis. |

| Companies covered:: | Hanesbrands Inc, Columbia Sportswear Co, Skechers USA Inc Class A, Nike Inc Class B, PVH Corp, VF Corporation, Skechers U.S.A., Inc., Under Armour, Inc., and Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the United States' activewear market is boosted by a higher consumer interest in fitness and health, which has led to a higher number of physical activities like yoga, running, and gym workouts. As consumers look to purchase clothing to suit their active lifestyles, higher physical movement towards healthier living and activewear clothing will be supported. Secondly, the physical attributes of sportswear have transitioned from being strictly gym apparel to one that has grown into a fashionable part of clothing and everyday wear due to the increase in athleisure.

Restraining Factors

The United States activewear market faces obstacles like an increasing number of brands is putting the U.S. sportswear market in a position of competition. With so many competitors in the sportswear market, it becomes more difficult for any one brand to differentiate itself from the others, including big brands to small and coming, less recognizable names.

Market Segmentation

The United States activewear market share is classified into distribution channel and end-use.

- The in-store segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States activewear market is segmented by distribution channel into in-store and online. Among these, the in-store segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven by retail channels that are an essential driving factor for in-store sales, as more consumers are seeking to shop upscale sports apparel in-store. Shopping in-store enables a better shopping experience for customers and allows them to assess the exact fit and shape of the garment. Retail channels also help companies prevent counterfeit products from invading their store and company stores that are associated with legitimate products.

- The women segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the end-use, the United States activewear market is segmented into men, women, and kids. Among these, the women segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is propelled because it puts women's comfort and functionality while also improving their performance, and continues to grow. In a survey, 49% of survey participants reported any skin irritation from tight sportswear, and 58% reported taking breaks in their workouts due to having to adjust their leggings continually.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States activewear market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Hanesbrands Inc

- Columbia Sportswear Co

- Skechers USA Inc Class A

- Nike Inc Class B

- PVH Corp

- VF Corporation

- Skechers U.S.A., Inc.

- Under Armour, Inc.

- Others

Recent Development

- In April 2024, Nike introduced a new wearable pump-compatible sports bra and EasyOn shoe aimed at providing more support and convenience for mothers. These products are designed to cater to the needs of active mothers who require both functionality and comfort in their athletic wear.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States activewear market based on the following segments:

United States Activewear Market, By Distribution Channel

- In-store

- Online

United States Activewear Market, By End-use

- Men

- Women

- Kids

Need help to buy this report?